Bloomberg Intelligence

December 01, 2023

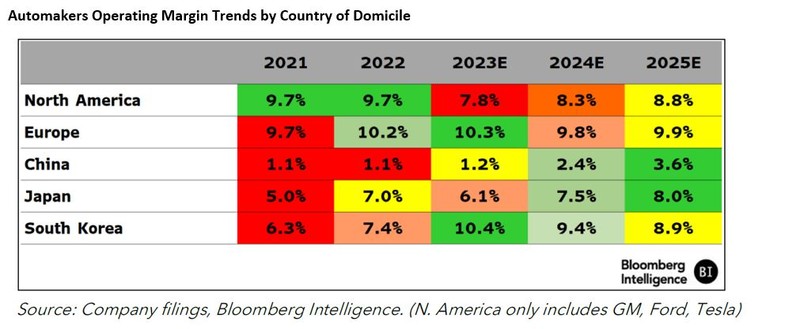

The global auto industry faces slower profit growth as the Covid-induced vehicle shortage, which gave US and EU automakers significant pricing power, is set to reverse. Average Ebit margins for US automakers could fall as much as 200 bps and EU peers will be stagnant at best, based on consensus. Japan’s automakers may get a 100-150-bp gain, due partly to a weaker yen, while the average profit margin in China is finally showing signs of a recovery after a seven-year decline, with our analysis indicating an expected increase of 100-200 bps.

Key Research Topics

- US Trucked Out: Despite ICE vehicles still making up three-quarters of profits for the world’s biggest manufacturers, higher inventory turns for pickup trucks and SUVs, the primary margin driver in the US, are earnings headwinds in the next 12-18 months.

- Europe’s Pricing Pressure: The mass market is most profoundly affected by reduced pricing power as easing supply chains put more cars on the lot, even as the economy appears to be worsening and consumers turn skittish.

- China’s Profit Inflection: China automakers’ Ebit margin will grow faster than US, EU and Japan peers in 2024 and 2025 on rising EV output. The cost gap between EVs and ICE-only vehicles in China is closing, incentivizing automakers to sell more of these vehicles.

- Technology Next Growth Driver: Connectivity and in-car user experience could be the next revenue and profit catalyst. Chinese auto startups appear to be in the forefront, with EU premium marques not far behind.

- Different EV Strategies: US automakers, focused on more profitable trucks and SUVs, have trimmed EV production targets while high battery costs and a lack of scale have limited European peers’ incentives to make more EVs. Japanese automakers are more agile with their strategy, while Chinese automakers’ domestic EV success faces challenges abroad.

Run BI <Go> Search “Global Autos 2024 Industry Outlook” to access the full report.

Not a Terminal user? Click here to learn more.