Bloomberg Market Specialists David Tung, Keith Gerstein and Kelly Lai contributed to this article. The original version appeared first on the Bloomberg Terminal.

Background

With the U.S. equity markets stretching valuations, some retail investors are turning to alternatives to diversify and reduce risk.

Private equity shops are catering to them by providing products with low minimum investments. That’s projected to help results at publicly traded giants Ares Management, Apollo Global Management, Blackstone, and KKR. For them, fee-related earnings are forecast to increase as much as 38% a year through 2023, according to analyst estimates.

What’s more, inflows into assets under management (AUM) are reaching record highs. For Blackstone Inc., which had an AUM of $618 billion at the end of 2020, analysts estimate inflows will total $196 billion in 2021.

The issue

Dry powder, committed capital that’s not yet invested, can fuel private equity dealmaking. Blackstone has multiple segments with ample dry powder. For two of them — private equity and real estate — dry powder largely held steady for two years before starting to drop in 2021.

Not all private equity firms are approaching the market in the same way as Blackstone. KKR & Co., which has focused on integrating its purchase of insurer Global Atlantic Financial Group, had done a lower volume of acquisitions in 2021 as of early November than it had in 2020 or 2019.

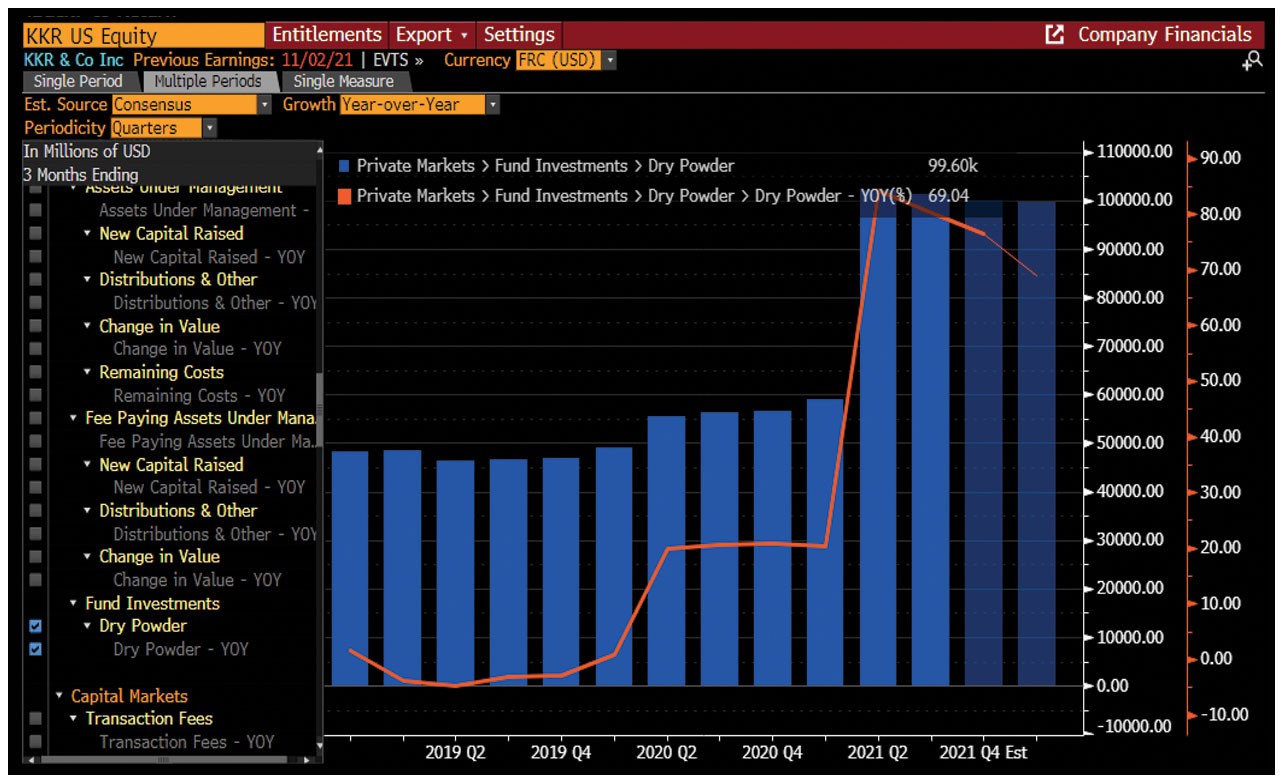

In the third quarter, KKR’s private markets dry powder, at $101 billion, was 80% higher than it had been a year earlier. This increase in dry powder is part of a trend that, according to estimates, is expected to result in KKR’s largest annual accumulation of such capital. While other companies have been stockpiling dry powder in 2021, KKR’s massive growth stands out.

In late November, KKR made a $12 billion bid for Telecom Italia SpA in what could be Europe’s largest buyout. In addition, New York- based KKR piled up dry powder thanks to a fundraising push.

The Company Financials function can monitor how dry powder at private equity firms will play out in the market.

Tracking

To dig into this, run {KKR US <Equity> MODL SOURCE <GO>}.

For more information on this or other functionality on Bloomberg Professional Services, click here to request a demo with a Bloomberg sales representative. Existing clients can press <HELP HELP> on their Bloomberg keyboard.