Background

Tesla Inc. executives said the company will focus on cutting supply chain costs this year, as it is “between two major growth waves.” That didn’t stop the stock from falling as much as 10% on missed earnings estimates.

The focus on improving profitability comes amid lower expectations for EV demand in the US and Europe. Restrictions on importing low-cost Chinese technology have also contributed to a rout among Tesla’s suppliers, rivals and customers. Bloomberg Intelligence sees this step back as a “prelude to two steps forward,” with Tesla improving efficiency for its parts, processes and vehicles in 2024 before introducing a new mass-market model in 2025.

The issue

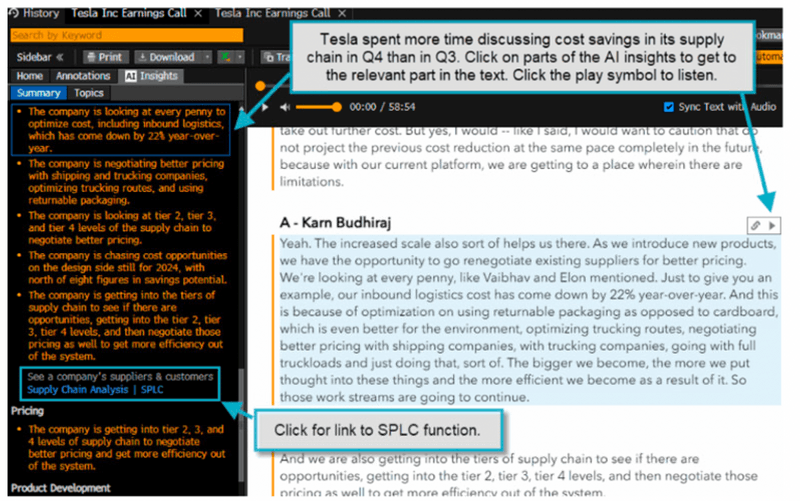

“As we introduce new products, we have the opportunity to go renegotiate existing suppliers for better pricing,” Tesla Vice President Karn Budhiraj said. He cites a 22% year-on-year cut in inbound logistics costs and having options for battery suppliers, including its own 4680 battery.

CEO Elon Musk is chasing design-driven cost cuts and is optimistic about commodity price declines. The company “may need more time to navigate its rough patch,” writes Steve Man, a BI auto analyst. But the cost-management focus will give it “greater flexibility to cut prices more, if necessary.”

Tesla shares dropped 17% in the month before its earnings after rising competition prompted it to cut Model 3 prices by 6% in China, and Red Sea shipping attacks disrupted production at its Model Y plant near Berlin. Rivals like Ford Motor Co. and BMW AG also declined as they failed to rival Tesla and China’s BYD Co. in either software or costs.

Suppliers from battery maker LG Energy Solution Ltd. to miner Glencore Plc saw their stock fall 10% or more in the month to Jan. 23. Customer Hertz Global Holdings Inc. slumped 15%, as it decided to sell 20,000 EVs due to their low resale values and high repair costs.

Battery metal prices slumped as new supply failed to find sufficient demand. Lithium dropped 80% on the year to Jan. 23, as aluminum, nickel, copper, cobalt and steel all fell. Median price forecasts for lithium, nickel and cobalt point to minimal price growth in 2024 as the EV demand slowdown erodes metals demand.

Tracking

Use Bloomberg’s DS, SPLC, BNEF and BI tools to analyze fundamentals across the EV supply chain.

For more information on this or other functionality on the Bloomberg Professional Service, click here to request a demo with a Bloomberg sales representative. Existing clients can press <HELP HELP> on their Bloomberg keyboard.