This article was written by Mike Pruzinsky, Equity Indices Product Manager at Bloomberg.

Looking back at 2023

In the face of economic and geopolitical uncertainties, global equity markets in 2023 were remarkably resilient as inflation declined and the possibility of a soft landing came more clearly into view. Investor patience was rewarded, as markets began to price in the impact of the Federal Reserve beginning rate cuts by midyear of 2024. This helped drive the Bloomberg World Large & Mid Cap (WORLD) Index higher, with this past November being the third-best month in the last 10 years. The index rose by 22.2% for the 2023 calendar year.

Still, divergence across regions and investment styles remained high, especially in the US stock market where the rise of the so-called “Magnificent Seven” stocks drove outsized returns. The traditional sectors of communications, consumer discretionary and technology rebounding sharply from the prior year also supported robust performance. Additionally, optimism for innovative technologies like artificial intelligence (AI) and blockchain bolstered market strength.

This year, investors will be paying close attention to any signs of deceleration in corporate earnings growth. They will also watch the health of the housing market and financial sectors, as they tend to be the most exposed to interest rate movements. Here are several key insights the Bloomberg Index product team is monitoring to help navigate the road ahead.

Developed markets vs. Emerging markets

Can developed markets continue their lead, or will emerging markets stocks be ready to shake off a lost decade?

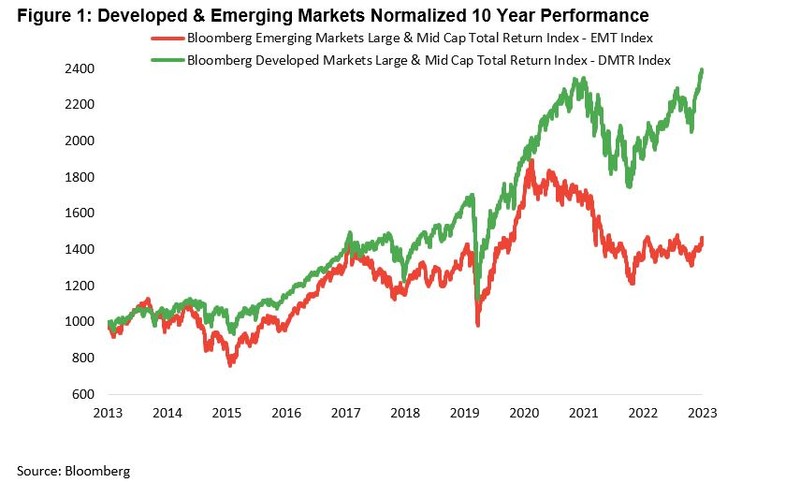

Developed market equities, as represented by the Bloomberg Developed Markets Large & Mid Cap (DM) Index, have significantly outpaced their emerging market peers since 2013. During the past 10 years, the Bloomberg Emerging Markets Large & Mid Cap (EM) Index returned a paltry 3.9% annually and was outperformed by over 93% cumulatively. This has led to investors pondering the merits of emerging market stocks, as they now trade at some of the cheapest relative levels in years.

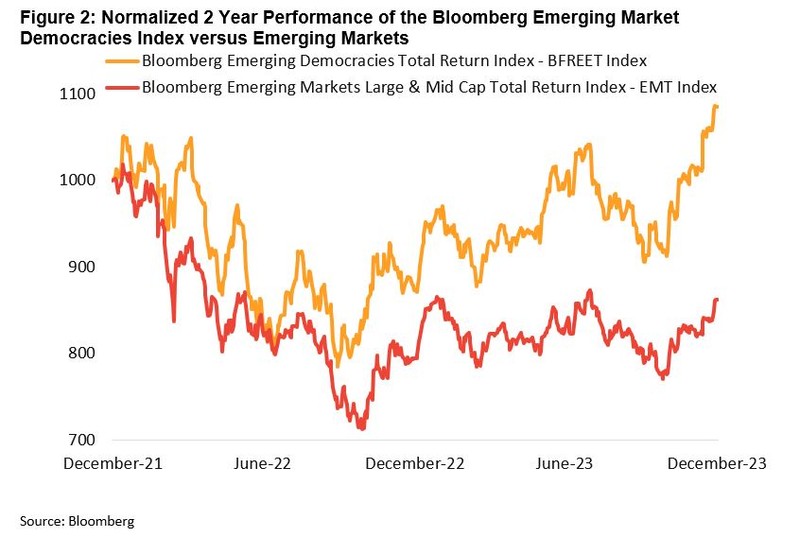

A deeper look at emerging markets further identifies potential opportunities for selecting companies that reside in countries where political rights and civil liberties are highly regarded. These stock markets often have a more transparent regulatory framework and enhanced investor protections. Free-market policies also tend to encourage competition and innovation, driving economic growth and stock market performance.

Additionally, these markets often benefit from a young and growing workforce, which can fuel productivity and economic expansion. A review of the Bloomberg Emerging Market Democracies Total Return (BFREET) Index, which is constructed to track the performance of companies that belong to countries classified as electoral democracies according to Freedom House, shows relative outperformance during the recent period of rising global tension.

What do the Magnificent 7 stocks do for an encore?

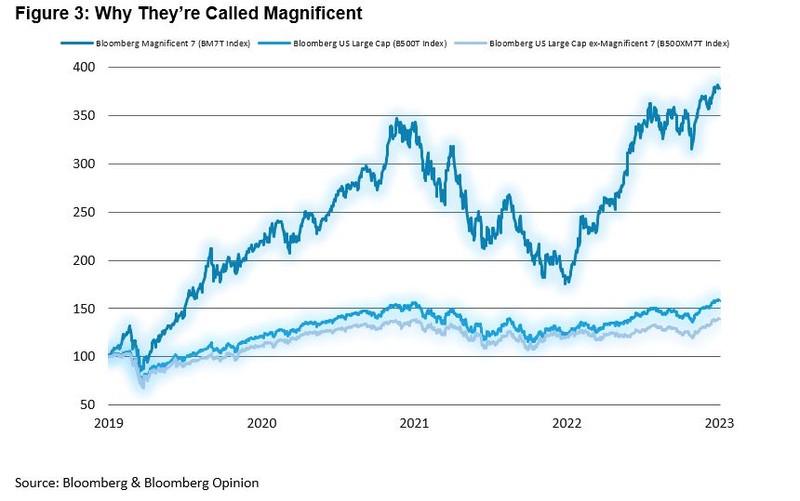

The Bloomberg Magnificent 7 Total Return (BM7T) Index (comprised of Amazon, Apple, Google, Meta, Microsoft, Nvidia and Tesla equally weighted with quarterly rebalance) rose an impressive 107% in 2023 and, as of the end of December, made up more than 27% of the market value of the Bloomberg US Large Cap (B500) Index. This concentration risk has led many to compare performance with and without these seven stocks.

Until now, no widely disseminated indices were available and well-suited to answer these questions. However, using the two mentioned Bloomberg indices above, along with the recently launched Bloomberg US Large Cap ex-Magnificent 7 Total Return (B500XM7T) Index, it becomes easy to run this type of analysis comparing performance and valuation.

With the Magnificent Seven’s recent run, some bearish analysts have drawn parallels to other market time periods where select companies drove company-concentrated performance, such as the Nifty 50 and the dot-com bubble. With the Magnificent Seven comprising a significant weight in market cap-weighted indices, it does serve as a reminder to investors that not all indices are created equal and that now may be an opportune time to explore the suitability of one’s benchmark usage.

See this overview for further details on the Bloomberg equity index offering and customization options.

Commercializing AI and finding profit

The potential for artificial intelligence (AI) to revolutionize industries and offer companies a competitive edge grabbed all the headlines in 2023. AI-driven technologies, including machine learning and natural language processing, continue to find more applications across a diverse set of sectors such as finance, healthcare and technology. This adoption and potential for continued growth has made AI stocks attractive to investors, as these companies stand at the forefront of innovation.

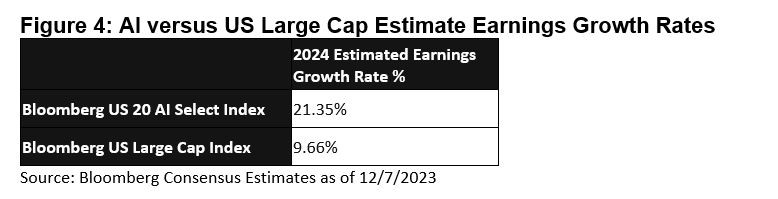

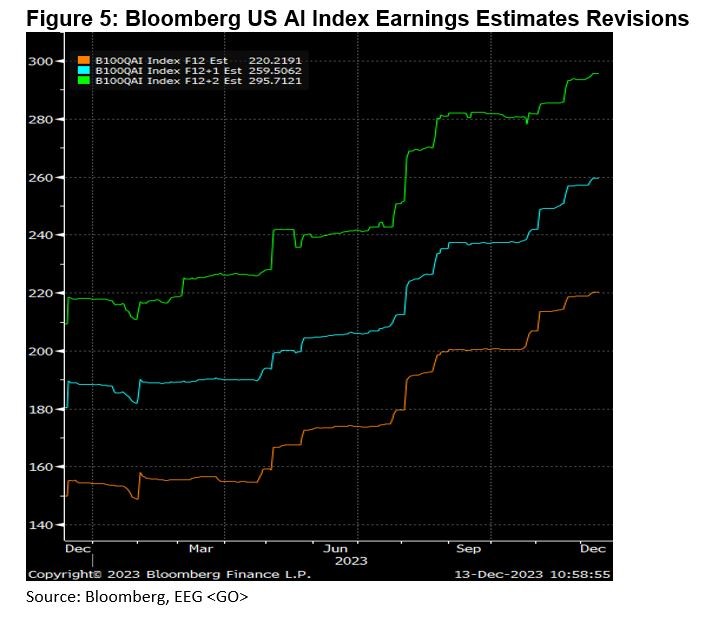

Long-term prospects for the Bloomberg US 20 AI Select Total Return (B100Q) Index show that translating to the bottom line, as consensus 2024 earnings estimate growth is expected to be more than double that of the broader market.

Also, AI may continue to be a catalyst for more positive earnings revisions in 2024.

How does factor investing evolve?

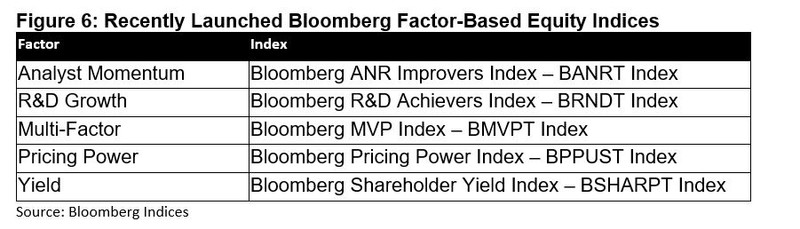

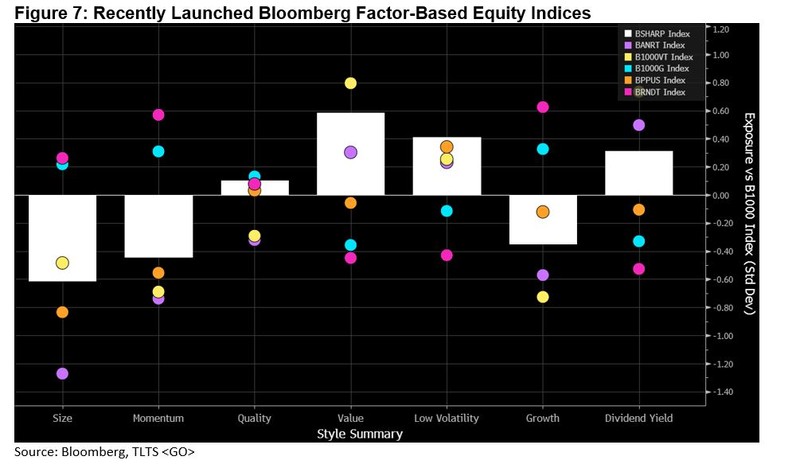

So far, the 2020s have witnessed a vastly different macroeconomic landscape than the previous decade, specifically with higher interest rates and higher inflation — the latter of which had not been seen for almost 40 years. However, the recent macro backdrop may present an opportunity for new systematic factor investment strategies to emerge and shine. While investors often think of the traditional factors of value and growth, the Bloomberg index research team has been working on developing innovative, factor-based index strategies that work across a diverse set of economic conditions. These indices tend to be based on unique data sets that may offer investors an edge versus more commonly allocated to factors.

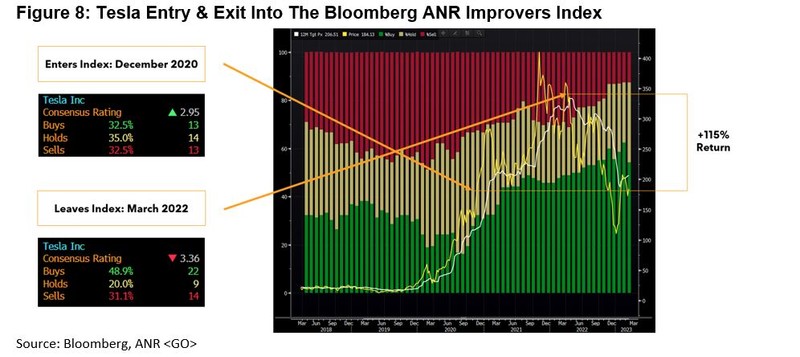

For example, take the Bloomberg ANR Improvers Total Return (BANRT) Index, which leverages the consensus analyst estimates that Bloomberg compiles from the popular ANR <GO> function. To determine selection, the index looks at companies with the highest analyst recommendation improvement score over time, with the idea being to select stocks that analysts have become more bullish on without converging to the consensus.

Another exciting index to watch is the Bloomberg Pricing Power Total Return (BPPUST) Index, which seeks to identify companies that are well-positioned to maintain a stable profit margin by passing along costs to loyal consumers. The index leverages key research to systematically select companies that do not necessarily have high margins but stability in gross profit margin.

For more information, see the blog and white paper here on cracking the code of pricing power.

Will the IRA and IIJA benefit companies focused on infrastructure and renewable energy?

While clean energy stocks faced headwinds last year, government policies and a commitment to combat climate change may support a bullish case for 2024. In particular, the Inflation Reduction Act (IRA) and Infrastructure Investment and Jobs Act (IIJA) loom as major potential catalysts for the bottom lines of companies that support infrastructure, renewable energy, electrification and climate adaptation solutions. With increased future demand for these services, stocks in solar, biofuels and hydrogen may offer potential for upside.

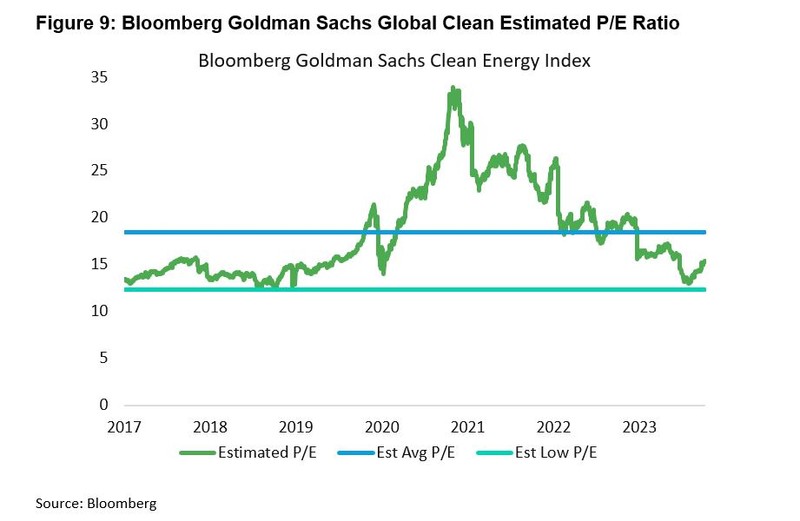

Take the Bloomberg Goldman Sachs Clean Energy Total Return (BGSCET) Index, which is constructed to use insights from both Bloomberg New Energy Finance (BNEF) and Bloomberg Intelligence (BI). Despite trading at a higher than average forward looking earnings multiple for most of the decade, the index recently bottomed near its low, but is still well below its historic average. These low investor expectations, combined with U.S. government support, should aid prospects for index members in 2024 that are supporting these efforts.

How will indexing evolve with personalized investing?

Indexing through passive investing continues to resonate with investors as ETFs and index-based products have seen 10 straight years of inflows, while active products have seen 10 straight years of outflows. The objective and transparent nature of indexing’s predictability has won over investors as indices tend to perform how you might expect.

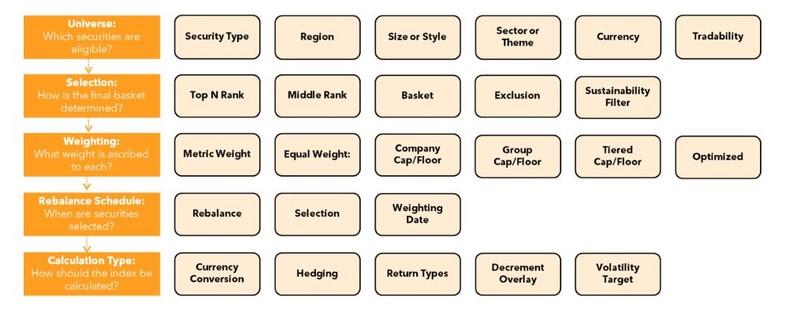

This validation of indices by asset owners and product issuers has led to increased sophistication in achieving their goals via a rules-based approach. Bloomberg Equity Indices take a building block approach to customization, as indices can be tailored to control eligibility, security selection, weighting, calculation type and more.

Moving through 2024

In summary, the 2024 stock market outlook appears optimistic, fueled by an ongoing economic recovery, technological advancements, and supportive fiscal policies. Still, investors should remain vigilant by monitoring for shifts in geopolitical factors and economic conditions. A prudent index strategy can help to navigate any potential challenges that lie ahead while capitalizing on the many exciting and emerging trends.

The data and other information included in this publication is for illustrative purposes only, available “as is”, non-binding and constitutes the provision of factual information, rather than financial product advice. BLOOMBERG and BLOOMBERG INDICES (the “Indices”) are trademarks or service marks of Bloomberg Finance L.P. (“BFLP”). BFLP and its affiliates, including BISL, the administrator of the Indices, or their licensors own all proprietary rights in the Indices. Bloomberg L.P. (“BLP”) or one of its subsidiaries provides BFLP, BISL and its subsidiaries with global marketing and operational support and service.