Background

The U.S. government’s $7 billion hydrogen hub pledge is part of $308 billion in global industry funding that may help double electrolyzer shipments next year, BloombergNEF estimates. Yet stocks in the sector are slumping before the 2023 UN Climate Change Conference in Dubai.

President Joe Biden awarded the funds to seven projects stretching from Pennsylvania to California, with recipients including Amazon.com Inc. and Exxon Mobil Corp. While hydrogen media items on the terminal hit a record ahead of COP28 in late November, sector stocks are falling in the fourth quarter for the first time in five years. Plug Power Inc. has dropped 90% from its January 2021 high.

The issue

While the terminal is seeking record weekly coverage of hydrogen, the Bloomberg Hydrogen ESG Total Return Index has slumped 17% since the end of July. Normally, hydrogen stocks rise in the fourth quarter as governments make energy transition pledges ahead of climate summits.

The Bloomberg Hydrogen ESG Total Return Index is down 6.2% this quarter, versus a 10.2% average gain during fourth quarters in the previous five years. A non-ESG version of this index performed better, as oil giants with hydrogen plans, such as Shell Plc, rallied. Hedge fund Argonaut Capital Partners argues that building a hydrogen-based economy is a “complete waste of time.” Some oil giants are doubling down on fossil fuels, with Exxon planning to buy rival Pioneer Natural Resources Co. and Chevron agreeing to purchase Hess.

Yet the U.S., EU and Japan have centered hydrogen in their carbon-cutting plans. The U.S. and Europe each expect 10 million tons of annual green hydrogen production by 2030. Meanwhile, BI notes that China is still the world’s largest electrolyzer market. Government funding is fueling green H2 projects, with electrolyzer shipments doubling every year since 2020, BNEF says. Blue H2 projects, involving fossil fuels and carbon capture, are taking longer to develop due to their larger size and technological complexity.

“The main pain point is demand,” the BNEF report concludes. “Producers need buyers. To raise H2 demand, more incentives – both carrots and sticks – will be needed.”

Tracking

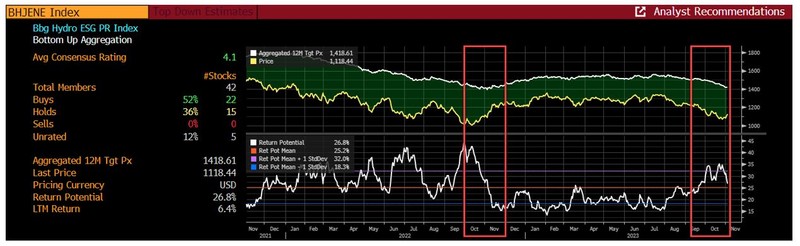

Use Bloomberg’s ANR function, to discover bottom up analyst price targets and long-term industry prospects. Based on these forecasts, the return potential was recently above one standard deviation and just crossed this mark. The last time this occurred was late in October 2022 and the index proceed to rally 15.8% over the next one month period.

For more information on this index or other functionality on the Bloomberg Professional Service, click here to request a demo with a Bloomberg sales representative. Existing clients can press <HELP HELP> on their Bloomberg keyboard.