This article was written by Scott Johnson. It appeared first on the Bloomberg Terminal.

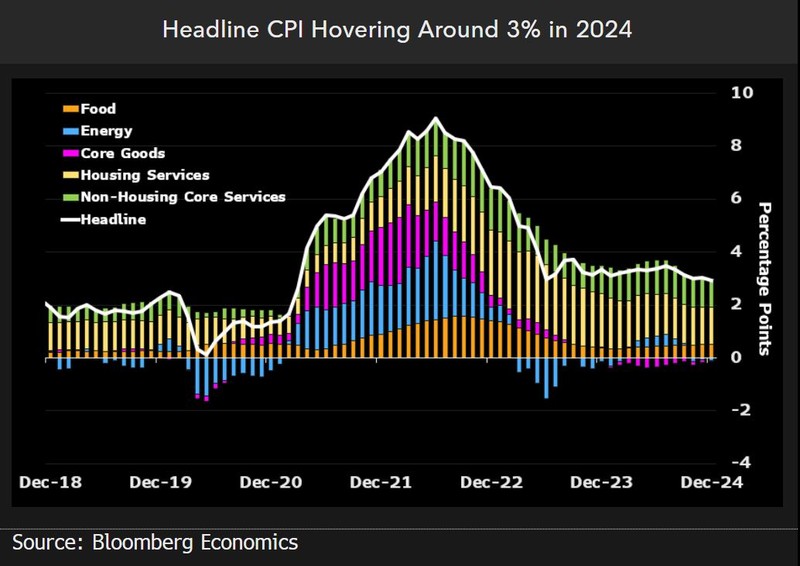

February may have brought another bump in the road toward slower US inflation. BE’s nowcast is in line with expectations of accelerating month-on-month headline CPI. Notably, inflation swaps flag a slightly hotter print. Our US economists see seasonal effects at work, and there may be good news if core CPI ebbs as predicted. Still, our models suggest most of the remaining excess inflation reflects sticky demand-driven factors. Fed policymakers will need more reassurance from the data to move ahead with rate cuts.

US CPI to rise on gas, core to fall on used cars

We expect headline CPI inflation for February, due March 12, to rise to 0.4% month on month (vs 0.3% prior), driven by gasoline prices. However, core inflation will likely slow to 0.3% (vs. 0.4% prior), with core goods – particularly used-car prices – driving disinflation. On an annual basis, headline and core inflation will likely register 3.2% and 3.7%, respectively, in February (vs. 3.1% and 3.9% prior).

Owners’ equivalent of rent (OER) was surprisingly hot in January, but we think it’s mostly just noise. Market rents suggest both OER and primary-rents inflation should fall throughout 2024, with overall shelter inflation dropping to 4.0% by the end of the year.

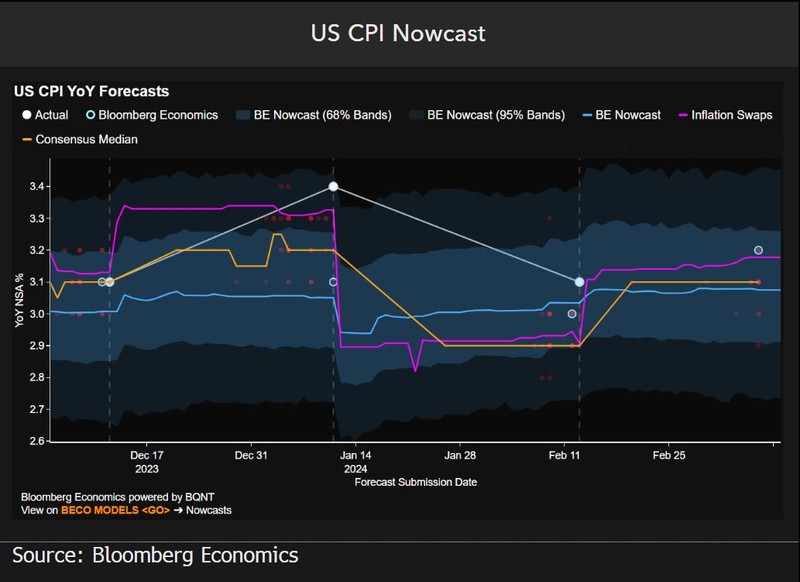

Nowcast puts US CPI inflation at 3.1% in February, Core at 3.7%

BE’s nowcast for the February CPI largely supports consensus expectations for both the headline and core. Our model points to a headline reading of 3.1% year on year, unchanged from January. On a month-on-month basis, the nowcast anticipates a 0.4% increase, up from 0.3% in the previous month. For core prices, our projection is 3.7% year on year, down from 3.9%, and 0.3% month on month, down from 0.4% in January. Markets see sharper acceleration, with swaps prices implying the headline at 0.5% month on month and at 3.2% year on year.

Over an evaluation period from 2012-2022, the final nowcast reading for the month has a standard error of 0.2 percentage point.

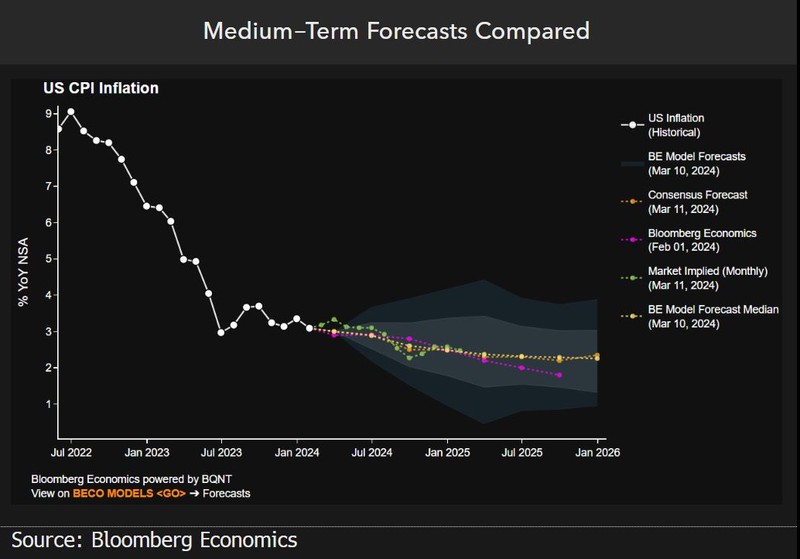

Markets see slower US inflation, but with bumpy road ahead

Looking beyond the February data, US inflation is widely expected to continue slowing over the medium term. Our US economists and consensus forecasts see CPI at an average 2.5% year on year in 4Q24, down from 3.2% at the end of last year. That’s also in line with the median in a BE model conditioned on forecasts for growth and commodities prices. But the monthly picture from markets is worth watching. Forecasts drawn from swaps pricing suggest inflation could accelerate further to 3.3% in March before resuming the slowdown.