As more and more electric vehicles hit the road, every gram of lithium will count to produce the batteries that power them. Ghana is now looking to capitalize on its resources, with its sovereign minerals fund announcing it will pour $32.9 million into Atlantic Lithium, which is developing the country’s first lithium mine.

This follows Australia’s Piedmont Lithium exercising its option last month to acquire a 22.5% stake in Atlantic Lithium’s Ghana portfolio and commit to solely fund the first $70 million required to develop the Ewoyaa lithium project. At its peak, Ewooya could produce about 65,000 metric tons lithium carbonate equivalent, enough to power about 1.4 million Tesla Model 3s.

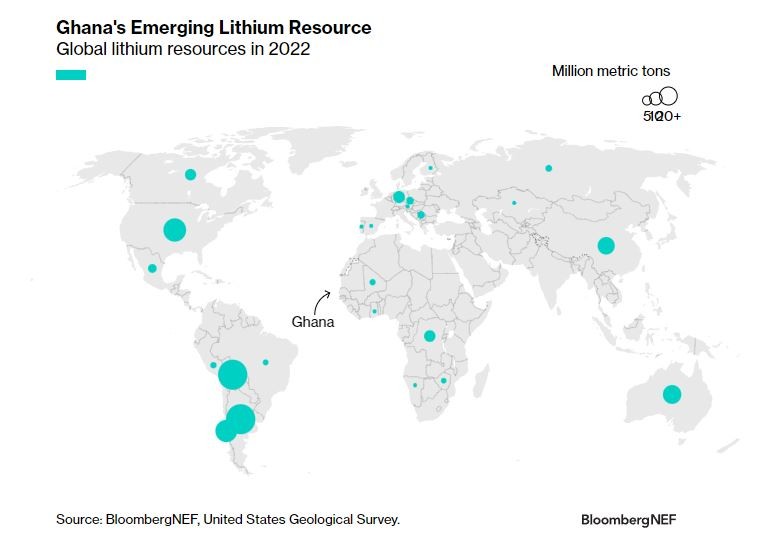

BloombergNEF estimates demand for lithium will more than double from today to reach 2.5 million metric tons lithium carbon equivalent by 2030. Increasing demand, coupled with rising geopolitical tension between the US and China, has led to the diversification of new lithium investments.

Historically, Chile and Australia have been the main countries that attracted exploration dollars. Other markets, such as Zimbabwe, the Democratic Republic of Congo, Namibia, Mali, Bolivia, Mexico and Canada, are also competing for exploration budgets. But despite the capital being invested in these countries, it has proven difficult to convert exploration projects into producing mines.

The investments from Piedmont Lithium and the Minerals Income Investment Fund should help accelerate Ewooya’s development and make Ghana a lithium producer in the second half of the decade. Earlier this year, the country’s cabinet approved a new green minerals policy to improve local participation in minerals such as lithium.

BloombergNEF (BNEF), Bloomberg’s primary research service, covers clean energy, advanced transport, digital industry, innovative materials and commodities. BNEF helps corporate strategy, finance and policy professionals navigate change and generate opportunities. Explore more content on the BNEF blog.