This article was written by Bloomberg Intelligence Senior ETF Analyst Eric Balchunas and Bloomberg Intelligence Associate Analyst Andre Yapp.

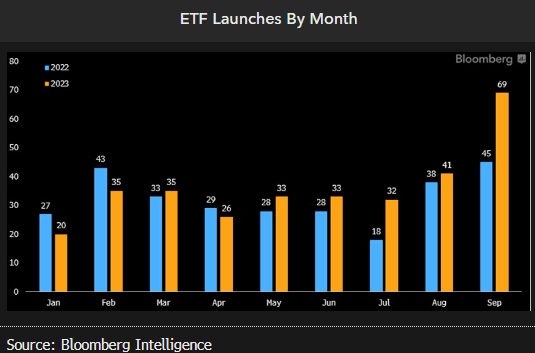

ETFs smashed their monthly launch record in September with 69 funds coming to market. Actively managed strategies were behind the surge, making up 71% of the new funds, up from 63% in the prior year. BondBloxx offered a new active fixed income ETF, BlackRock launched an equity income ETF and Invesco expanded its portfolio of defined maturity fixed-income ETFs.

ETFs break all-time launch record with 69

In September, 69 new ETFs hit the market, the most new launches in any month ever. This brings the total number of new launches to 344 this year, a 42.7% increase relative to last year, and puts them on pace to tie or break the all-time annual record. The extra push is coming from active ETFs, which were late to the ETF party.

New launches in September included defined maturity fixed-income ETFs from BlackRock and Invesco, with the former’s offerings focusing on TIPs and government treasuries while the latter focused on corporate and municipal bonds. Amplify and State Street each launched a dividend factor ETF — COWS and SPDG, respectively — with the former tracking the Kelly US Cash Flow Dividend Leaders Index and the latter tracking the S&P sector-neutral aristocrats index.

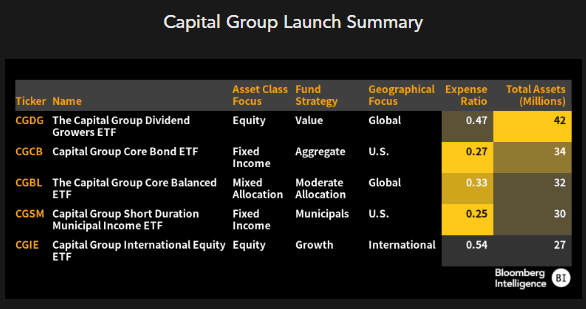

Capital group leads active push with five launches

Capital Group launched five new actively managed ETFs, expanding its stable of ETF offerings to 14. Among the offerings was the issuer’s first mixed-allocation ETF, the Capital Group Core Balanced ETF (CGBL), with a global focus costing investors 33 basis points. Additionally, the issuer introduced two equity ETFs and two fixed-income ETFs. This includes ETFs for dividend growers, international equity, aggregate bonds and municipal bonds costing between 25 and 54 basis points.

Despite the issuer’s limited ETF offerings, Capital Group punches above its weight, racking up $13 billion in assets — in large part because of their guts to come in with lower-cost active ETFs even if it means some cannibalizing of their mutual fund business.

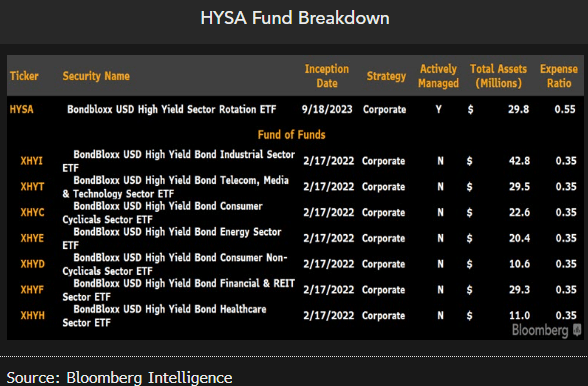

Hidden fees may hamper BondBlocxx’s high yield ETF

The BondBloxx USD High Yield Bond Sector Rotation (HYSA) is another actively managed ETF launched in September that tactically allocates among BondBloxx’s seven high-yield bond industry sector ETFs and seeks to outperform the ICE BofA US Cash Pay High Yield Constrained Index. At an expense ratio of 55 bps, HYSA is in line with the median expense ratio among high-yield actively managed fixed-income ETFs. However, with the fund of fund structure, the ETF could incur extra costs of the underlying funds. ETFs of ETFs have been a tough sell historically, so performance will be crucial if HYSA is to find an audience.

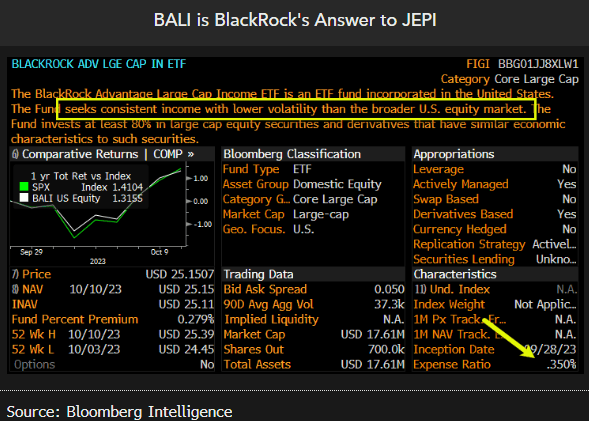

BlackRock latest to take inspiration from JEPI

BlackRock also added to the slew of actively managed ETFs with its answer to JPMorgan’s blockbuster hit JEPI, which looks to jack up income and lower volatility by selling call options. The BlackRock Advantage Large Cap Income ETF (BALI) employs basically the same strategy and for a similar fee of 0.35%. There have been about a half-dozen of these equity income ETFs launched in the past year. This is not surprising since the ETF industry has a habit of me-too-ing anything that proves to a big organic hit like JEPI, which now has about $30 billion in assets. BlackRock has such good distribution that we think this will likely get assets even though it is a bit late to this party.

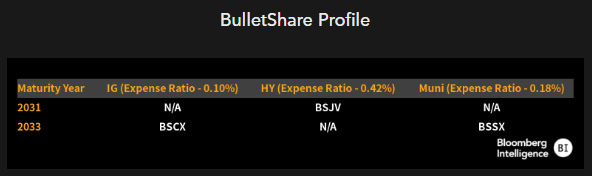

Invesco expands BulletShare bond ETF offering

Invesco launched three new BulletShares ETFs in September, adding to its suite of fixed-term portfolios that allow investors to “ladder” bonds, or tailor their maturity profiles with defined maturity year and their credit risk exposure. Among the launches last month was a high-yield corporate bond ETF maturing in 2031 (BSJV), an investment-grade corporate bond ETF maturing in 2033 (BSCX) and a municipal bond ETF maturing in 2033 (BSSX). BulletShare ETFs’ targeting of a particular maturity enables investors to take a more tactical approach to fixed income investing and the construction of laddered portfolios. However, with the inversion of the yield curve, we suspect that these longer-duration ETFs may initially struggle to attract flows, but may ultimately find an audience if the interest rate environment normalizes.