This article was written by Mike Pruzinsky, Equity Indices Product Manager at Bloomberg.

Broad-based market indices serve as a financial yardstick for measuring investment performance, guiding investment decision making, and assessing the effectiveness of investment strategies. When a financial index is selected as a fund’s official benchmark, the index will function as a common denominator to communicate investment performance to clients and investors. It also acts as the universe of securities in which the fund’s portfolio manager can invest. As such, indices serve a vital role and should be well maintained to meet these demands. In particular, the frequency of measuring index constituents for selection should be appropriate so that membership reflects the stated goals of the index.

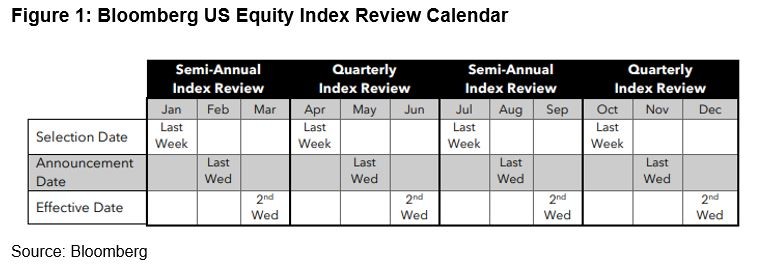

The Bloomberg U.S. Domestic Equity Indices perform the process of index reconstitution semi-annually. This aims to strike a balance of keeping indices well represented as markets change with a responsive rules-based approach, while limiting unnecessary turnover.

Learn More: What goes into maintaining an equity index?

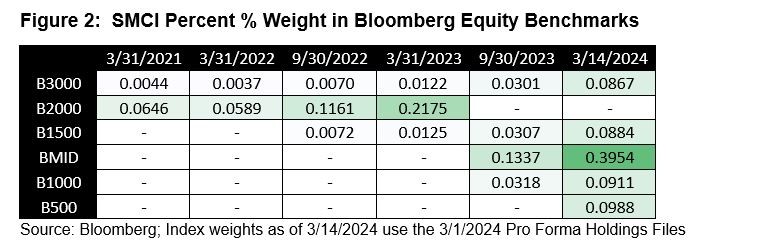

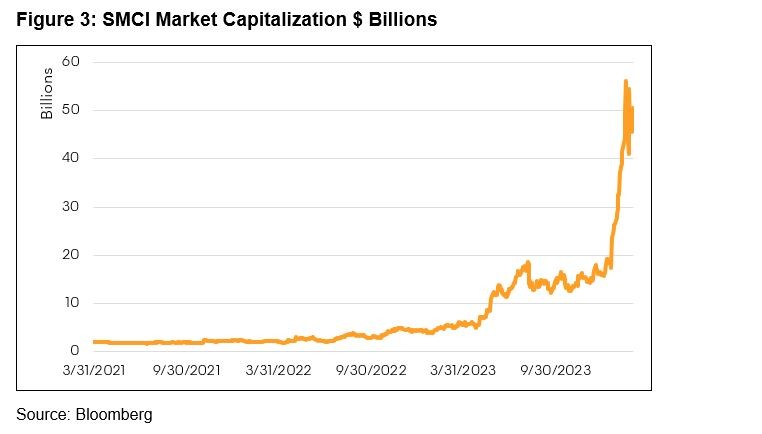

Securities in the Bloomberg U.S. Domestic Indices are organized based on market capitalization rank and grouped into security counts so that as a stock grows in significance it becomes higher ranked. For example, take the recent run of AI beneficiaries and specifically the upward surge in the stock price of Super Micro (SMCI US Equity). Over the past two years, the stock has gained over $40 billion in market value. In 2022, the stock was part of the B2000 which contains all the companies in the B3000 (top 3000 securities) that are not members of the B1000 (top 1000 securities). At the September 2022 reconstitution, Super Micro entered the B1500 (top 1500 securities). Then a year later during the September 2023 reconstitution the stock graduated from the B2000 and was added to the B1000 and BMID (securities 201-1000) indices. Later this month effective on the close of Wednesday March 13th, Super Micro will receive its cap and gown to become a member of the B500 (top 500 securities) completing its journey from small cap to large cap.

Learn More: Benefits of an automated, rules-based approach

With a market capitalization of over $50 billion dollars, Super Micro has also gained the attention of S&P Dow Jones Indices. On March 1st, it was announced that the stock would join the S&P 500 Index effective on Monday, March 18th. Still, other index providers have been slow to grade members and reflect change.

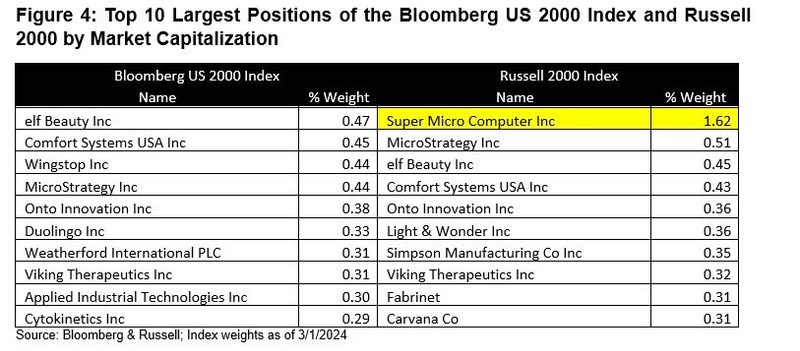

Take the Russell 2000 Index which is commonly associated with being a standard for benchmarking U.S. small cap stocks. Super Micro is currently the largest index constituent by far and has failed to graduate into indices that track companies of comparable size. Just like Ryan Reynolds’s portal of seventh-year senior Van Wilder, we expect Super Micro will eventually make the grade, but the unresponsiveness of the index is telling. Tuition money is also at stake as this type of discrepancy can unfairly penalize fund managers who are benchmarked against a less responsive index, but have other restrictions in place that prevents the purchase of a company with such a large market capitalization as part of a small cap portfolio. Since the end of 2022, Super Micro has held an average weight of 0.50% in the index but contributed 165 basis points or 8.8% of the Russell 2000’s 18.74% total return.

By performing reconstitution semi-annually, Bloomberg’s equity indices are measuring markets often enough to be reflective of a stock’s aptitude with appropriate categorization. Whether it be the latest technology of artificial intelligence (AI), geo-political tensions, or a future market event on the horizon, know that Bloomberg’s semi-annually reconstitution will allow for index constituents to be judged using pre-set rules and be responsive to market events.

Learn More: Bloomberg’s equity index offering overview.

The data and other information included in this publication is for illustrative purposes only, available “as is”, non-binding and constitutes the provision of factual information, rather than financial product advice. BLOOMBERG and BLOOMBERG INDICES (the “Indices”) are trademarks or service marks of Bloomberg Finance L.P. (“BFLP”). BFLP and its affiliates, including BISL, the administrator of the Indices, or their licensors own all proprietary rights in the Indices. Bloomberg L.P. (“BLP”) or one of its subsidiaries provides BFLP, BISL and its subsidiaries with global marketing and operational support and service.