Background

The resilience of Asian currencies is being tested by receding bets over the Federal Reserve’s interest rate cuts, geopolitical conflicts in the Red Sea and a deteriorating economy in China.

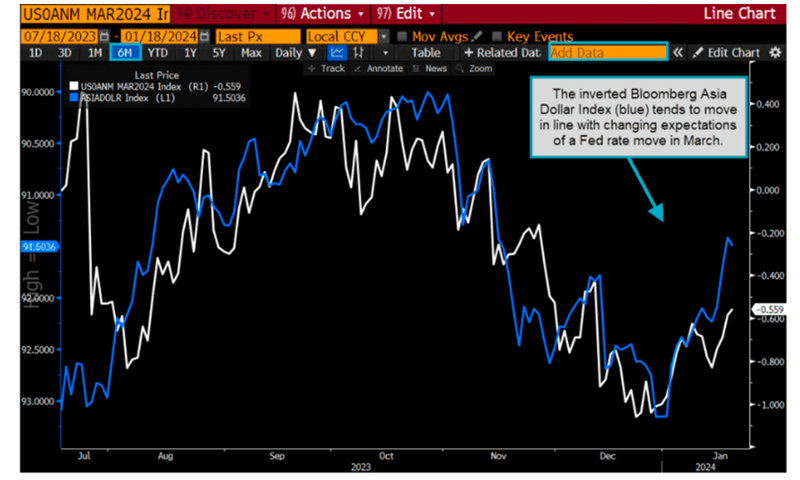

Futures traders have retreated from bets on a March Fed rate cut. This sent ripples across riskier markets, with South Korea’s won falling 2% over the past week. Option traders are favoring dollar calls against Asian currencies. Without a clearer turnaround in regional exports, the region’s currencies may remain victims of higher volatility.

The issue

Chances of a rate cut have declined significantly from earlier implications of a full quarter-point reduction. Analysis shows that regional currencies have retreated as doubts over a Fed cut grow. Stronger-than-expected US retail sales data, meanwhile, have bumped up GDP expectations and motivated a reassessment of the likely path for US monetary policy.

There are other factors in play. Foreign investors accelerated selling of Asian stocks as the US escalated strikes on Yemen’s Houthis, while China data disappointed amid investor pessimism about the yuan. Risk reversals for major Asian currencies have turned negative as traders curbed enthusiasm.

The flight to the dollar as a haven strengthened in early 2024, with risk reversals indicating deteriorating sentiment on Asian currencies. Implied volatility is higher for dollar call options than for puts across all four currencies. Notable is a big slide in the 25-delta 3-month USDTWD risk reversal.

The options market is signaling higher volatility for the Korean won during 2024. The three-month USDKRW options skew suggests traders are becoming more negative on the Korean won, a trend also seen for the one-year contracts.

Growth in South Korean exports moderated at the start of the year, suggesting any recovery in global trade this year could be bumpy. For now, economists are less optimistic overall. Asia Ex-Japan’s real GDP growth is forecast to moderate notably this quarter as the Chinese economy is seen extending its weakness, while Indian growth is also likely to continue letting up.

Tracking

Use Bloomberg’s WIRP, WCRS, OVDV, GP and ECFC functions to analyze the currency market. Run NSUB FFMSTORY to subscribe to functions-based stories.

For more information on this or other functionality on the Bloomberg Professional Service, click here to request a demo with a Bloomberg sales representative. Existing clients can press <HELP HELP> on their Bloomberg keyboard.