This analysis is by Bloomberg Intelligence Senior Macro Strategist Mike McGlone. It appeared first on the Bloomberg Terminal.

A broad commodity-price recovery is looking increasingly unlikely for 2024, as it would depend on some combination of a rebound in Chinese economic growth, more OPEC supply cuts, poor grain production, a weaker dollar and a resilient US stock market. US corn ending stocks are at about 25% above the five-year average, and the expanding glut of crude oil and liquid fuel supply in the US and Canada about matches OPEC’s spare capacity. Both appear as reciprocal reactions to the 2022 price pumps. We see leanings toward a continuation of the downward cycle in 2024 and a potential acceleration in deflation, especially if the rising US stock market tide ebbs.

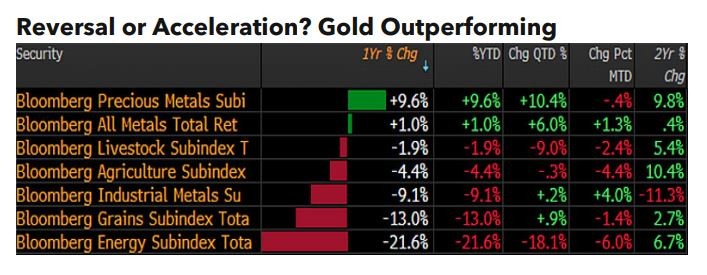

Gold may be resuming its rally from the onset of the millennium, and could gain momentum if the US enters an elusive recession on the back of aggressive Fed tightening.

Commodity deflation in 2023 risks trickling down into 2025

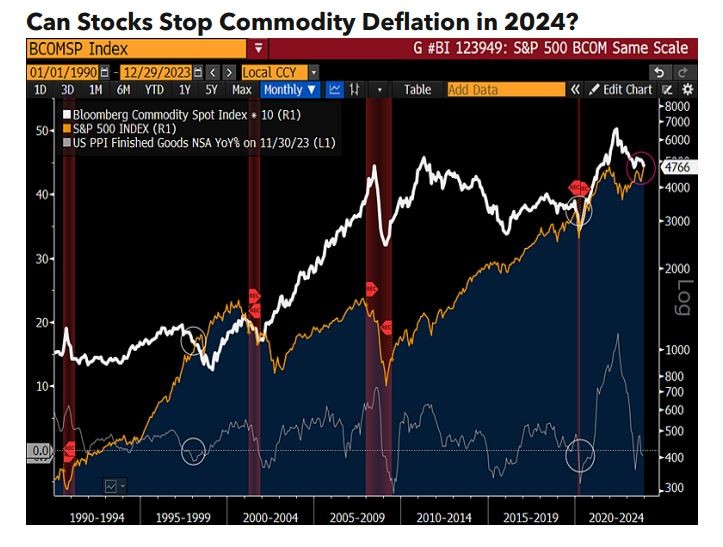

Commodities may be center stage in 2024 for the other side of the unprecedented 2020-22 liquidity and price pump that’s dumping at the end of 2023. It’s a question of what might stop a typical reversion lower in the cycle, and an inordinate burden may be on the US stock market to remain resilient.

Risks of not being transitory – Commodity deflation

The Bloomberg Commodity Spot Index (BCOM) and S&P 500 (SPX) may emphasize deflation risks in 2024, notably if the stock market drops. It was 1998 when the BCOM (multiplied by 10 to put it on the same scale) first crossed paths with SPX. That year, the producer price index finished-goods gauge bottomed at minus 1.7% as the stock market ran up to the peak of 2000, which wasn’t definitively breached until 2013. Our graphic shows BCOM on track to drop below SPX soon. The indexes intersected in 1Q20 in a similar commodities down, stocks-up trajectory when the distortions of the pandemic, and the greatest-ever liquidity injection, pumped up all assets.

Commodities may be at the advent of a downward-reversion cycle on the back of 2022 price spikes. If stocks fall, deflation reciprocal to recent inflation might not be transitory.

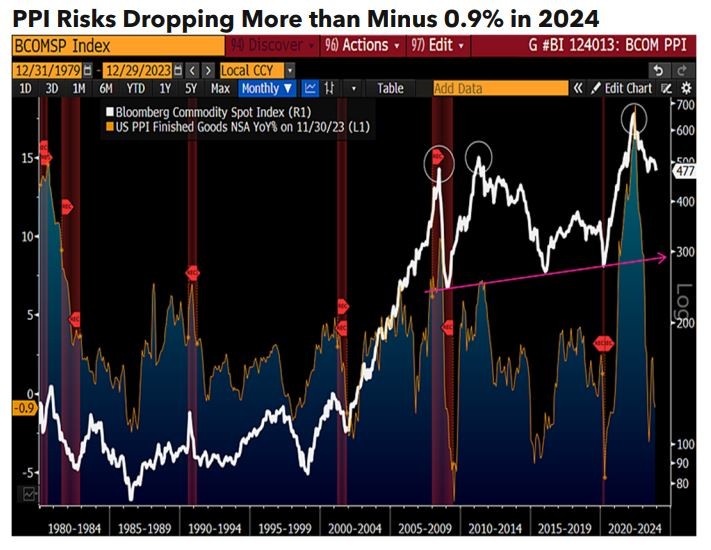

Deflation might be early days if commodities a guide

The 2024 year may be looked upon as a typical deflationary response to the greatest inflation in about 40 years to the 2022 peak. Commodities could recover due to an expanding global economy and demand-pull forces, or keep falling with trickle down implications as the unprecedented coordinated rate hikes of 2022-23 take effect. Our bias is the latter. The chart shows the Bloomberg Commodity Spot Index well above the support line from the 2008 nadir, and the producer price index finished goods at minus 0.9%.

To reverse deflating PPI, the US stock market tide may need to keep rising. Weakening commodities could be signaling deflationary domino risks if stocks fall in a typical US recession.

Recession pessimism vs. Soft landing optimism

The consensus reversal to a US economic soft landing might show the pendulum leaning too far to the optimistic side vs. the recession pessimism at the start of 2023. A key question for 2024 is what it might take for the Bloomberg Commodity Spot Index to rebound, with the gauge at the bottom of our annual scorecard after a roughly 11% drop. Absent another supply shock, it appears that the US stock market will need to remain resilient or the deflationary domino’s might tumble. A top global 24/7 traded risk-asset leading indicator, Bitcoin, may provide some guidance, notably if it gives back some of 2023’s about 160% gain.

The reverberations from the price spikes of Russia’s invasion of Ukraine and the most aggressive central-bank tightening period in history may remain the predominant commodity headwinds in 2024.

Commodities tilting toward a great reset

Gold is rising and most commodities are falling, and there’s risk of that trajectory accelerating in 2024. It may take some combination of a reversal of China’s property crisis and Europe’s tilt toward recession, a resilient US stock market and a weak dollar to stall the downward reversion process in most commodities. This year was about a typical elastic response to too-hot prices in 2022, and if history is a guide 2024 may be about probing for too-cold bottoms. The three Cs appear likely to fall back toward target support levels: around $40 a barrel WTI crude oil, $3 a pound copper and $4 a bushel corn.

The effects of the most aggressive central-bank tightening period in history may be subdued, and economies and commodities could recover. But rising gold may be anticipating that they don’t.