This analysis is by Bloomberg Intelligence Senior Macro Strategist Mike McGlone. It appeared first on the Bloomberg Terminal.

Materials prices appear to be on the wrong side of a typical commodity and global-interest-rate cycle to rebound in 2024. Stabilization in deteriorating energy, base-metal and grain prices may require the US stock market to remain resilient while facing a recession, which portends deflationary-domino risks if equities fall. Gold outperforming most commodities and the S&P 500 on a year-over-year basis to Nov. 29 may show inklings toward our base case: A great reset worthy of the biggest liquidity pump-then-dump in history.

The lessons of four decade highs in inflation could be enduring and curtail Federal Reserve easing. Gold is on track to shift $2,000 an ounce resistance into support, copper may head toward $3 a pound and WTI crude oil approach $40 a barrel, if Bloomberg Economics’ US recession outlook plays out.

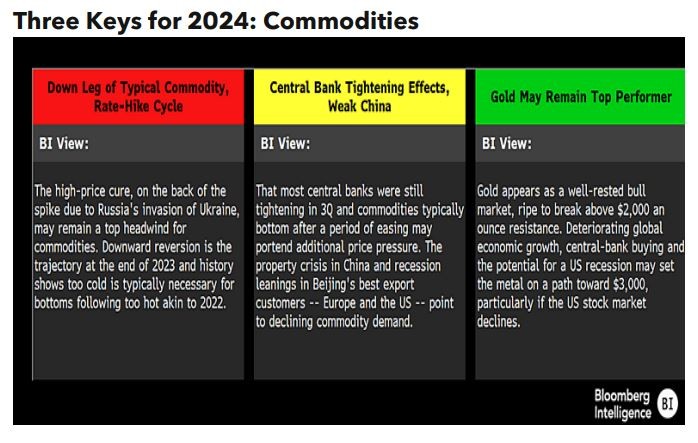

Commodities too hot up to 2022 peak could go too cold into 2025

Deteriorating economic growth in Europe, the US and China while most central banks were still tightening in 3Q signals that the high-price cure from the 2021-22 rally could maintain the downtrend in commodity prices into 2025. The burden on the US stock market to lift all boats could prove too much.

Hot commodities in 2022 could be too cold in 2024

Commodities are in a downward trajectory nearing the end of 2023 that may accelerate in 2024. The stage of the cycle, on the back of a heated surge to the 2022 peak, is unfavorable, and it’s likely a question of how low prices will need to go for a typical reset. Our graphic of the Bloomberg Commodity Spot Index (BCOM) vs. global GDP shows what might be early reversion days from the sharp rally. What’s notable is the excess of downside room in the BCOM and S&P 500 vs. GDP. Next year may be about what stops the commodity pendulum from swinging relatively cheap, and the potentially inordinate burden on a rising US stock market to lift all boats.

A primary catalyst for the BCOM to continue its lower highs and lows trajectory vs. GDP may be a US stock market drawdown, typical in recessions.

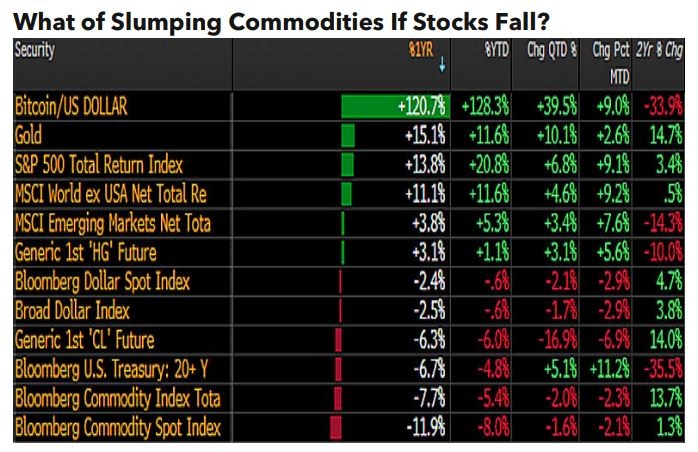

Commodities show deflation; What of stocks?

The S&P 500 is about as stretched vs. global GDP as the 2000 peak and the commodity-to-stock index correlation is near the highest ever, which may portend deflation risks in 2024. Our graphic showing the Bloomberg Commodity Spot Index (BCOM) declining and S&P 500 rising in 2023 appears unsustainable, particularly if the US follows recessionary leanings in Europe. Deteriorating economic growth and the property crisis in China, and the Conference Board’s leading indicators index at minus 7.6%, may be grounds for commodities to continue a normal downward reversion path following the high-velocity rally to the 2022 apex.

At about 0.50, the 40-quarter correlation between the BCOM and the S&P 500 compares with minus 0.60 at the start of 2000. The Great Recession lifted correlations, but that liquidity fuel may be past tense.

Deflationary dominoes a risk to equities in 2024

Gold near the top of our annual macro performance scorecard and the Bloomberg Commodity Spot Index on the bottom is a global recessionary trajectory. The potential for trend reversal or acceleration is a key question for 2024, and our bias is the latter. What appears unsustainable are falling Treasury bond and rising stock-market prices, especially with 2024 US recession outlooks from Bloomberg Economics and the Conference Board’s index of leading indicators. The US economy has been resilient in 2023, but so has central bank vigilance, and it may not be until 3Q24 that coordinated rate hikes from 3Q will be fully felt.

Europe’s recession leanings and deteriorating growth in China point to a key falling-domino risk: The US stock market likely needs to remain resilient or deflation may be a primary theme a year from now.

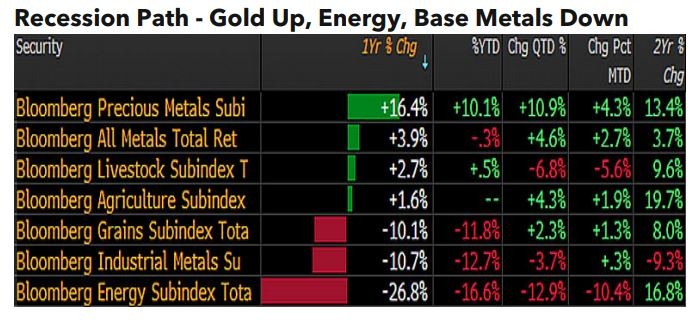

Gold could be a top performer again in 2024

Another global recessionary signal is that energy is at the bottom of our commodity-sector annual performance scorecard and precious metals are on top. A primary spark that may accelerate this trend is a typical US stock-market drawdown for a recession. If that can be avoided and Europe and China rebound from sliding growth — on the back of the most aggressive global central-bank tightening period ever, which may not have ended in 3Q — commodity prices could stabilize in 2024.

Our base case for a great reset is guided by the lessons of history, economics and big liquidity pumps that dump. The year 2025 may be marked by a lower plateau in risk assets and underpinnings from central-bank easing. The down leg of a typical commodity cycle and the Fed still focused on higher for longer might tilt 2024 outperformance toward gold.