The end of 2023 is near and everywhere we look, there seems to be an escalation in both domestic and international social, geopolitical or economic events that could impact the strength of the US economy. It has been several months since various economic models predicted that the Federal Reserve (Fed) would reverse course and start cutting short-term rates. On the other hand, the Fed’s Chair, Jerome Powell has repeatedly indicated that the central bank intends to keep the rates higher for longer.

With such a busy back-drop, one might ask, where would short-term interest rates be if the policy makers followed the Taylor Rule?

The Taylor Rule has had a spotty history with the US policy makers. The last departure away from the rule was announced in August of 2020, at the annual meeting of the central bankers at Jackson Hole (WI). During that meeting, Chair Powell announced that the Fed is changing its approach to inflation by moving to a monetary policy that allows for lower unemployment coupled with a higher level of inflation. In other words, the Fed was aiming to allow for the economy to run at a higher gear and even “overheat,” even if that means a higher inflation. Powell further suggested during the same meeting, he was not interested in linking “inflation to any particular employment rate.”

In effect, the Fed announced its decision to break away from its long-standing economic policy based on the theory of the Taylor Rule, which meant in practice that the future policy decisions would be rather discretionary. It is worth remembering that the Fed’s policy making is governed by Federal Reserve Act from 1913, which defined a dual mandate of the central bank’s monetary policy: maintaining maximum employment and stable prices. As one can imagine that if the policy makers are to allow the economy to exceed the maximum employment and let it “overheat,” in doing so they may introduce an un-welcome higher inflation. Over the years the maximum unemployment was accepted to be between 4%-5% of unemployment, whereas price-stability was assumed to be with inflation at 2%.

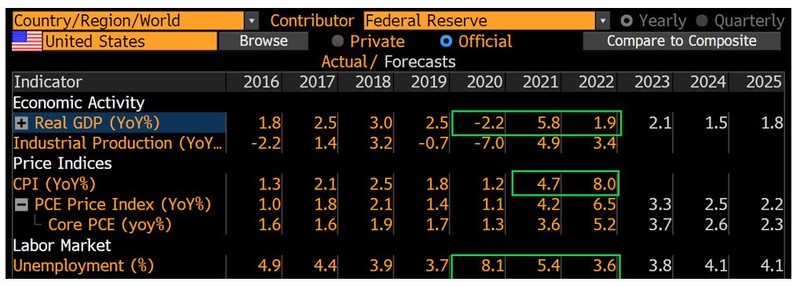

Managing a “soft landing” after the Global Pandemic, is not an easy task, and the data clearly shows the challenges that the Fed is facing three years later: an elevated and structural/sticky inflation.

From the table above we see that Fed left the economy running at a higher pace in 2021 by and delaying the rate hiking cycle, aiming to achieve the proverbial “soft landing” yet knowing that this would possibly result in higher and likely sticky inflation. In March of 2022, the Fed embarked on a very aggressive interest rate hiking cycle. The latter seems to be working, as economic data shows some signs of reducing inflation and while keeping the economy going.

Now, many global geo-political events are starting to show their impact on the domestic economic data, and we now see signs of a re-acceleration of inflation. The latest CPI print was higher on both MoM expectations and YoY basis.

In the current climate, it is likely that increasing tensions in the Middle East will drive the global price of oil and energy higher, and thus lead to even higher domestic inflation. The latter is reinforced by the following Bloomberg analysis: “The September CPI report won’t convince Fed officials that interest rates are sufficiently restrictive. There’s some encouraging disinflation progress in the goods sector, but not so much in services, where rents disinflation stalled. The Israel-Hamas conflict has now tipped the balance once again toward upside inflation risks.”

Revisiting the Taylor Rule, one can immediately see that the Fed is facing a serious problem – short-term interest rates, which are at 5.5% — are not high enough. The model suggests a much higher level for the short term of 8.01%.

Over the years economists as well as policy makers loved the simplicity of the Taylor Rule, which stated that: the policy makers should raise short-term interest rates when inflation increases and lower them when economic growth slows down.

Applying a rules-based approach, brings transparency to the Fed’s policy decisions and shifts the focus from a “discretionary policy to the quality and timeliness of the underlying data.

The Taylor Rule was widely used tool by the Central Bankers in the 1980s and the 1990s, and helped policy makers to set the short-term rates, which led to economic prosperity in the 1990s. Would this rule work the same in the current multi-polar world? It is hard to say.