This analysis is by Bloomberg Intelligence Equity Strategist Laurent Douillet & Strategist Tim Craighead. It appeared first on the Bloomberg Terminal.

High-duration and cyclical companies are feeling the pressure from sustained rate rises and recession fears, while the Stoxx 600 has rebounded from its early March lows, led by defensive names. Even if inflation has peaked, the derating trend may not be over as persistent price rises could lead central banks to tighten over the neutral rate.

Continued sell-off for 25% of Stoxx 600 Index

Though the Stoxx 600 Index has recovered 7% from its March 7 lows, 25% of its members are seeing further selling pressure, with a share-price decline of at least 5% since then, and 49 are in oversold territory (14-day RSI below 30). With rising interest rates and recession fears dominating market headlines, high duration (health care, technology) and cyclical sectors account for 80% of these index members. Their fundamentals are mixed, with four sectors showing positive EPS revisions over the past two months but with downgrades outnumbering upgrades two-to-one.

Their average blended forward P/E has fallen to a more reasonable 20.9x, a 66% premium vs. the Stoxx 600 Index at 12.6x, vs. 96% at the beginning of the year. The largest deratings are in technology (23.6x vs. 40.8x) and industrials (21.6 vs. 34.3x).

Pressure still on despite Stoxx 600 rebound

High-duration companies diverging based on cyclicality

The ongoing rise in the 10-year bond yield — up 100 basis points over the past two months — continues to put pressure on high-duration companies, with the top quintile of our duration factor being down 10% vs. a decline of 5% for the fifth quintile. Among the highest-duration sectors in Europe (technology, health care, consumer staples and industrials), defensives benefit from investor rotation to safe havens, with food, beverage and tobacco and heath care up 10% and 7% respectively, while recession fears put pressure on the technology and industrials sectors, which are broadly flat.

For the 150 companies that saw additional selling pressure since March 7, their duration was higher than the Stoxx 600 at the time (19.5 years vs. 18), with the largest spreads being in financials, health care and industrials.

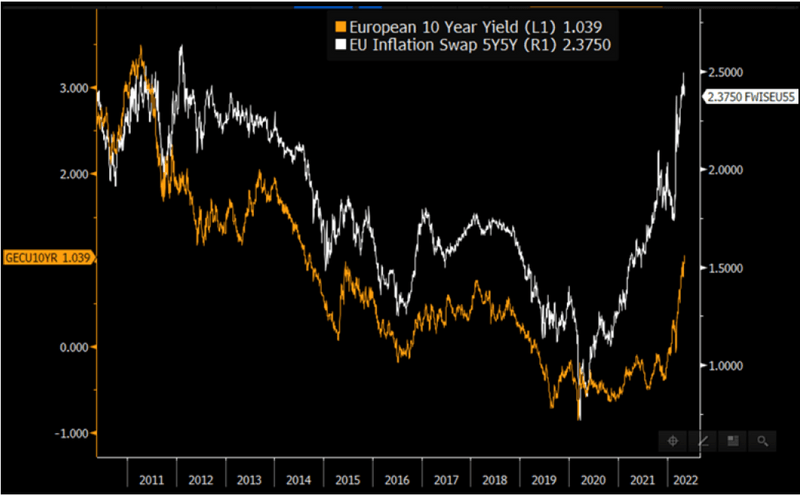

European 10Y yield vs. Inflation 5Y5Y swap

Health care, real estate dominate oversold equity screen

Thirty-three companies in the Stoxx 600 Index that have had positive earnings revisions since March 7 are currently in oversold territory (14-day RSI below 30) after underperforming the benchmark by an average of about 14%. Despite being a low-duration sector, real estate has been hit by rising rates and recession fears. Property and health-care companies each have eight of the 33, to make up almost half the list.

Following a significant derating year-to-date (average of 33.5%), 28 companies have their blended forward P/E ratio standing below the 5-year average and 15 are below the 10-year average, including companies like Kering, Ashtead, Vonovia and Ipsen. Half of the list also has an analyst recommendation above 4, while only four have a rating below 3.

Equity screen of oversold companies

Stubborn inflation is a risk to Stoxx 600 P/E multiple

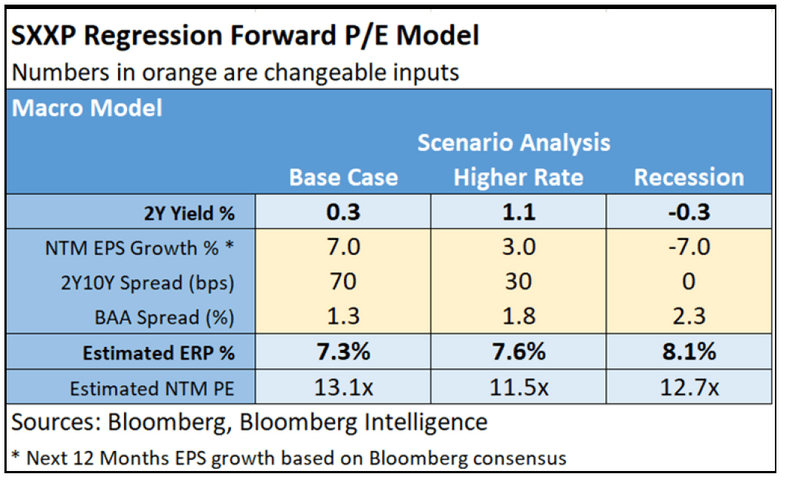

Higher-than-expected core inflation in Europe (3.5% in March) and a weaker Euro may force the ECB to raise rates more aggressively than we expected earlier in the year, pushing the fair-value multiple of the Stoxx 600 Index lower. Based on current market expectations, the ECB deposit rate should reach 0.25% by year-end, justifying a 2-year and 10-year bond yield close to their current levels of 0.25-0.3% and 1%, respectively. Assuming an EPS growth rate of 7% would give a fair blended forward P/E multiple of about 13x vs. our previous forecasted 13.5-14x.

High inflation could force the ECB to hike rates even more, leading to a lower EPS growth rate, a flatter yield curve and higher credit risk. As a result, the Stoxx 600 P/E could fall to 11.5x, the lowest since 2012.

Stoxx 600 P/E scenario analysis

Value cyclicals still facing large discounts

Investors’ scepticism toward value-cyclical groups remains high as the price-to-book ratios of four groups (banks, autos, oil & gas, and basic resources) are at a significant discount to their expected return on equity, based on 2023 consensus. Their estimated cost of equity averages 17% vs. 6.7% for the Stoxx 600, though they are delivering solid results and have a stronger financial position than a decade ago. Their rerating requires a sustainable economic recovery, which would lead to a higher earnings visibility and support their improved return on equity.

Excluding the value cyclical groups, the correlation between the price-to-book ratio and the return on equity of the remaining Stoxx 600 sub-indexes is 0.91, showing a strong consistency despite their two-year earnings growth prospects diverging significantly.

Stoxx 600 industries 2023 price-to-book vs. ROE