This article was written by Tod Van Name, Global Head of FX Electronic Trading at Bloomberg. It was first published on e-Forex.

Bloomberg is a pioneer in supporting the growth and evolution of electronic trading in FX. e-Forex spoke to Tod Van Name, Global Head of Foreign Exchange electronic trading at Bloomberg, about how it is leading the way in the ongoing development of this space despite the accelerated pace of change in recent months.

Q

Bloomberg has been making a number of changes to its e-FX services over the past year. What has been driving those enhancements?

A

The main thing that really drives us here at Bloomberg is the interaction that we have with clients. Especially now, clients across all business areas are looking at practical ways to improve their performance and reduce their transaction costs. We are driven to deliver the tools which can help them to achieve this, whether that is by increasing automation tools, making it easier for them to access the market or helping to streamline their workflows. For example, firms that trade many different asset classes, such as bonds, stocks, or commodities, tend to aggregate currency risk and they need a more effective way to manage that process.

Clients have also been talking to us about how to manage the shifts in liquidity that we’ve seen of late. Asia Pacific (APAC) has had a really remarkable increase in volume, with Singapore, Hong Kong, Tokyo and Sydney trading much more actively than they were five or six years ago. In addition, there is the recent update to the FX Global Code, designed to improve transparency and efficiency but will clearly impact liquidity providers and platforms. These are the type of trends we listen to and which help drive what we build and deploy to our clients.

Q

Can you share more detail about some of the specific features or new products which you have recently released?

A

Of course – at Bloomberg we release new software nearly every week, in part because the market changes so rapidly but also because it can take some time to develop and build a new product which can add real value to our clients. One recent example is the new Supplementary Cost Tool which we added to FXGO at the end of last year.

This tool allows our users to evaluate the pricing that they’re getting from their liquidity providers, but also allows them to also factor in any additional costs such as prime broker fees, custodial fees or banking charges, which they would not normally see until the execution was complete.

With the supplementary cost tool, the software will return to the user the best actual prices, net of fees, not just the best prices that the liquidity providers are showing. This is important because it allows clients to account for more than just the exchange rate but also the associated costs.

It’s a tool that has really taken off and the monetary benefits this has delivered to clients so far has been substantial. It is something many clients have requested, and we are looking to expand this feature.

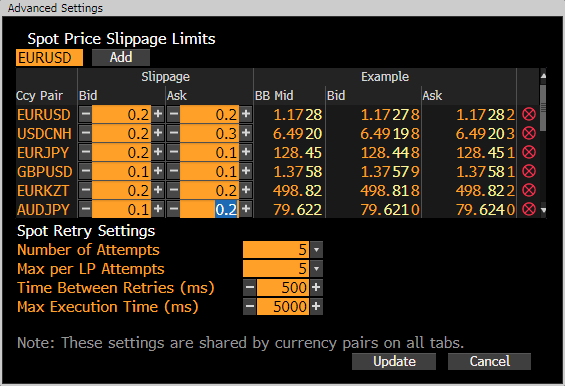

Another key release has been our Slippage and Retry tool which allows the user to determine a tolerance for accepting fills within a specified parameter. For example, in fast moving or volatile markets clients may be unable to complete trades on rates that constantly change in milliseconds. Slippage and retry allows traders to set a tolerance, in fractions of a price, and aggress other quotes within that parameter.

Trade negotiation in this manner is completed immediately, within tight proximity without having to chase a market that may be running away. In addition, clients also have settings that will allow them to retry a trade attempt at the server level, which reduces the latency of trying to click on the next price when it appears on the screen, If you put those two things together, the success that clients can have trading in very volatile and very fast moving markets has greatly increased and their risk of price movement has been reduced, providing a more fluid experience and greater confidence.

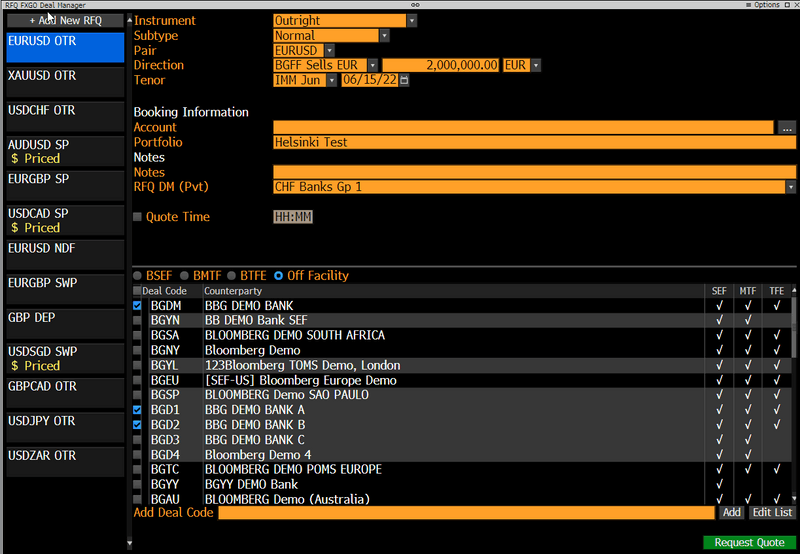

Another brand new release has been our RFQ Manager, which allows clients who trade by RFQ to create templates for frequent trades with default parameters like currency pair, notional amount or tenor without the hassle of typing in those parameters every time they want to request a price.

RFQ Manager is a component that allows the user to define a limitless number of templates in an organized and intuitive structure. It also allows them to create a list of their favorite counterparties for each template, and then quickly send an RFQ, saving time and reduce the risk of keying errors.

The RFQ Manager is a launchpad component that fits neatly into the users’ desktop, and can even be linked to news, charts and other contextual components.

The important thing that all of these recent developments have in common is that they solve problems where there is process friction, and where it can make client workflow more efficient while minimizing risk.

Our clients have been excited and eager to offer feedback while working with us through the development phase, ensuring that what we release has widespread support and rapid adoption. We view this collaboration as essential to building successful and innovative solutions.

Q

Has there been a change in demand for execution analytics and how have you responded?

A

Absolutely, no question at all. One of the benefits to the increase in electronic trading, particularly in the FX market, is it provides a significant amount of trading data which you can now use and analyze. In the early TCA days this was primarily just looking at the post trade data, but the growth in available data means we now have much better tools that help clients evaluate pre-trade execution strategies as well.

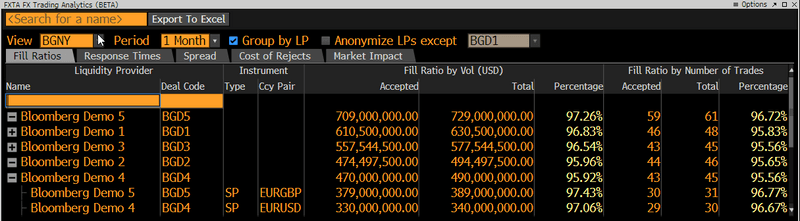

As a major liquidity platform, we have really focused on things that we can do to introduce information that improves the ability of clients to make better, more informed decisions. One of the features that we released recently is a feature that allows clients to view and evaluate their streaming performance.

As a buyside client this allows you to look at the performance of your liquidity provider across several parameters, such as risk reject ratios, the cost of the reject if you miss a trade, what the response time is from your counterparties, spread analysis, and the impact of trades on the market. These analytics become very powerful for clients that are looking to make intelligent decisions about how to optimize trade negotiation using quantitative metrics.

One other thing that we’ve introduced, which has already had a really great response from our clients, is the ability for a liquidity provider to take their proprietary analytics, in areas like FX algo trading, and display this unique intellectual property within a window inside the FXGO platform.

For example, if you want to know what the liquidity profile of GBP/ USD looks like right now, and you are enabled, you can look at a particular liquidity provider and review an array of parameters, and compare risk transfer pricing to various algo strategies. When ready to proceed with an algo order, clients can send the order directly to the LP, and observe as the order is filled in real time. Once complete, the performance of the fill can be assessed through a variety of post-trade analytics.

What users really like about this is that it’s customized by the liquidity providers. We started that with one bank a year and a half ago and now we’ve got three other banks as well providing analytics. It’s been a very interesting evolution in how you can manage and marry different technologies together to provide a much more powerful experience for the user.

Q

Where do you think the future evolution of the electronic FX trading market will take us?

A

We’re at a really interesting time in the market. Our clients tell us that what they’re really looking for are ways that they can improve efficiency and reduce risk. The solutions that they are most focused on involve improving workflow processes, and using technology to mimic that workflow, but doing it in an automated fashion so that it’s much faster and much less error prone.

We’ve actually developed automation tools allow clients to do that, such as Trade Best which enables them to set the parameters to trade by RFQ, or Rule Based Trading, which I think we’re going to see a lot more of in the future, which allows a client to specify under what conditions they want an order executed and then, when those conditions are met, they can go to market. Automation will continue to evolve and find increasing adoption among a wide range of market participants.

We’ve already begun to see an increased use in electronic trading for derivatives, particularly for NDFs and options, and this trend is going to continue. Clients have found that even complicated structures can be traded electronically. June, for example, was a record month for us in electronically traded options, and the number of banks which support automated pricing continues to grow. We have 23 banks now that provide electronic pricing for options, across a wide range of currency pairs and structures, and we expect this to continue as clients migrate toward the efficiency of electronic trading.

Another important change is managing complex workflows. Client demand greater flexibility in how they stage orders, provide account allocation, net or aggregate them, and then manage the trading process, whether by RFQ or streaming, batch or list trading, fixing orders, local or generic orders, or by a combination of methods including direct order routing (DOR) or via an API. One thing is certain, the FX market will continue to evolve and client demand for robust, reliable solutions will continue to increase.