This article is by Kapil Phadnis, Sanghyun Park and Gabriel Kan.

Smart Close Algorithm

The closing auction is one of the biggest liquidity events in global equity markets. It represents about 10% of the total volume in U.S. and Asia, and 20% in Europe (Table 1). On special event days, such as month end and futures expiry, closing auction volume can be as much as doubled from the regular days. Institutional traders often participate in the closing auctions because they are benchmarked to the closing prices or they want to leverage the available liquidity in the auctions. A tropicalized algorithm is needed to account for the regional differences in the market microstructure. Executing the whole order in the closing auction can lead to significant impact on the closing price. Traders may opt to trade part of their order in the continuous session to limit their market impact, and the ideal allocation would then be a balance between market impact (trading in the closing auction) and tracking error (trading in the continuous session). To facilitate our clients in this regard, Bloomberg Tradebook’s Smart Close Algorithm offers a dynamic and customizable strategy that provides an optimal execution to benchmark the closing price. Smart Close also leverages Tradebook’s closing auction technology and the proprietary volume prediction model to achieve the ideal execution.

| Country | Firm | Closing Auction % |

| Japan | Sony Corp | 5.8% |

| Australia | CLS Ltd | 19.5% |

| UK | Vodafone Group PLC | 27.1% |

| US | Pfizer | 8.5% |

Table 1: Closing auction volume as a percentage of total day volume. Source: STAZ<GO> on February 12, 2016

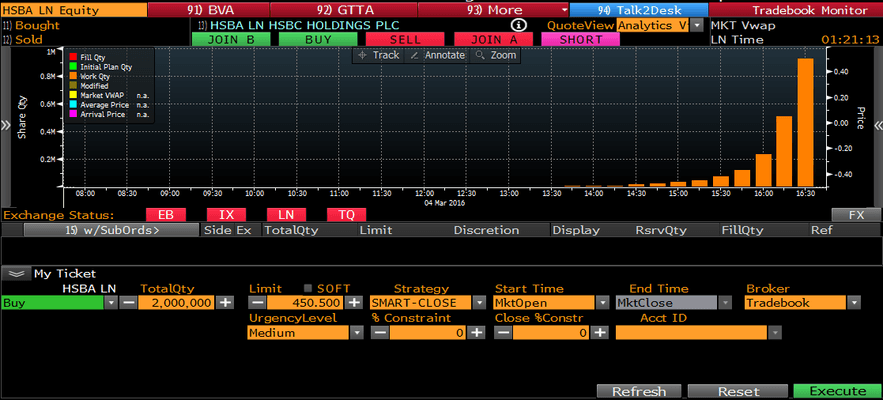

Figure 1. An example of Smart Close order ticket and visualization of the trading schedule on GTMQ<GO>.

Tradebook Closing Auction Technology

Closing auction mechanics can be vague and intricate. Order types, order handling in the pre-matching session, auction matching rules, auction extension rules and price limits all contribute to the complexity. Such difficulties are further exposed when a trader wants to execute a global basket and needs to account for the regional differences in the auction mechanisms (Table 2).

| Market | Pre-Auction Call Period | Market-on-Close Order Type | Random Closing Time | Trade at Last Session |

| Australia | Yes | No | Yes | Offered by Chi-X |

| Japan | Overlapped with the continuous session | Yes | No | No |

| Singapore | Yes | Yes | Yes | No |

| London | Yes | Yes | Yes | Yes |

| Germany | Yes | Yes | Yes | No |

| France | Yes | Yes | Yes | No |

| Brazil | Yes | Yes | Yes | No |

| Canada | Overlapped with the continuous session | Yes | Yes | No |

| US | Overlapped with the continuous session | No | No | No |

Table 2: Closing auction mechanisms of major markets. Source: BTMI<GO>.

In order to facilitate closing auction trading, Tradebook tropicalizes the auction logic that accounts for characteristics of individual markets. The strategy slices the shares into child auction orders to minimize market impact as well as maximize the chance of execution. An accurate prediction of the closing price distribution (Figure 2) would allow setting a limit price that is aggressive enough to not re-price the orders too frequently and lose the queue position, but also passive enough to not make a market impact. By incorporating both the real-time indicative prices and historical market data, Tradebook’s auction logic dynamically re-revises auction orders to improve execution.

Figure 2. Differences between indicative price and the actual closing price of VOD LN during the pre-auction session.

Predicting the closing auction volume is particularly important to control market impact. The auction book build-up usually requires several minutes to stabilize in the pre-auction session (Figure 3). Indicative volume provided by the exchange becomes a valuable factor to predict the final closing auction volume. Comparing to predicting by the 30-day average volume, Tradebook’s closing auction volume prediction model that uses indicative volume can reduce the prediction error by as much as 40% (Figure 4). The model does not only improve the prediction near the matching time, but also in the beginning of the pre-auction session.

While the Smart Close algorithm fully leverages Tradebook’s closing auction technology, it also provides the ideal allocation between the closing auction and continuous session. Details are further discussed in our next post.

Figure 3. Indicative volume as a percentage of final closing auction volume of VOD LN during the pre-auction session.