This analysis is by Bloomberg Intelligence Market Analyst Brian Meehan. It appeared first on the Bloomberg Terminal.

Execution costs of institutional investors’ investment-grade and high-yield credits have improved, based on data from Bloomberg’s Trade Cost Analysis (BTCA) group, as inflation expectations imply the market believes central banks are gaining the upper hand, which should keep appetite healthy. Inflation remains a concern and central banks keep raising rates, yet credit yields are the highest in over a decade.

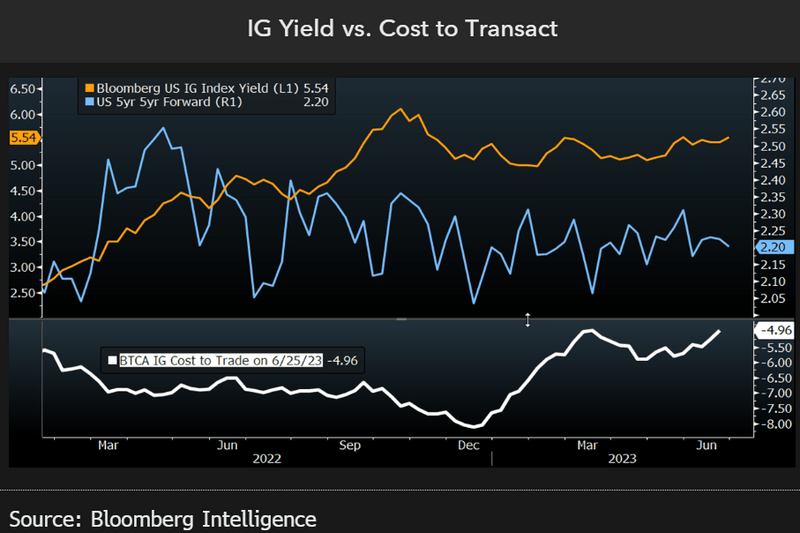

Global investment-grade liquidity improves

With investment-grade yields close to levels last seen in 2009, credit could keep drawing interest and the cost to transact should improve. Investment-grade yields moved higher at the start of the tightening cycle. Central banks are still hiking, and while sovereign 10-year yields have increased this quarter, most of the pain has been in the front end as the 2s-10s become more inverted. The US five-year forward has held firm as investors anticipate the latter stages of the tightening cycle.

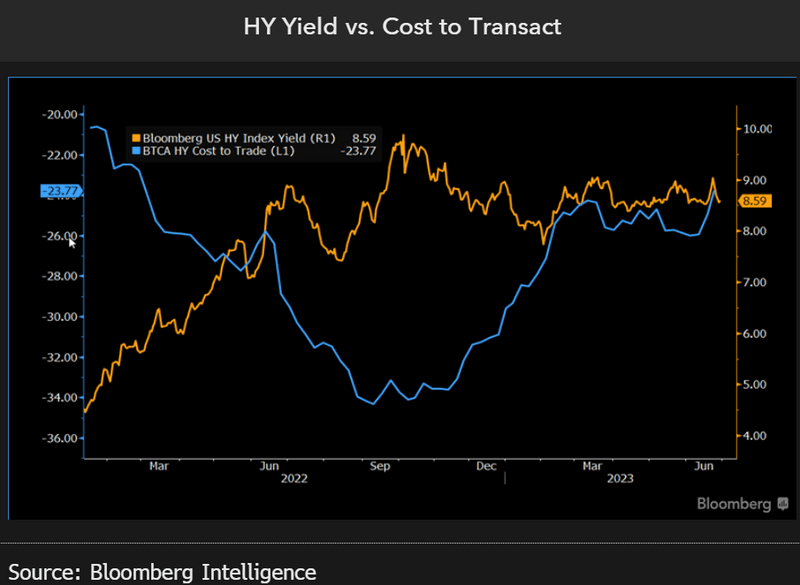

Cost to transact global high yield improves

Continued investor demand should support the high-yield market and lead to a continued decrease in the cost to transact. The cost to execute in high yield initially worsened as the increase spooked investors conditioned to low rates. That’s changed over the past six months as investors were buying high yield at levels near 10-year highs. Investors historically have been rewarded for embracing high yield near these levels.

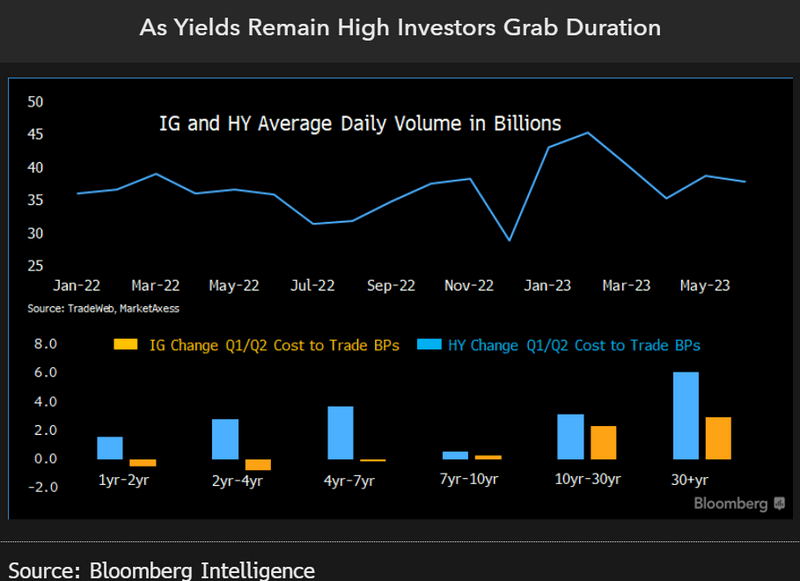

Largest liquidity improvement in longer duration

Investment grade saw its best gains in the cost to transact in longer durations, while high yield’s cost to trade improved across every duration sector. Investment-grade and high-yield daily trading volumes remained near the higher end of the recent range, supporting continued improvement in execution costs for both.

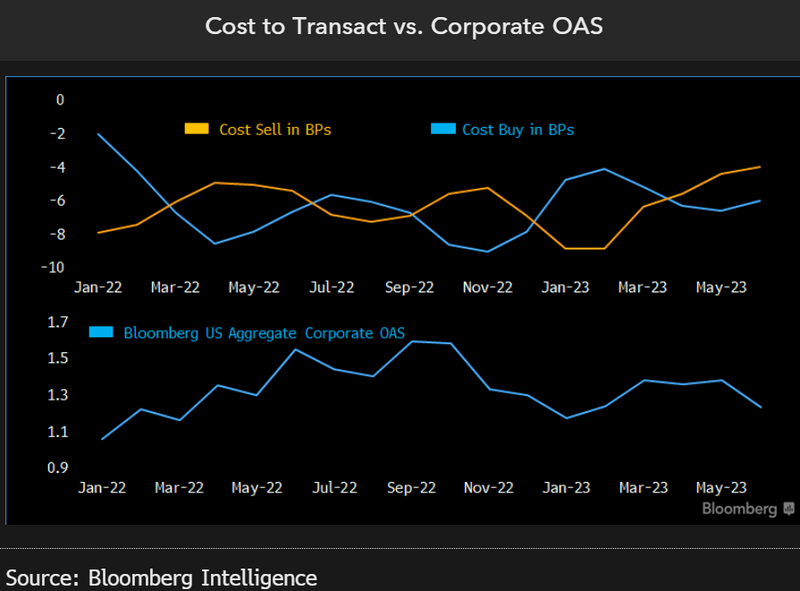

Cost to buy and sell has improved

The cost to execute improved for both buys and sells. The Bloomberg US Aggregate Corporate option-adjusted spread (OAS) tightened off levels seen during the Credit Suisse and US regional bank blowups in March. Continued tightening in the OAS should lead to a further reduction in execution expenses.