This article is an excerpt from a discussion that took place at the inaugural Buy-Side Forum Mumbai 2023 event.

Investing in India has witnessed a remarkable transformation over the years, offering individuals and institutions a diverse range of investment alternatives. The “Make in India” initiative that launched in 2014 is one example, helping spur a doubling of foreign direct investment to $83 billion by 2022.

By keeping inflation under control, making supply chain reforms and restructuring tax collection, India is achieving growth and opening up investment opportunities for local and foreign private equity investors.

The rise of equity investments

Equity investments have long been a favored choice for investors seeking long-term growth. The Indian equity market has witnessed significant advancements, from traditional stock trading to the emergence of online trading platforms.

Regulatory changes have played a role in democratizing equity investing in India. The introduction of the Securities and Exchange Board of India in 1992 brought about greater transparency and investor protection, spurring investor participation.

Expansion of hybrid capital

Hybrid capital instruments such as preference shares, convertible bonds and mezzanine financing, have gained popularity in recent years. These instruments combine elements of equity and debt, providing investors with the potential for equity-like upside and debt-like stability.

Startups and small and medium-size businesses have particularly benefited from the flexibility of hybrid capital. According to India’s Department for Promotion of Industry and Internal Trade, the country has recognized more than 92,000 since the launch of the Startup India initiative. Hybrid capital instruments have supported the growth of these startups, enabling them to raise capital for expansion and innovation. You can source company data on the Bloomberg terminal.

Growth in credit investments

Credit investments, including bonds, debentures and fixed-income securities, have become an essential part of diversified portfolios. The Indian credit market has experienced significant growth across government bonds, corporate debt instruments and other fixed-income products.

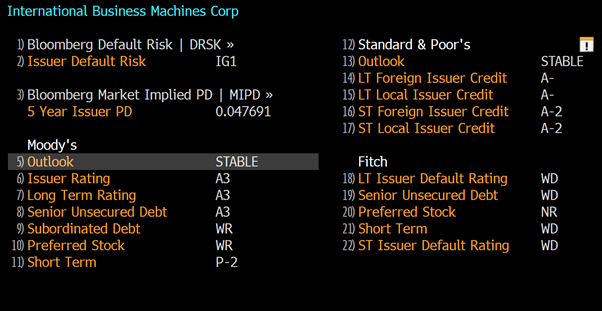

Investors can analyze the different risk factors, credit scores and returns associated with credit instruments to aid them in making informed investments in this asset class. Investors benefit from credit ratings supplied by organizations such as the Credit Rating Information Services of India Limited, International Credit Rating Agency and CARE Ratings. On Bloomberg you can get to a company (equity) credit rating by entering the code CRPR which will give you the credit rating profile.

The role of technology and fintech

Technology and the rise of financial technology solutions have contributed to the evolution of investment alternatives in India. Digital platforms, robo-advisors and online investment portals have made investing more convenient and accessible to a broader range of investors. According to a report by NASSCOM, the Indian fintech market is projected to reach $150 billion to $160 billion in transaction value by 2025, indicating the rapid adoption of fintech solutions by investors.

Technology-driven tools such as algorithmic trading, portfolio management apps and advanced analytics have given investors enhanced decision-making capabilities. For instance, robo-advisory platforms such as Groww and Zerodha have gained popularity among retail investors. These platforms provide intuitive interfaces and personalized investment recommendations based on investor risk profiles.

Regulatory frameworks and investor protection

Regulatory authorities such as SEBI and the Reserve Bank of India play a crucial role in shaping the investment landscape by enforcing transparency, fair practices and investor safeguards across investment alternatives. Investor protection measures can instill trust and ensure a level playing field for investors.

As the primary regulator of the Indian securities market, SEBI has introduced various regulations to protect the interests of investors. These include guidelines for disclosure and transparency, insider trading regulations and measures to enhance corporate governance. Meanwhile, RBI regulates the credit market and ensures financial system stability for credit investments.

An expanding market for alternative investment funds

The evolution of investment alternatives in India across equity, hybrid capital and credit has opened up new avenues for investors. With a deeper understanding of these options, investors can make informed decisions that align with their financial goals and risk appetite. Staying informed about the changing dynamics of India’s investment landscape is crucial to harnessing the opportunities presented by these alternative investment avenues.

By leveraging the advancements in technology, taking advantage of regulatory protections and gaining insights from relevant data, investors in India can navigate the evolving alternative investment funds landscape with confidence.