This analysis is by Bloomberg Intelligence Director of Equity, Chief Equity Strategist Gina Martin Adams and Bloomberg Intelligence Chief EM Credit Strategist. It appeared first on the Bloomberg Terminal.

As equity markets flounder, bond returns may continue to benefit from a shift in focus to growth from inflation in 2023. Our equity analysts see a rocky year that finishes with stocks about where they ended 1Q, with developed markets’ headwinds offset by emerging markets’ China-led recovery. A strong overweight on US small caps, and Taiwanese equities with a severe underweight to US large caps, might be needed to yield the annualized return of the MSCI ACWI from 2010-19 (6.7%).

Meanwhile, just about anything will do in bonds, as our 12-month total-return projections remain positive in all 13 asset classes under coverage at Bloomberg Intelligence, though maximal fixed-income returns could be achieved by substituting US investment-grade and high-yield credit for European government bonds and UK gilts.

The global equity outlook appears to hinge on emerging markets

Global equities are likely to remain about flat over the next 12 months as European and US large-cap return prospects are held back by slowing growth and limited rate reversals, which may be offset by emerging-market potential. Equity volatility should keep slowing in the next year as inflation moderates, but might remain above long-term averages. A large overweight on US small-cap equities could optimize risk adjusted returns in a global portfolio.

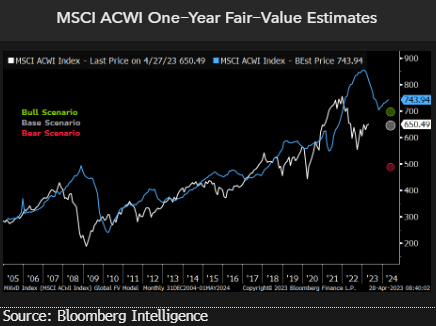

Global equities could flatline as developed markets reverse

A soft landing in the developed world may be needed to pull global equity returns into positive territory over the next year, according to our global fair-value model. Our model for global equities suggests limited gains are likely in the year ahead in dollar terms, driven by a reversal in US and European equities after their recent relief rally. That assumes a continuing decline in US EPS levels in the next 12 months, combined with flat P/E. Our fair-value model suggests that European equities might likewise face minor downside pressure. Emerging markets are likely to offset the weakness.

Our bull case, where global equities rise more than 8%, could emerge if a softer landing is achieved in the developed world. Our bear case of down 20% or more assumes severe stagflation.

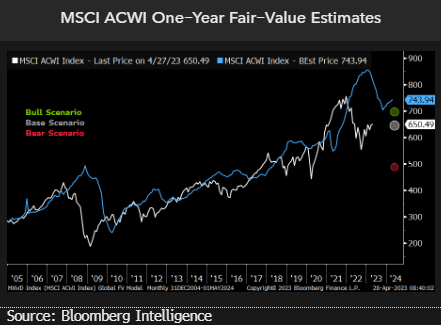

Global equities could flatline as developed markets reverse

A soft landing in the developed world may be needed to pull global equity returns into positive territory over the next year, according to our global fair-value model. Our model for global equities suggests limited gains are likely in the year ahead in dollar terms, driven by a reversal in US and European equities after their recent relief rally. That assumes a continuing decline in US EPS levels in the next 12 months, combined with flat P/E. Our fair-value model suggests that European equities might likewise face minor downside pressure. Emerging markets are likely to offset the weakness.

Our bull case, where global equities rise more than 8%, could emerge if a softer landing is achieved in the developed world. Our bear case of down 20% or more assumes severe stagflation.

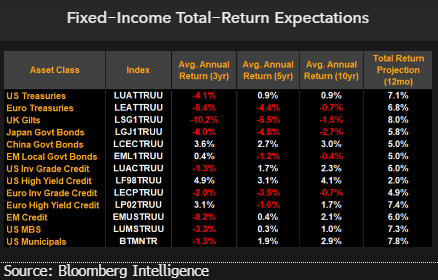

Return projections remain positive across global fixed income

Central bank activity is beginning to plateau as financial stability concerns cause creditors to shift their focus from inflation to growth. Fixed income performance expectations have moderated since year-end, yet 12-month total return projections remain positive in all 13 asset classes under coverage at Bloomberg Intelligence.

For more of our research, visit BI ASET <GO>. To subscribe, click on the button above.

Bond bulls better brace for bumpy road ahead

Fixed income performance expectations have moderated since year-end, yet 12-month total return projections remain positive in all 13 asset classes under coverage at Bloomberg Intelligence. Set to lead the broader fixed income universe are UK gilts (up 8%), US municipal bonds (up 7.8%), European high yield (up 7.4%) and US mortgages (up 7.3%). Conversely, US high yield (up 2%), European investment grade (up 4.9%), China government bonds (up 5%) and EM local debt (up 5%) are projected to trail fixed income peers over the 12-month period through March 2024.

Central bank activity is beginning to plateau, causing market participants to prepare for dovish pivots in monetary policy. Interest rate differentials could continue to tighten between Europe and the US, with non-dollar asset classes potentially a key beneficiary.

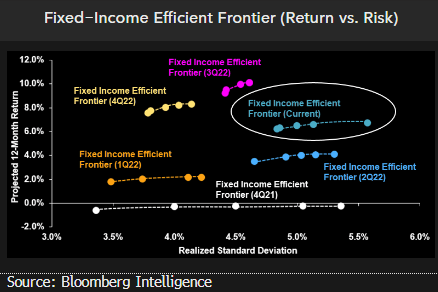

Are bonds beginning to lose their ballast?

Our fixed income efficient frontier remains firmly entrenched in positive territory, yet underlying Sharpe ratios have collapsed amid weaker total return expectations and a rising risk-free rate. In every optimal portfolio combination along the efficient frontier, US Treasuries, US mortgages and US municipals are afforded the maximum allocation possible. Conversely, Japanese government bonds, European investment grade and EM local debt receive the minimum allocation in every optimal portfolio.

Our core analysis employs US Treasury yield estimates of 2.53% (two-year), 2.95% (five-year), 3.15% (10-year) and 3.22% (30-year) when calculating 12-month total-return forecasts for our efficient frontier (aqua). Click the exhibit to construct optimal mean-variance portfolios, as conceived by American economist Harry Markowitz.