This analysis is by Bloomberg Intelligence Senior Macro Strategist Mike McGlone. It appeared first on the Bloomberg Terminal.

Natural gas, the primary source of heat, electricity and fertilizer in the US, has dropped below its break-even cost of around $2 per million British thermal units, with implications for most commodities, notably crude oil. Equities are outperforming and have gained momentum, which may be offsetting deflationary forces from commodities and delaying central-bank easing that’s often necessary for commodity-price nadirs. China’s increasing dependence on fiscal and monetary stimulus for economic resilience may be reflected in slumping commodities, with the exception of gold.

But the old analog metal faces competition from the digital version, Bitcoin. Seasonality and record futures shorts in corn and grains suggest some bear-market buoyancy, which may shift responsive sellers’ attention toward relatively elevated crude oil.

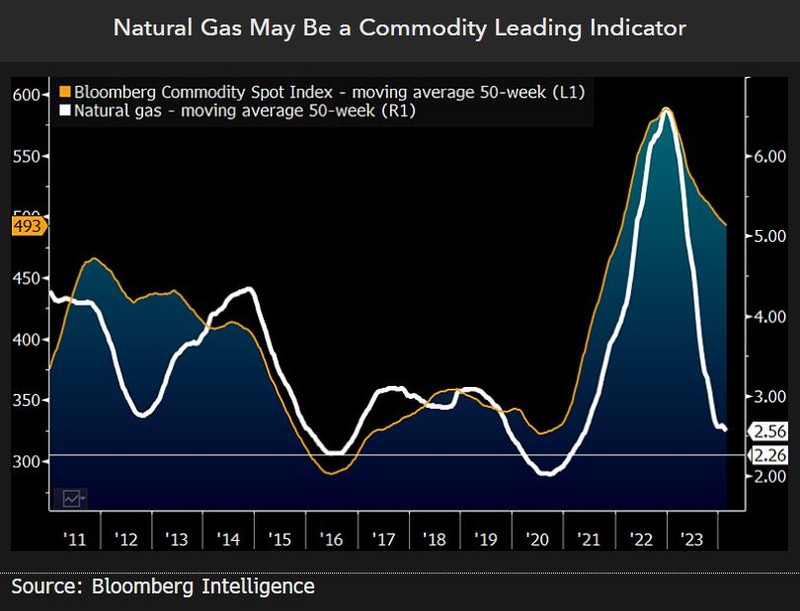

For commodities to bottom in the downward reversion cycle such as the one from 2022’s extreme highs, they would typically need some combination of prices below break-even costs, central-bank easing, a weakening dollar and rising demand-pull forces from expanding global economic growth and China. US natural gas may be a leading indicator.

Is natural gas fueling commodity deflation?

Natural gas is the highest-volatility major commodity and cleanest fossil fuel, and appears to be in early days of the low-price cure, with leading implications for broad raw materials. Gas production is at the forefront of advancing technology, pressuring prices of tangible commodities, notably in the US, and buoying related intangible equities. Our graphic shows 50-week moving averages to focus on trends, highlighting gas’ propensity to form lower lows while the Bloomberg Commodity Spot Index stays relatively elevated.

What stops the downtrend? Our bias is gas is nearing the inverse of the high-price cure from the 2022 stretch, but commodities have plenty of room below. Price spikes from the biggest-ever money pump, Russia’s invasion of Ukraine and China in decline may be ample reason for an enduring commodity bear market.

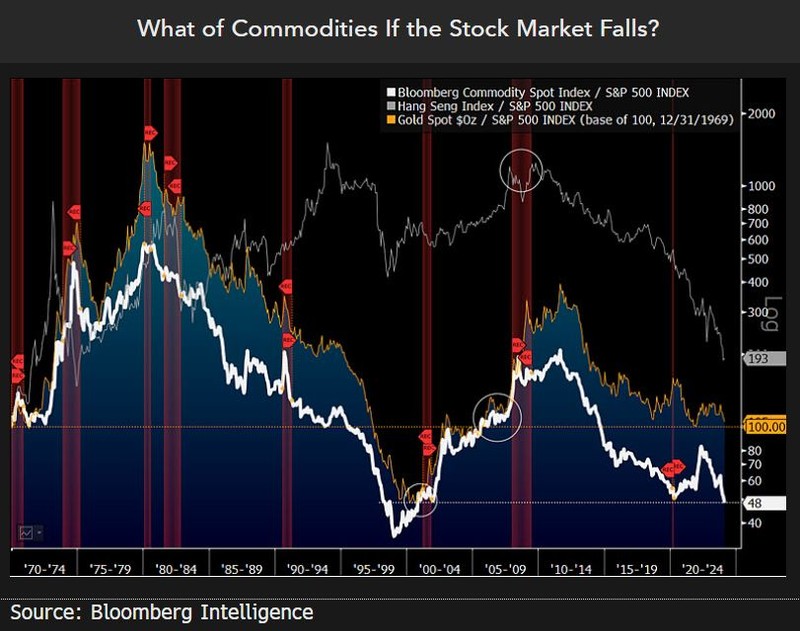

Top commodity risk may be stock-market reversion

The Great Recession in 2008-09 marked a peak in the Hang Seng Index (HSI) vs. S&P 500 (SPX), and a similar relative downward track in commodities may show great-reset leanings. The Bloomberg Commodity Spot Index has dropped to the lowest vs. the stocks benchmark since 2001, just before the roughly 50% SPX drawdown and 2001 recession. It may be about how high the SPX is vs. the BCOM and HSI that matters most. Our take is that it might be an inordinate burden for the US stock market to keep rising, and that the minus-3% average of producer price indexes in the US, China, Japan and Germany could be a precursor for a deflationary tide if the SPX drops.

What’s notable from our graphic other than the HSI/SPX ratio falling to the lowest level since 1975 is the resilience of gold. The gold/SPX ratio is at about the same as in 2007.

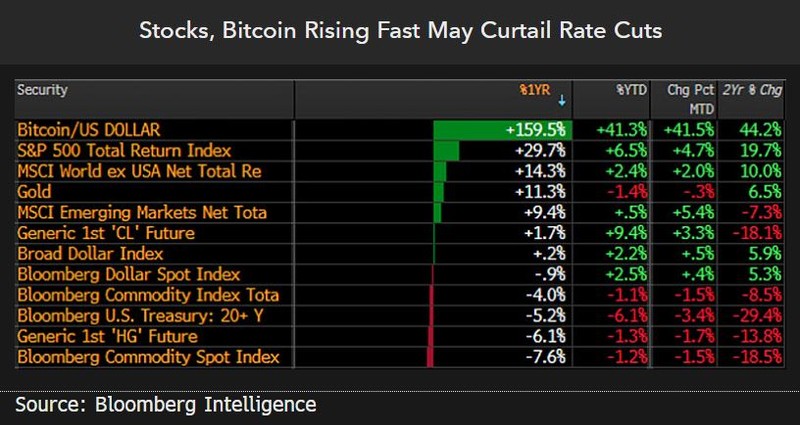

Is the high-price cure trickling down?

Speculative excesses in risk assets may be curtailing Fed easing, with implications similar to the high-price cure that topped out commodities in 2022. If rapid rate-hike cycles akin to 2022-23 are a guide, it can take a decent lag to central-bank pivots for commodities to bottom. The difference this time — China in decline — may portend enduring material-price headwinds. Our take from the annual scorecard showing the S&P 500 up about 30% and Bitcoin 160% is that it may be irresponsible for the Fed to ease with their inflation metrics above target and recently ticking up.

It makes sense that inflation can stay elevated with the stock market and cryptos rising rapidly in a world increasingly dominated by intangible assets. The low-price cure in most tangible commodities appears distant, with the exception of natural gas.

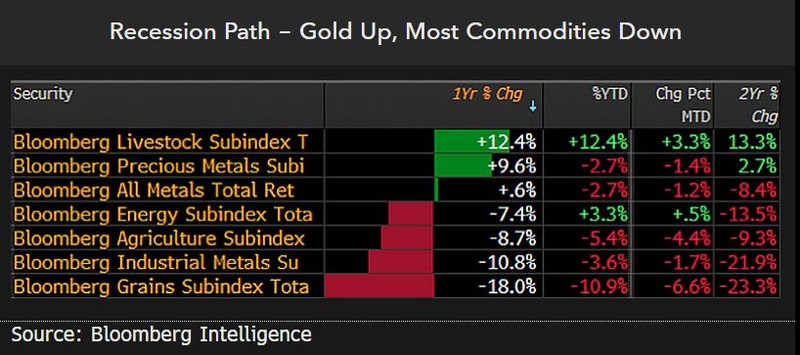

Commodity deflation could be driving gold inflation

Gold outperforming most commodities may be gaining momentum in 2024, particularly if the US stock market has some back-and-fill. It makes sense that the Bloomberg Precious Metals Subindex is down about 3% in 2024 to Feb. 28, with the S&P 500 up 6% and US T-bills yielding over 5%. Why buy gold with the stock market on a tear amid high interest rates? This is showing up in ETF outflows tracking the metal, but the deepest pockets on the planet — central banks — are accumulating. China is a top gold buyer and behind divergent strength in the metal.

Resilient gold may be anticipating an end-game, indicated by most commodities declining and a potentially inordinate burden of the US stock market to remain elevated. If stocks fall, deflationary dominos may tumble, on the back of commodities.