Global copper producers benefited from robust China demand in 1H as decarbonization drivers offset a weak property market, but that may change unless Beijing stimulates more assertively. Mined supply could return strongly until 2025, tipping the market into a modest, multiyear surplus. South America’s challenging regulatory and political environments, which impede delivery of new mines, remain solid midterm supports. In this report, our interactive copper supply-and-demand model analyzes risks and opportunities for the rest of the decade.

Demand for electric vehicles and renewables could remain decisive drivers over the next two decades, offsetting the negative pull from China’s maturing economy and sustaining consumption at or slightly above long-term trends. Yet in the near term, copper could fall below $8,000 a ton, with marginal cost support kicking in at $7,400.

Key Research Topics

- Once Delayed, New Supply Leads to Glut: Miners promised a big output increase in 2H, with over 800,000 tons of additional supply. Mined supply could have a bumper 2024, up 4-4.5%, but the benefit of greenfield and brownfield projects, many initiated over a decade ago, may start to dissipate from 2027, based on our bottom-up analysis. We calculate an additional 6 million metric tons of capacity could be needed by 2032.

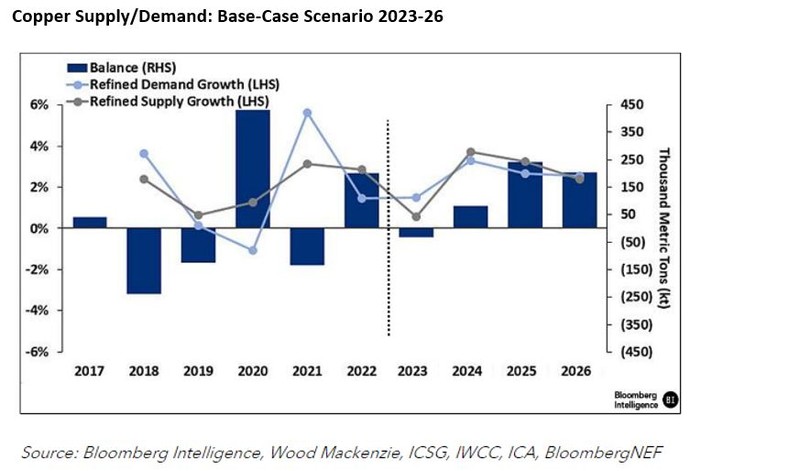

- China’s Disproportionate Drag on Demand: Unless its property sector recovers, the drag on others — like consumer durables and autos — could pull down growth in China’s copper demand to 2% or below over the next few years vs. our base scenario of 2.2-3.2%. That could shift the copper market from balanced in 2023 to a surplus of 300,000-500,000 tons a year from 2024-26.

- Renewables Add to Scarcity by 2030: Mined copper supply growth could falter by the middle of the decade as regulatory approvals become more protracted, which means supply could lag behind robust decarbonization demand. Market deficits at the end of the decade look likely unless the miners can speed up their development.

- Companies With Best Growth Prospects: Zijin Mining could achieve compound annual output growth of 14% by 2026 thanks to acquisitions, while Antofagasta may expand at 5% over the same period using brownfield projects.

Run BI <Go> Search “Global Copper 2024 Industry Outlook” to access the full report.

Not a Terminal user? Click here to learn more.