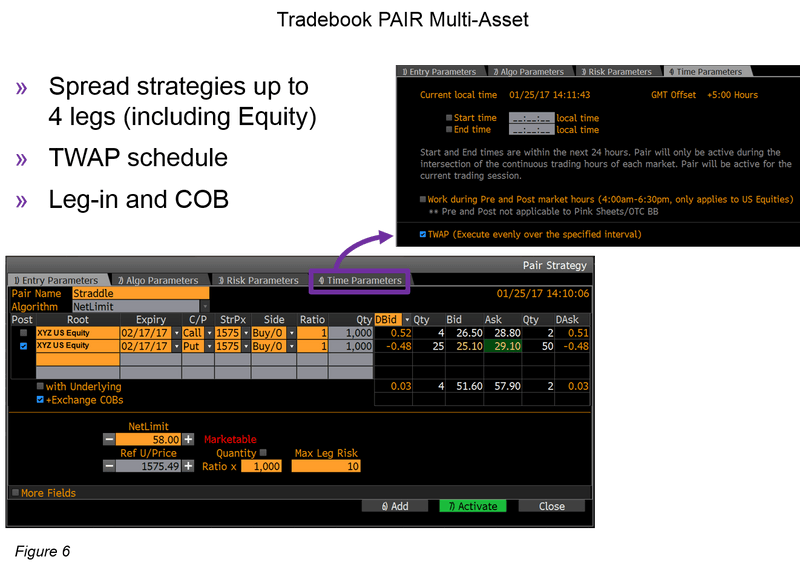

Options spread strategies account for nearly half the daily volume in the U.S. options market. Tradebook’s PAIR Multi-Asset platform provides an optimized TWAP solution to execute options spreads; it intelligently seeks execution quality in the individual legs and as a package on the Complex Order Books.

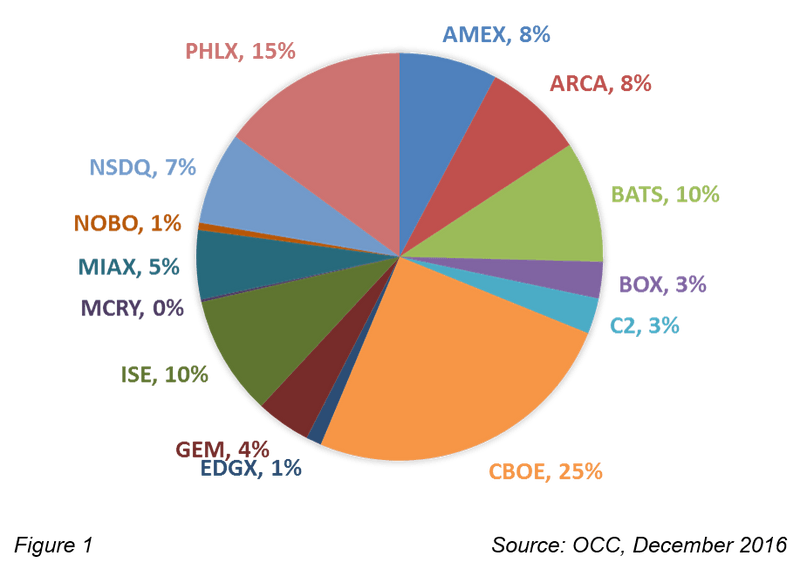

The U.S. options market continues to be fragmented across 15 options exchanges, with the recent addition of Miami Pearl (Figure 1) For the month of December 2016, all the exchanges, other than the top two CBOE (25%) and PHLX (15%), had less than 10% market share in contracts traded.

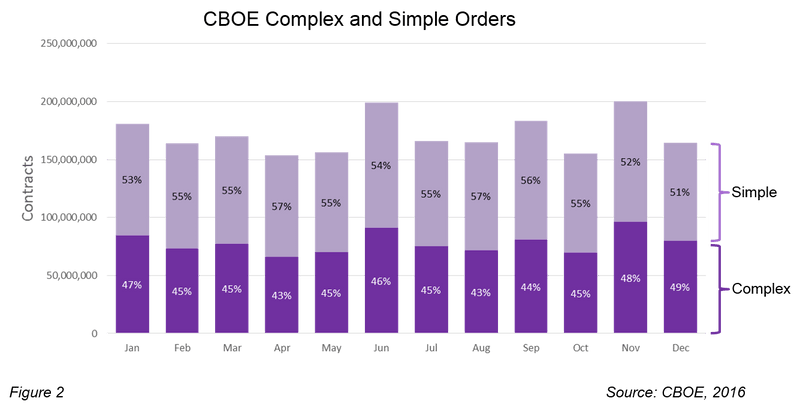

Additional liquidity may also be found for spread strategies in the Complex Order Books (COB) on seven options exchanges. In a profile of the CBOE in 2016, nearly half the volume (~45%) was executed as complex spreads (Figure 2).

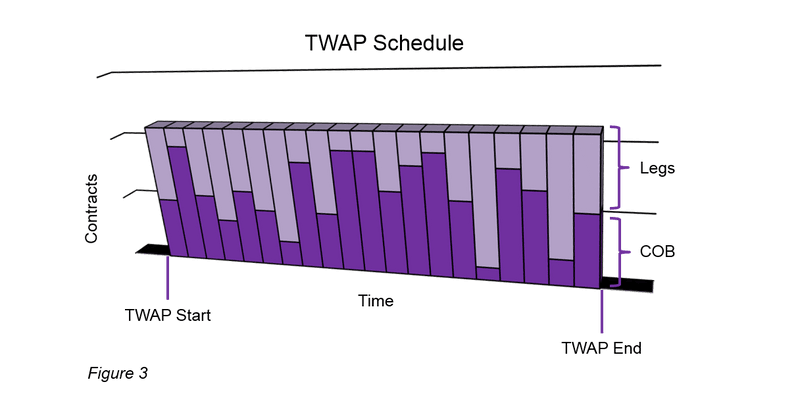

Using a time-weight average price (TWAP) strategy allows a large order to be sliced over the day or a set time period (Figure 3). A TWAP can reduce market impact with smaller child orders and allow for price discovery when executing over an extended time period. Execution quality is enhanced by executing the individual legs of a spread order on the 15 exchanges and as a spread package across the seven Complex Order Books.

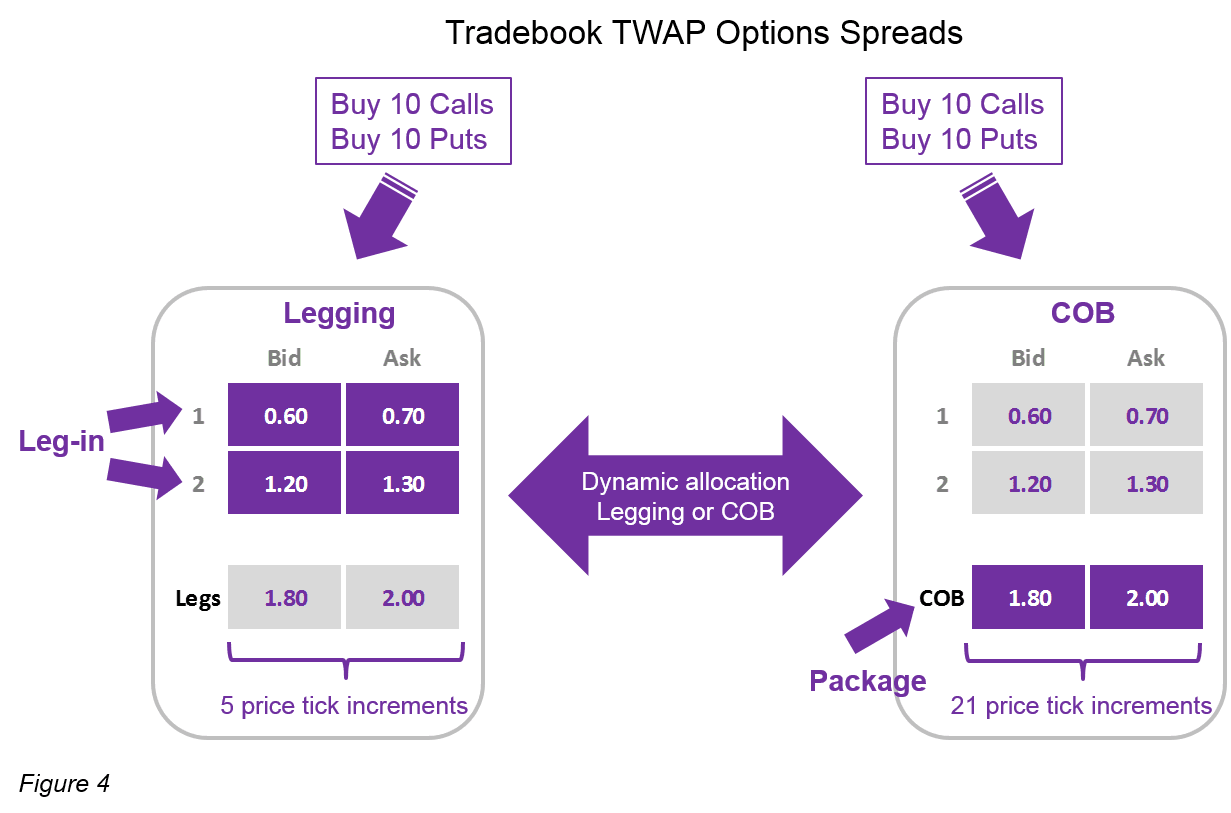

For example, a slice of a large order would attempt to execute small child orders in a 3-minute time slice, with two slice managers independently working two spread orders. A “legging” slice manager will leg-in to each leg of the spread order. Concurrently, the second “COB” slice manager will send the complete spread package to execute for the spread price (Figure 4).

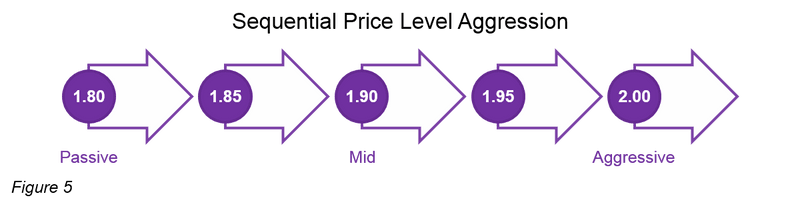

Price improvement opportunities are discovered for the orders by sequentially stepping through each price tick increment from passive to aggressive levels in random time intervals.

Working a spread strategy by simultaneously legging-in and using a COB package allows the trade to take advantage of price tick increment differences in the individual contracts and the COB spread price. In the same example, the minimum price tick increment for the individual contracts happens to be 5 cents. Therefore, adding the prices of the two contracts will allow for only five possible price tick increments $(1.80, 1.85, 1.90, 1.95, 2.00) for the spread price.

The COB, however, allows for 1-cent price tick increments when executing the complete spread package for a possible 21 price levels $(1.81, 1.82, …, 2.00). By starting with a passive price, then gradually increasing by 1 cent at a time, the order has the possibility for a better price execution compared with moving in 5-cent increments.

Further, the strategy dynamically allocates orders between the two slice managers, depending on which manager is getting a better execution in terms of price and liquidity. If the COB manager is better, then the Legging order is canceled and sent to the COB and vice versa.

Tradebook’s PAIR Multi-Asset platform can execute customized option/option and option/equity spreads for up to four legs as a TWAP (Figure 6). The strategy can be set to leg-in only or to include the COBs for all available liquidity and price discovery.