Bloomberg Market Specialist Michael Pruzinsky contributed to this article. The original version appeared first on the Bloomberg Terminal.

Background

Thematic investing’s potential for profiting from long-term shifts in the economy’s structure has attracted increasing interest from institutional and retail investors. In 2021 alone, thematic exchange-traded funds received nearly $49 billion in inflows, or about as much as 2019 and 2020 combined, according to a Bloomberg Intelligence data analysis.

Some investors are also intrigued by what they consider previously unavailable opportunities. “What we’re finding is that many people equate the ability to invest in an entirely new category of thematic investing as to what they might have experienced had they begun investing in cloud computing or other categories a decade ago,” said Michael Sonnenshein, CEO of Grayscale Investment LLC, operator of the world’s biggest crypto fund.

The issue

Traditional indices are constructed by analyzing historical data and using sector, country and size classifications to determine whether to include a security in a benchmark. Those methods aren’t geared toward capturing forward-looking trends, however. To counter this, thematic indices are created using techniques that translate evolving micro- and macroeconomic trends into passive benchmarks.

To build thematic benchmarks, Bloomberg Indices’ team assesses emerging trends in “traditional” sectors, macroeconomic trends and values-based trends. Within those themes, it then provides a transparent, rules-based approach to security selection that’s forward-looking and cross-sectional.

Bloomberg Indices’ thematic benchmarks are backed by extensive research by Bloomberg Intelligence analysts, who create theme baskets to track the companies involved in given trends. Bloomberg Indices then uses those baskets as the starting universe for designing indices to track emerging trends in a rules-based manner.

Tracking

Want to explore growing industries such as electric vehicles, cybersecurity or hydrogen? Bloomberg Indices’ thematic benchmarks can help.

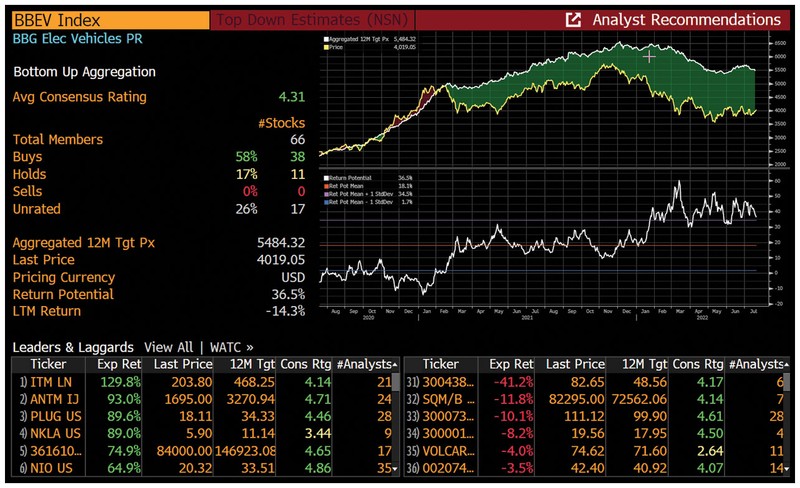

For a bottom-up consensus of analyst price targets for the EV index, run {BEV <Index> ANR <GO>}. The spread between the current index price and the aggregated 12-month target price of its constituents widened dramatically this year.

For more information on this or other functionality on the Bloomberg Professional Service, click here to request a demo with a Bloomberg sales representative. Existing clients can press <HELP HELP> on their Bloomberg keyboard.