This article was written by Bloomberg Intelligence Senior ESG Analyst Shaheen Contractor. It appeared first on the Bloomberg Terminal.

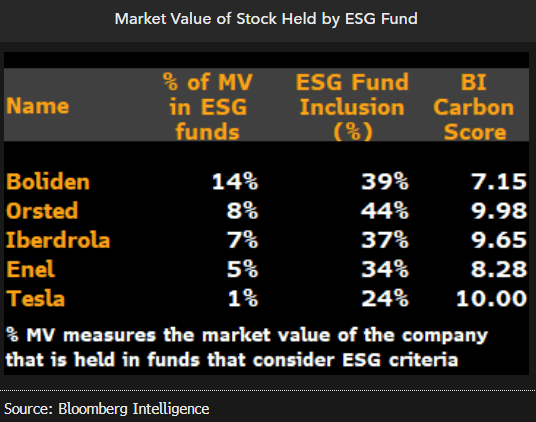

Companies in the top quartile of our BI Carbon scores are more likely to attract capital from ESG investors and benefit from further investment as those funds grow. Among smaller companies that lead in the scoring, such as miner Boliden, ESG funds account for at least 14% of its market value — pointing not only to the potential to attract more funds but also risks should it falter on ESG or flows into such funds decline. For larger stocks like Tesla, the trajectory of ESG investing will have little impact because such funds account for only 1% of market value.

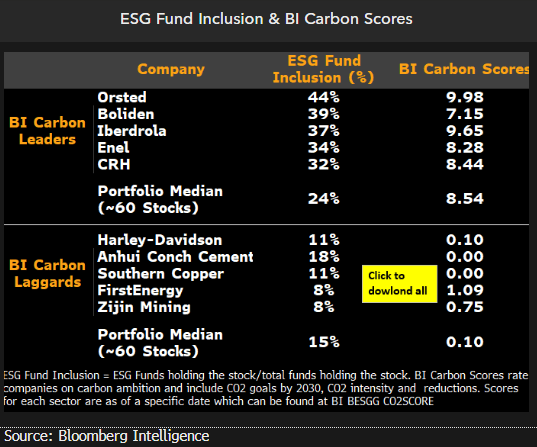

High BI carbon scores means greater ESG fund inclusion

Companies in our BI Carbon Leaders portfolio have the greatest share of inclusion (ESG funds holding the stock vs. all funds owning it) at a median of 24% — meaning almost one in every four funds owning the stock is an ESG fund. This shows that climate ambition is being recognized in stock selection and may attract more interest as ESG investing accelerates. The Laggards portfolio has a lower inclusion rate at 15%, suggesting that companies that ignore the low-carbon transition could be left behind. Orsted, Enel and CRH have a high inclusion rate of more than 30%. Southern Copper and First Energy rank low.

Our Leaders portfolio includes those with top-quartile BI Carbon scores with the laggards at the bottom.

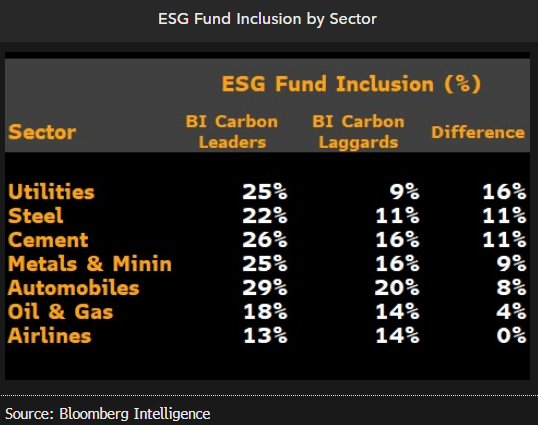

Climate-ambitious utilities included the most, airlines least

The higher ESG fund inclusion rate for better-scoring BI Carbon companies is maintained at the sector and regional level, though some sectors show greater spreads between those at the top and those at the bottom. The difference is the highest in utilities, where leaders have a median ESG fund inclusion rate of 25%, with the laggards at 9% — indicating that companies in the sector stand to attract investors from setting carbon goals. Airlines is the only sector to show no difference between leaders and laggards, indicating ESG investors are indifferent to the industry’s carbon goals. This points to risk and also a missed opportunity as airlines remain a carbon-dependent industry.

At the regional level, Europe shows the greatest difference in ESG fund inclusion for leaders and laggards. APAC has the least.

14% of Boliden’s market value in ESG funds means benefits, risks

Smaller companies that lead on BI Carbon scores, such as Boliden, have at least 14% of their market value held by funds that consider ESG — a benefit if such funds continue to gather assets. However, given the moderately high dependency, such companies could face risks if they have a negative ESG-related event that causes funds to sell or if the funds lose steam. Larger companies such as Tesla have 1% of their market value in ESG funds and are unlikely to be impacted by the trajectory of ESG funds.

Our analysis includes managed funds that consider ESG factors as tracked by Bloomberg data. We include equity funds with more than $100 million in assets as of 2022 and those with holdings data. Due to this, actual values could potentially be higher.

BI carbon portfolio methodology

The Leaders portfolio consists of stocks in the top quartile of our BI Carbon scores, while our laggards include the bottom quartile. BI Carbon scores help investors identify companies that have set carbon goals in-line with the Paris Agreement’s climate requirements. The scores assess carbon across eight sectors for reduction trends, current and future CO2 intensity, planned cuts and positioning compared to a temperature-aligned benchmark by 2030.

We include all sectors scored except for chemicals, as it awaits an update.