Bloomberg Market Specialists Lilian Gao, Rae Lin, and Norah Wang contributed to this article. The original version appeared first on the Bloomberg Terminal.

Background

Tesla Inc.’s Elon Musk says Chinese electric vehicle makers could “demolish” most other rivals if free of trade barriers. Yet their overseas expansion is underpinned by domestic vulnerabilities: a bruising price war, a slowing economy and industry consolidation.

BYD Co., which leapfrogged Tesla in 2023 as the world’s biggest EV maker, is no exception in facing slower sales growth and turning to exports for growth. Rival Chinese EV makers are mostly unprofitable, triggering M&A as competition stiffens.

The issue

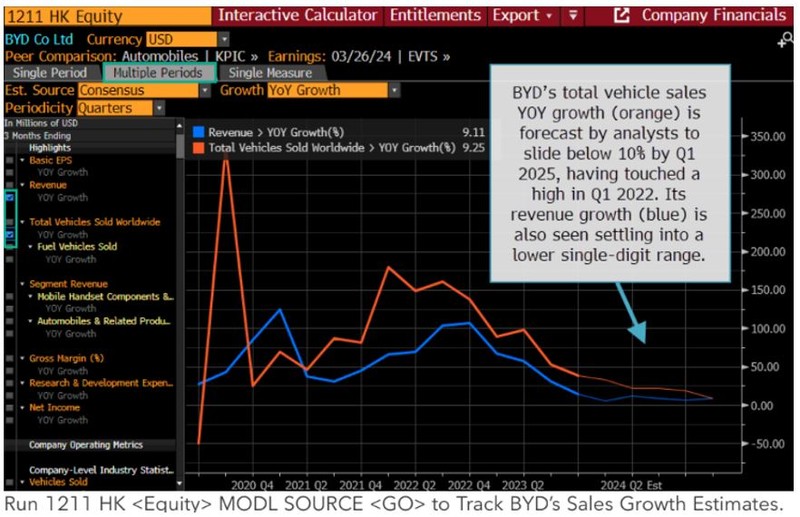

Analysts forecast BYD’s year-over-year vehicle sales growth to fall below 10% in the first quarter of 2025, having peaked in Q1 2022. BYD’s revenue growth may also be in a lower-single-digit range. The company reported record-breaking preliminary 2023 net income in January, although the range fell short of analyst estimates for 31.5 billion yuan.

Joanna Chen, a Bloomberg Intelligence industry analyst, wrote in a January report that BYD might eventually shift resources to Europe for global expansion. Thailand, Israel, Australia and Brazil were the company’s top overseas markets by battery EV unit sales in 2023, the report said.

2023 saw a surge in Chinese EV exports, especially to Asia and Europe. Despite the export surge, tougher domestic competition is driving M&A as smaller EV makers seek lifelines. Deal volume in the second half of 2023 surged to the highest since Q2 2019.

Tesla’s Musk raised the alarm about rapid overseas expansion by Chinese EV makers when reporting quarterly earnings last month.

“The Chinese car companies are the most competitive car companies in the world,” Musk said in the transcript. “They will have significant success outside of China depending on what kind of tariffs or trade barriers are established. Frankly, I think if there are not trade barriers established, they will pretty much demolish most other car companies in the world.”

The Biden administration is considering additional restrictions on imports of Chinese EVs and parts originating from China. These measures would address data security concerns by preventing Chinese automakers from moving cars and components into the US through third countries like Mexico.

Tracking

Use Bloomberg’s MODL, DSET, DS TA and MA functions to analyze the auto industry. Run NSUB FFMSTORY <GO> to subscribe to functions-based stories.

For more information on this or other functionality on the Bloomberg Professional Service, click here to request a demo with a Bloomberg sales representative. Existing clients can press <HELP HELP> on their Bloomberg keyboard.