This article is by Gabriel Kan.

As of December 5, 2016, investors in China can trade stocks in Hong Kong through the new Shenzhen-Hong Kong Stock Connect (SZSE-HK Connect) [HKEx News Release]. This will further integrate the equity markets in China since the launch of the Shanghai-Hong Kong Stock Connect (SSE-HK Connect) in 2014. Investors in China are known to be retail-driven and exhibit different market behaviors and trading styles than their institution-driven Hong Kong equity market peers. Following up our study on the Shanghai-Hong Kong Stock connect in 2015, we revisit the impact of the southbound Shanghai-Hong Kong Stock Connect volume in the second half of 2016, and attempt to gain more insights into the new Shenzhen-Hong Kong Stock Connect.

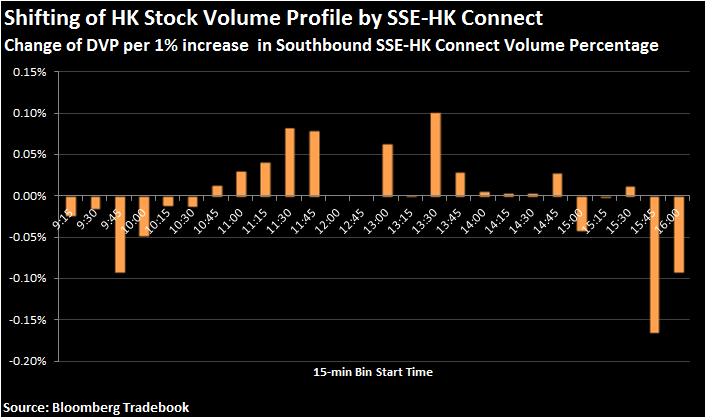

Our goal is to understand the impact of the southbound Shanghai-Hong Kong Stock Connect on the trading activities profile for the Hong Kong index members. We focus on the members of the Hang Seng Index (HSI Index) and the Hang Seng China Enterprises Index (HSCEI Index). While Hong Kong Stock Exchange (HKEx) introduced the new closing auction scheme in late July, we start our study from August 2016 through mid-December 2016. To measure the activities from the SSE-HK Connect, we look at the total southbound connect turnover as a percentage of the total Hong Kong Stock Exchange turnover. For each 15-minute time interval, we regress the daily volume percentage (DVP) on the Connect volume percentage, and estimate the impact of the Connect activities on the DVP.

Unlike a typical volume curve, southbound SSE-HK Connect appears to be more active in the middle of the day between 10:45 and 14:00 local time. When the Connect volume is high, the daily volume curve is flattening, exhibiting particularly less volume around both the opening and closing auctions. One interesting observation is the DVP spike between 14:45 and 15:00, which suggests an increase in the Connect activities right before the Shanghai market close. Impact of the Connect volume is either negligible or negative after the Shanghai market close at 15:00. In particular, a 1% increase in the Connect volume leads to an average of 0.1% decrease in the Hong Kong closing auction percentage. This can be explained by the retail-driven China investors who are less active after the Shanghai market closes and also in the closing auction.

With the start of the Shenzhen-Hong Kong Stock Connect, it will be interesting to see whether it will further reinforce a similar impact on the Hong Kong stock market. Particularly, when the Connect volume stabilizes, how it will temporarily or permanently shift the Hong Kong volume profile, or further changing the market structure to a new normal.