2023 has been a landmark year for the planet, giving us a glimpse of the future that awaits us if global warming continues unchecked. With this in mind, Bloomberg has partnered with Carbon Growth Partners to produce this whitepaper that aims to show the importance of carbon credits in the transition to a net-zero economy — and make it clear just how easy it is for organizations to use offsets as part of their journey to net-zero.

Market fundamentals: An asymmetrical upside case

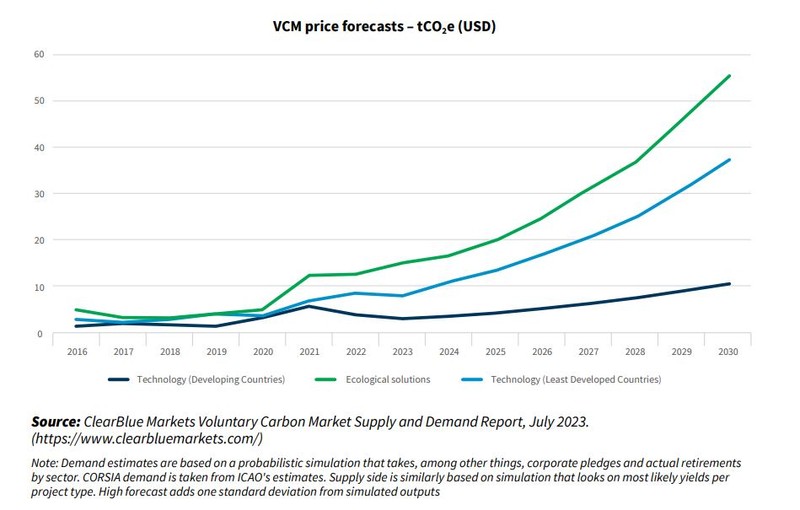

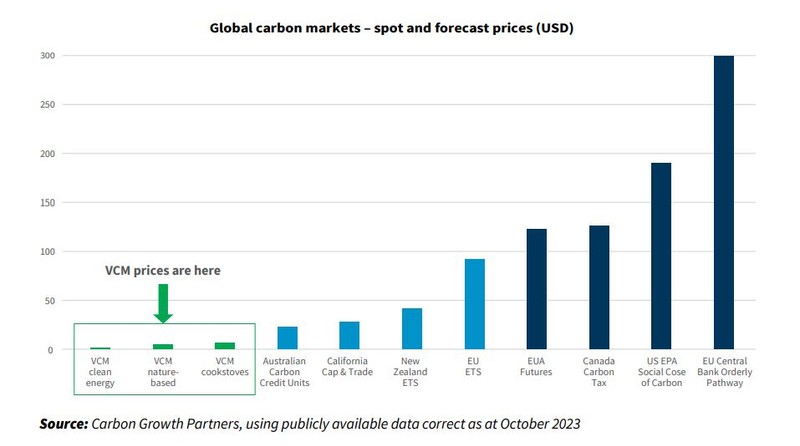

Carbon prices are expected to rise significantly as more ambitious emissions reduction commitments are made and met, and the supply of carbon credits is constrained.

While 2023 has been a challenging year for carbon prices, strong fundamentals of growing corporate demand, combined with new rules that will make it harder to generate carbon credits, could flip market conditions from oversupplied to undersupplied in the near term. This would put significant upward pressure on prices, especially for sought-after, nature-based credits.

The convergence of voluntary markets with national cap-and-trade markets and Paris Agreement markets could see prices rise even faster and even more quickly.

Supply of high integrity credits: A constraint that will further tighten

The supply of high-quality carbon credits is constrained and price inelastic. Every carbon credit in existence across the four largest crediting standards could offset global emissions for just eight days.

Several key drivers will coalesce to constrain supply for the rest of this decade and beyond: