This article was co-authored by Sujeet Banerjee, Product Manager for Bloomberg Indices and Luke Oliver, Head of Climate Investments for KraneShares.

As transport and industrial sectors accelerate to achieve electrification and eliminate dependence on fossil fuels, the demand for electrification metals is expected to increase exponentially. This surge in demand has also created a variety of economic and supply-chain problems, according to BNEF research there are three main universal challenges facing the electrification supply: Scarcity, Geo-Politics, and Sustainability.

Metals such as copper, lithium, cobalt, and nickel are essential for the production of electric vehicles and renewable energy technologies. These metals are used in batteries, motors, and other critical components of these technologies. As a result, the demand for these metals has increased

significantly in recent years, driven by the growth of the electric vehicle market and the increasing adoption of renewable energy.

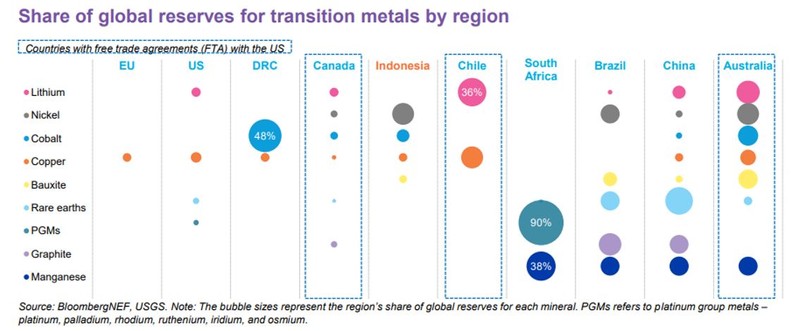

The supply of these metals, however, is limited, and their production is concentrated in a few countries. For example, about half of the world’s cobalt supply comes from the Democratic Republic of Congo, while China is the largest producer of rare earth metals, which are critical for the production of electric motors. This concentration of supply poses a significant risk to the electrification industry, as any disruption in the supply chain could lead to price volatility and supply shortages.

In addition, national priorities and geopolitics play significant roles in securing these metals, magnifying the supply-demand imbalance. Governments are stepping in to strengthen domestic supply security; policies like the US Inflation Reduction Act (IRA) and Free Trade Agreement (FTA) subsidize a significant amount of cost if the raw material is sourced from FTA countries, creating a more complex pricing mechanism for these metals.

The supply and demand dynamics of electrification metals have significant implications for investors. Investors should consider the concentration of supply when evaluating investments in companies that produce or use these metals. To address this need, Bloomberg has developed the Electrification Metals Index (BELEC), which is a composite index that tracks the price movements of six key metals: copper, aluminum, nickel, cobalt, lithium, and Zinc. These metals are essential for the production of electric vehicles, batteries, wind turbines, solar panels, and other renewable energy technologies.

BNEF research estimates net zero by 2050 would require metals valued at $10 trillion. For instance, lithium and cobalt are key metals needed for the production of batteries. Aluminum is currently used in transmission and distribution grids, is a core part of solar panels and wind turbines, and is expected to have increasing use in EV batteries over time due to its durability and low weight. Copper is one of the fundamental metals used for electric wiring and cabling, is a vital part of existing renewable energy technologies, and is heavily used in EVs; electric vehicles require double the amount of copper that traditional ICE vehicles do.

KraneShares Electrification Metals ETF KMET tracking the Bloomberg Electrification Metals index is strongly positioned to capture the growing demand and value of the metals needed for electrification.

Investors should also consider whether electrification is to be a truly sustainable transition. To achieve such a transition, a unified global approach is needed to ensure sustainable material sourcing, efficient battery production, and effective end-of-life processing. In July 2023, the EU Battery Regulation Amendment was adopted by the EU Council, laying out the structure to achieve sustainable battery lifecycles. It was one of the first large frameworks addressing transition sustainability and is unlikely to be the last.

Metals will certainly be a pivotal part of the electrification of our world. Scarcity, sourcing, and sustainably will heavily define their exact role. Bloomberg’s allocation to metals in its electrification metal index is based on the metal’s relevance to electrification and its supply-demand imbalances.

The data and other information included in this publication is for illustrative purposes only, available “as is”, non-binding and constitutes the provision of factual information, rather than financial product advice. BLOOMBERG and BLOOMBERG INDICES (the “Indices”) are trademarks or service marks of Bloomberg Finance L.P. (“BFLP”). BFLP and its affiliates, including BISL, the administrator of the Indices, or their licensors own all proprietary rights in the Indices. Bloomberg L.P. (“BLP”) or one of its subsidiaries provides BFLP, BISL and its subsidiaries with global marketing and operational support and service.