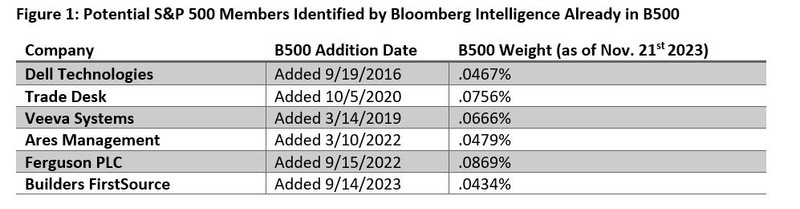

This blog post, published on November 27, 2023, pre-dates S&P’s announcement on December 1, 2023 that Builders FirstSource, a current member of the Bloomberg US Large Cap Index, would be added to the S&P 500.

Background

The B500 is Bloomberg’s US Large Cap Price Return Index that contains the 500 most highly capitalized US companies weighted by float market cap. With a market capitalization of $37.58 trillion and membership of 500 equities, the B500 shares similar qualities to other fixed count peers in the marketplace.

Raising the bar for membership

Despite current market conditions and a complex geopolitical climate, leading U.S. equities maintain high market capitalization, raising the bar for membership in large cap U.S. indices to the highest levels in over a decade. However, membership selection for the B500 is based on more than just market capitalization.

Though the B500 and S&P 500 possess similar membership, returns, and turnover, they notably differ on their approach to index selection. The B500 follows a fully automated rules-based approach, whereas the S&P 500 follows a committee-based structure. As a result, the B500 eliminates potential biases and systematically evaluates potential members, which may lead to earlier additions of qualified companies when compared to indices using a judgement-based approach.

To see how this difference in methodology can affect these indices, we can examine an example from a recent article by Bloomberg Intelligence analysts: Who’s Next to Join the S&P 500 Club? Meet Our 10 Candidates

In this article, Bloomberg Intelligence analysts proposed 10 potential candidates for entry into the S&P 500. Of these proposed constituents, 6 of 10 have already entered the B500 based upon the requirements set forth in its rules-based methodology, highlighting the value of the automated selection process.

The members proposed by Bloomberg Intelligence represent exposure across different sectors: Industrials, Health Care, Financials, Communications, Information Technology and more. These six companies already meet the thresholds for float-adjusted liquidity and profitability to join major market indices. They also have significant market capitalization – between $10 and $50 billion USD. In general, the B500 tends to contain companies with a higher market capitalization as is outlined in the index methodology. The automated approach for identifying large, qualified companies removes the need to make subjective decisions for companies on the cusp of selection. For the B500, the average market capitalization of a company in the index is $80 billion USD with an average free float percentage of 94%. By contrast, the average market capitalization of companies in the S&P 500 is $39 billion USD with an average free float percentage of 96%. Although the B500 and S&P 500 have a correlation of over 99%, they currently share approximately 86% of members, meaning 14% of constituents drives a $40 billion difference in average market capitalization between the indices.

For more information and an overview of the Bloomberg’s US Domestic Indices please click here.

The data and other information included in this publication is for illustrative purposes only, available “as is”, non-binding and constitutes the provision of factual information, rather than financial product advice. BLOOMBERG and BLOOMBERG INDICES (the “Indices”) are trademarks or service marks of Bloomberg Finance L.P. (“BFLP”). BFLP and its affiliates, including BISL, the administrator of the Indices, or their licensors own all proprietary rights in the Indices. Bloomberg L.P. (“BLP”) or one of its subsidiaries provides BFLP, BISL and its subsidiaries with global marketing and operational support and service.