This analysis is by Bloomberg Intelligence Director for Market Structure Research Larry R Tabb. It appeared first on the Bloomberg Terminal.

A year of consolidation begs the question of whether alternative trading systems’ promised benefits — more competition, less regulation and avoiding exchange fees — help U.S. equity market structure. The reality is more challenging, as fragmented liquidity and the dark nature of these pools make them less effective, prone to nefarious activities and more reliant on trading algorithms. It hasn’t, however, stopped new entrants from rewriting the status quo.

Promise of institutional matching without impact stalls

Dark pools, or automated trading systems (ATS), are similar to exchanges but don’t display pre-trade data. Unlike an exchange, which shows bid and offer pricing, an ATS needs to be pinged to ascertain a willing trading partner. Dark pools were developed in the early 2000s as a way for larger investors to find each other, but they quickly became broker platforms to match algorithmic trading flow without paying exchange fees.

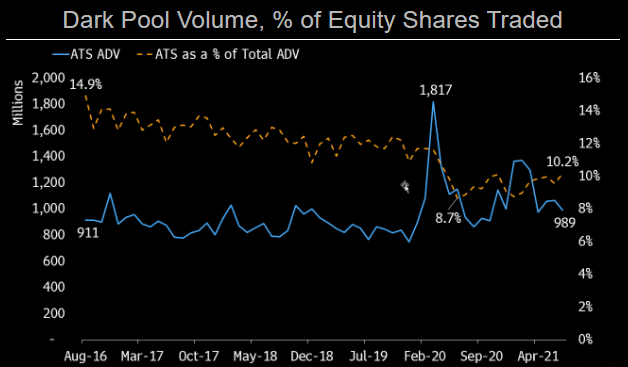

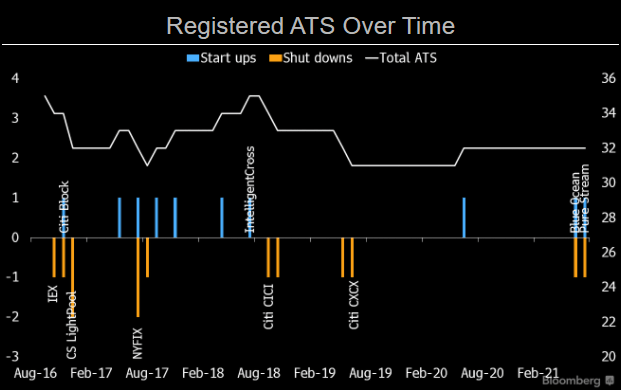

ATS market share has declined from about 15% of U.S. equity volume in late 2016, when Finra began distributing the data. It fell to 8.7% in June 2020 and January. As a result, traditional platforms consolidated and additional venues launched, targeting new market segments and ways to match buyers and sellers.

ATS volume stagnant, but models are changing

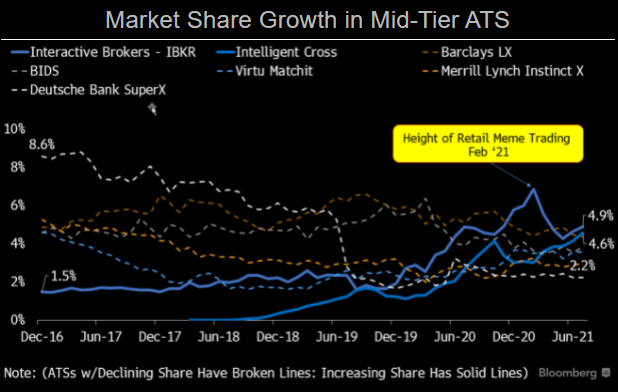

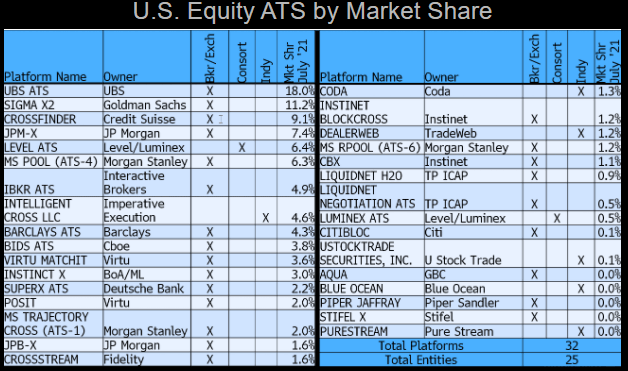

The composition of alternative trading systems is changing as the group’s market share falls toward 10%. UBS is dominant among the top players. UBS ATS has a retail slant, pairing the company’s institutional client base with its non-internalized retail-order flow. The next five by market share are broker pools and consortia focusing on matching institutional clients’ algorithmic flow. Though the top players are stable, change is happening in the second and third tiers. Smaller, more traditional platforms are consolidating, while newer players are entering, as they rethink the type of flow that’s matched, along with the matching process and the markets served.

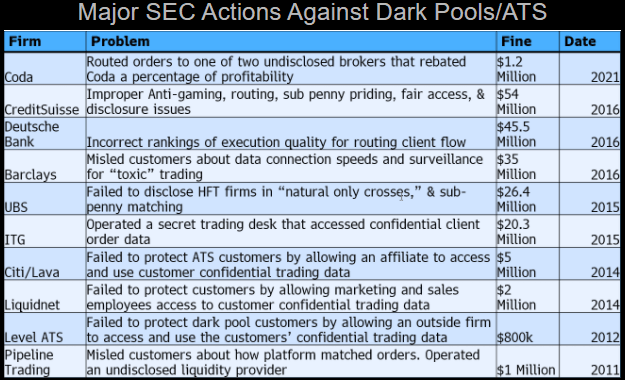

Regulatory infractions increased scrutiny, transparency

The Securities and Exchange Commission has taken numerous actions against dark pools, hurting equity trading flows over time. Though a few venues, such as Pipeline Trading Systems, were shuttered because of regulatory infractions, most SEC actions involve a lack of order and information protection, sub-penny rules and/or inappropriate disclosures. The SEC found issues with ATS sharing data with internal routers (Citi/Lava), matching at sub-penny prices (Credit Suisse and UBS), and some firms having undisclosed proprietary trading relationships (ITG/Posit).

The latest SEC enforcement involved Coda, an agency-only trading venue, which had two undisclosed routing/revenue-sharing agreements.

Older non-broker ATS consolidate as market share slips

The ATS market has been under pressure. Though regulation caused a few pools to shut down, competition has been the biggest obstacle. Earlier this year, Cboe acquired sell-side consortium BIDS Trading for its European matching infrastructure, while TP ICAP purchased two alternative trading systems of the independently owned large-block trading platform Liquidnet. Last week, Level ATS and Luminex announced a merger, where the sell- and buy-side consortia would consolidate businesses, while keeping liquidity pools independent.

Instinet Crossing ceased operations in 2021. TZero’s Pro Securities ATS transitioned its license to Blue Ocean.

ATS languishing, not dead just yet

Older alternative trading systems such as Interactive Brokers are consolidating and increasing their share. This hasn’t deterred the emergence of new platforms like Blue Ocean and PureStream. Interactive Brokers and Intelligent Cross control almost 10% of the market, increasing their share from 1.5% by targeting different demographics and rethinking matching strategies. Interactive Brokers exposes retail orders to market-maker competition, while Intelligent Cross uses AI to reduce slippage and adverse selection.

Blue Ocean has developed an after-hours market. PureStream created a strategy for matching algorithmic trading flow with less market impact.