Background

What drove 2023’s record net income at JPMorgan Chase & Co., and what are the lessons for 2024’s broader market prospects? Why is JPMorgan expanding its workforce as Citigroup Inc. cuts 20,000 staff?

JPMorgan’s profit was driven by a surprise forecast that unprecedented net interest income (NII) may withstand Federal Reserve rate cuts this year, according to an AI-powered summary of its earnings call. Technology investments are generating more business and driving the company’s hiring plans. Meanwhile, Citi said its tech spending had boosted productivity, allowing for job cuts.

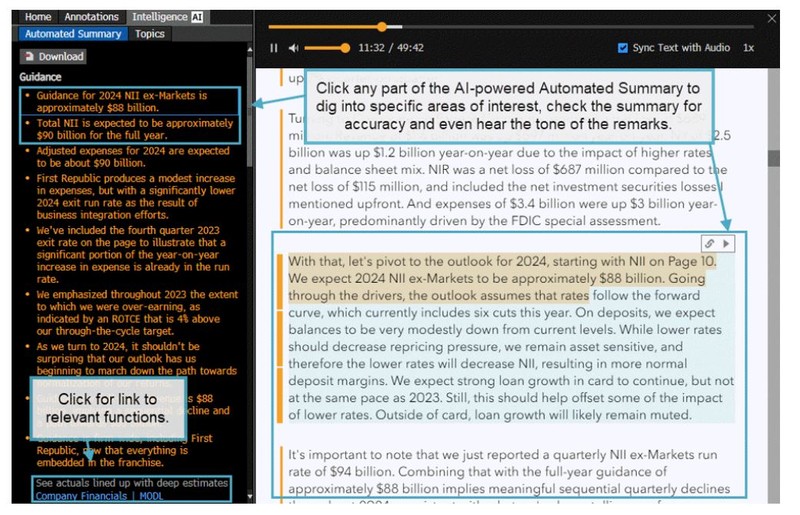

Use Bloomberg’s new AI-Powered Earnings Call Summaries to access highlights within one to two minutes of the transcript being available. The summaries save time getting to crucial parts of the transcript, digging into specific areas of interest and checking the summary for accuracy at the exact reference point in the original document.

The issue

NII of $90 billion ($88 billion excluding markets) in 2024 is higher than both 2023’s total and the consensus forecast for this year. The bank assumes Fed rate cuts will support loan growth and markets earnings while reducing pressure to pay higher deposit rates. That may help offset lower returns on assets, including loans and investments.

The momentum of NII forecasts was strongly upward even before JPMorgan’s higher guidance, with the potential for further revisions to the consensus. Capital Allocation shows the bank plans $2 billion of buybacks a quarter, and M&A indicates the bank is uncertain over capital markets normalization.

JPMorgan will hire bankers domestically and internationally because of new clients and new loans, especially as it accelerates its innovation economy strategy. Scrolling down to the final item in the 35-point earnings call summary shows new products, features and platforms driving growth and volume-related technology expenses.

Meanwhile, the three drivers of Citigroup’s job cuts are reduction of management layers, eliminating stranded costs after exiting markets and realizing productivity savings from technology investment.

AI-Powered Earnings Call Summaries are a key productivity tool to stay on top of what’s important and glean deeper insights across the coverage scope. The summaries highlight the key topics addressed by management, such as guidance, capital allocation, labor plans and the macro environment. Bloomberg Intelligence analysts, with decades of domain expertise helped train our state-of-the-art AI to more accurately understand the nuances of financial language and anticipate what’s important to investors.

Tracking

Run JPM US Equity DS TA <GO> to Access the AI-Powered Summary.

For more information on this or other functionality on the Bloomberg Professional Service, click here to request a demo with a Bloomberg sales representative. Existing clients can press <HELP HELP> on their Bloomberg keyboard.