Background

A year after the Inflation Reduction Act was signed into law in the U.S., the global solar power supply chain is struggling to turn booming sales into investor returns.

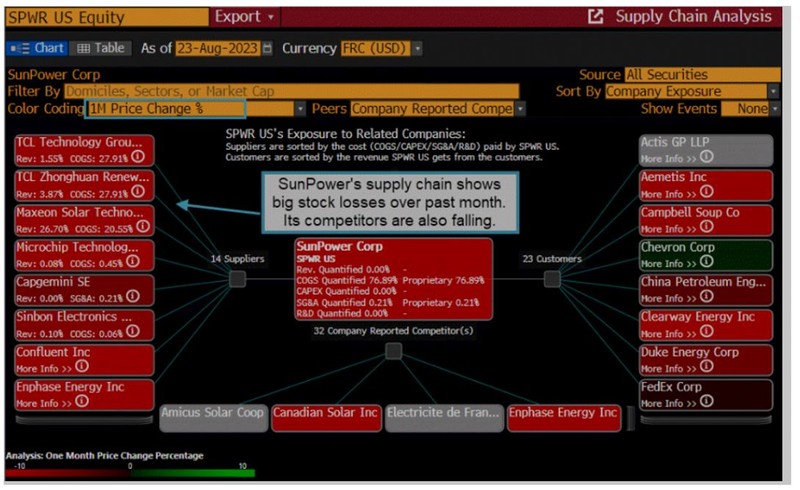

Shares in California-based SunPower Corp. and Canadian Solar Inc. dropped 38% and 30%, respectively, in the past month, amid anxiety over rising U.S. interest rates, oversupply across the supply chain and expanding tariff barriers. SunPower panel supplier Maxeon Solar Technologies Ltd. slid 53%, even as it announced plans to build a $1.2 billion U.S. silicon solar panel factory. BloombergNEF expects China to outpace the U.S. in solar power installations this decade.

The issue

SunPower, which sells solar systems to homes, slid in the past month. Year-over-year sales growth slowed to 12% in the second quarter, down from 26% the quarter prior, on higher customer borrowing costs and less-favorable subsidies for solar without storage. Analysts forecast revenue to shrink in the third and fourth quarters.

Among global solar stocks, Maxeon, SunPower, Sunrun Inc. and Canadian Solar are the worst performers over the past month. Yet analysts are predicting huge gains in the year ahead, with target prices not declining at the same pace as share prices.

IRA incentives have spurred renewables expansion. The U.S. utility-scale clean energy sector announced $271 billion of investment in all kinds of projects in the past 12 months, the American Clean Power Association estimates. In that period, announcements were made for 83 solar, wind and battery manufacturing facilities, with a combined $22 billion in investment and support for nearly 30,000 new American jobs.

One reason manufacturers are investing in upstream factories outside China is because of the U.S. enacting tariffs as high as 254% on some panels made in Southeast Asia starting in June 2024. SunPower suppliers have more than 55% of their facilities in China and 19% in the U.S. Maxeon is in a similar position, with 68% of its supplier facilities in China and only 12% in the U.S.

BloombergNEF estimates that U.S. solar installs will surge but still lag China. While the U.S. is projected to install 34 GW of solar capacity in 2023, up from 24 GW last year, China is projected to add 209 GW. China is also considering substantial plans for solar projects off its eastern coastline.

U.S. solar deployment faces constraints such as severe grid connection hurdles, labor shortages, and curtailment risks in California and Texas, according to the BloombergNEF 3Q 2023 Global PV Market Outlook. China has an 80% share in making ingots, wafers, cells and modules, giving its industry scale and supply chain advantages. BloombergNEF estimates it costs three times more to build a 1 GW per year silicon solar module manufacturing facility in the U.S. than in China.

Tracking

Use Bloomberg’s SPLC, WATC and BNEF tools to analyze the industry. Run SPWR US Equity SPLC to See Losses Across the SunPower Supply Chain.

For more information on this or other functionality on the Bloomberg Professional Service, click here to request a demo with a Bloomberg sales representative. Existing clients can press <HELP HELP> on their Bloomberg keyboard.