This analysis is by Bloomberg Intelligence Strategist Breanne Dougherty and Senior Associate Analyst Jessica Lin. It appeared first on the Bloomberg Terminal.

It’s been a volatile three years for investing across themes such as EVs, robotics and biofuels even with the breakout of artificial intelligence in 2023, based on our portfolio of 30 themes. This year, we believe thematic-based investing could be poised for a return to the forefront where it belongs, with the potential for a standout year for cloud, cybersecurity, 5G and genomics.

Only 27% of our themes posted positive three-year returns, while global theme ETF assets dropped 13% from their peak in 2021.

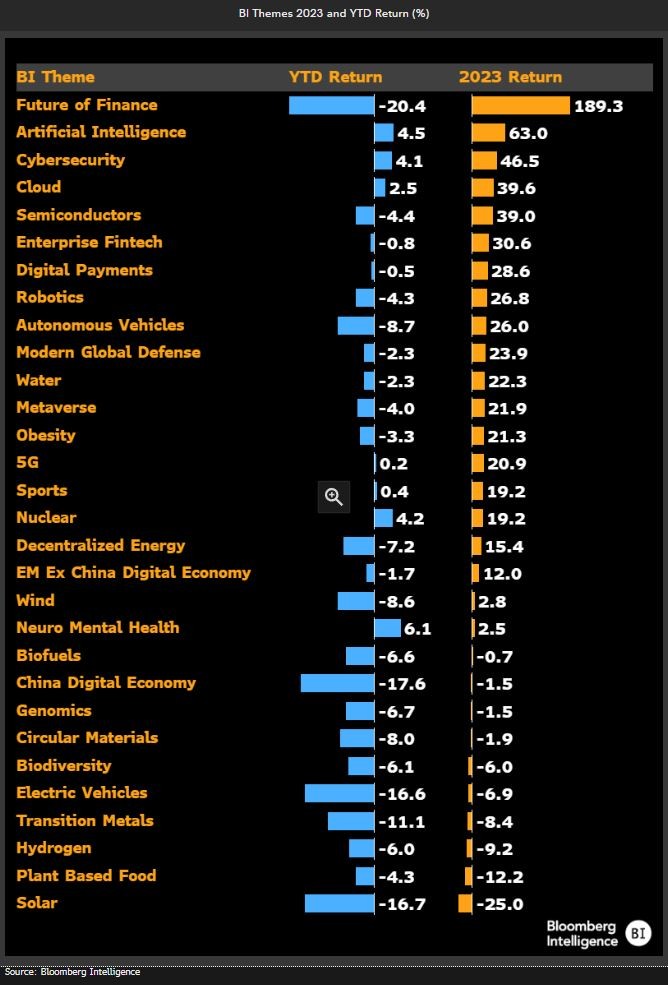

AI dominated 2023, but Future of Finance led on returns

Our Future of Finance theme had the highest returns of our 30 BI groups (rising 189%) in 2023, with the caveats being that its performance reflected an escape from the throes of a deep crypto winter that took hold in 2022 and extended into 2023 (three-year return is negative 23%). And so far this year, its 20% decline is the steepest among our themes. AI came in second with a 63% return last year, notably also being among the minority of our themes with a positive three-year return (7%) and one up so far in 2024.

For this year, on our radar are established Accelerating Tech themes, where investor interest seemingly waned in 2022-23 and where we see clear AI tailwinds for cybersecurity, cloud, 5G. Also, themes where deal acceleration may be a potential catalyst, including digital payments, genomics and, again, cybersecurity.

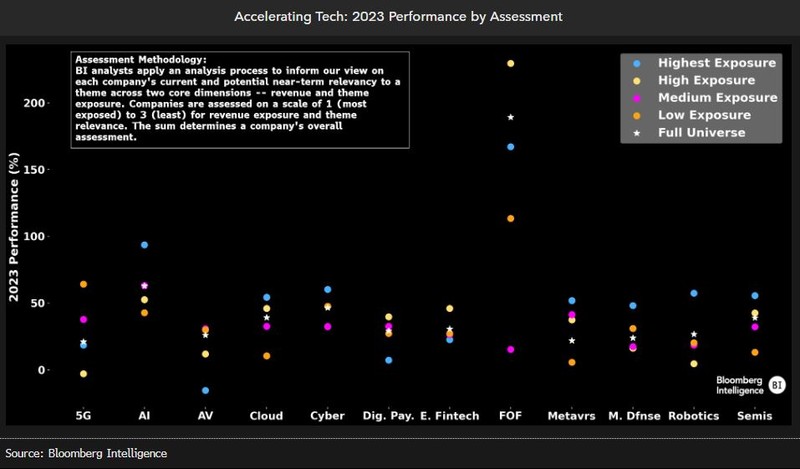

Look to strong AI intersection names and themes in 2024

BI’s highest-assessment AI names led our Accelerating Tech category in 2023 returns, and also brought in the strongest returns in their respective themes for AI-adjacent themes. Four of six of those names in AI overlap, with cloud (Crowdstrike, Adobe, Datadog, Dropbox) and two of four AI names with cybersecurity (Crowdstrike, SentinelOne) demonstrating a valuable intersection across themes. We see cloud and cybersecurity as themes overshadowed by AI in 2023 that may get their due this year.

Hyperscale cloud companies Microsoft, Amazon and Alphabet returned 58%, 81% and 58% in 2023. While they are lower-assessed names due to diversified business models, these companies are dominant forces in AI and cloud. Because their models require extensive computing and storage, AI proliferation should continue to help these names.

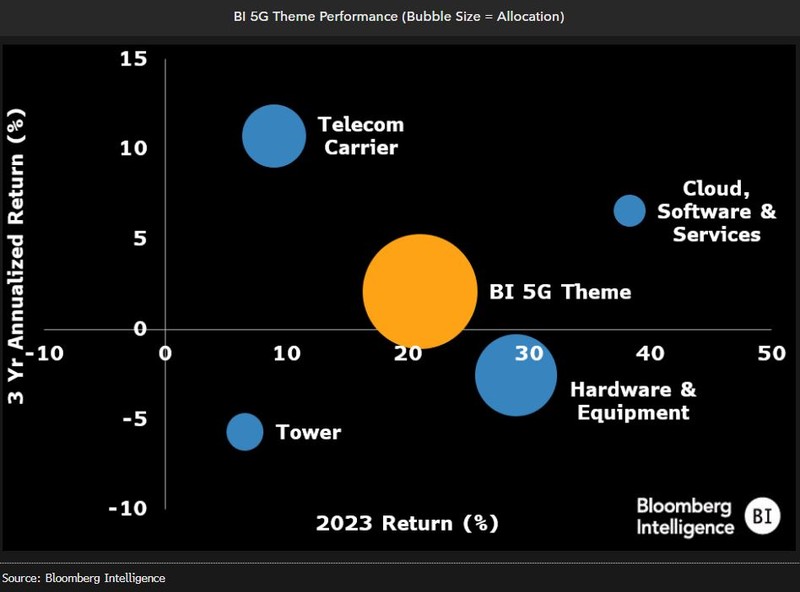

5G the potential dark horse of 2024; recent deal a bellwether?

We expect AI proliferation to serve as a catalyst to multiple themes, with standouts to watch being cloud and cybersecurity. We also see 5G as an emerging dark horse this year. The theme has lost favor with investors (2023 ETF outflows of $1.5 billion) but has a strong relevance to AI proliferation — and there’s been an uptick in investor engagement. Elliott launched an activist campaign at Crown Castle in November, and KKR announced a string of telecommunications deals in the last couple of years. Most recently (Jan. 9), Hewlett Packard Enterprise announced the acquisition of Juniper Networks for about $13 billion. Hewlett Packard is solely mapped to our AI universe, Juniper mapped to both our 5G and cybersecurity themes with a highest BI assessment for the former.

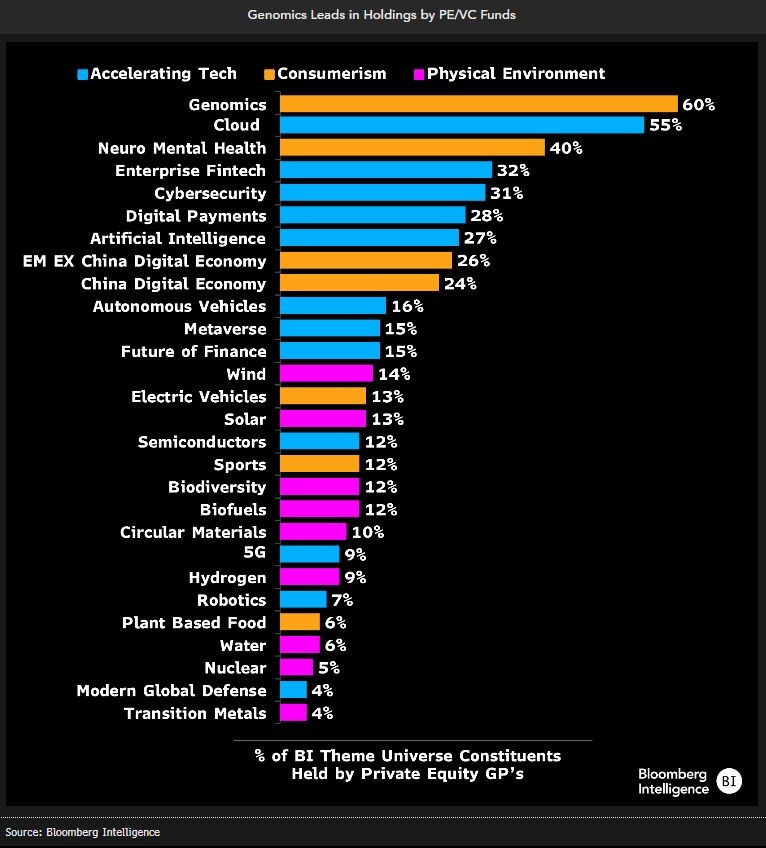

Genomics gets spotlight on public/private markets intersection

Our genomics theme has a three-year trailing annualized performance of negative 26%. Yet, with high exposure to early-innings innovation and a strong intersection of public/private markets, genomics has the highest percentage of equities out of our 30 themes held in PE/VC funds and may be poised to take spotlight in 2024. Names from our universe with high representation in funds in our analysis: Sophia Genetics, Twist, Verve and Caribou. Of note, other names in our universe — Beam, CRISPR and Intellia — have Cathie Wood’s ARK Investment listed as the biggest shareholder at 11-13% each.

While overarching low-risk tolerance has been challenging for early-innings innovation themes like genomics, pent-up demand from muted 2022-23 PE/VC and M&A activity could be unleashed at the first hint of reversing risk views.

Robotics & AI ETF inflow buoyed 2023; look to more in 2024

Flows into global theme ETFs fell to $7 billion in 2023 from $16 billion in 2022 and $75 billion in 2021. Innovation dominated inflows ($11 billion), though more than 85% went to three China ETFs investing mainly in Chinese stocks. Robotics & AI came in second ($4.8 billion) and defense third ($2.2 billion). Flows and performance weren’t universally correlated: cybersecurity, cloud and 5G returned 42%, 36% and 29% last year, but combined had over $3.5 billion in outflows, which could mean investors reallocated to AI. In 2024, Robotics & AI has maintained inflows ($487 million), with cloud and cybersecurity picking some up; 5G is still on an outflow trend.

The biggest disconnects: First Trust Cloud Computing, Cathay Global Autonomous & EVs and ARK Innovation had outflows of $615-$827 million but returned 52-68% in 2023.