Well over a decade ago, FX led the adoption of electronic trading. The efficiency experienced by the FX markets through this electronification is now being rolled out across other asset classes.

Along the way, there have been incremental improvements to FX electronic workflow, from confirmation, matching and settlement to the addition of other instruments such as FX options.

Now, the market is ready for the next phase of automation. FX market participants who are responsible for FX hedging are also responsible for the reporting obligations that come with trading FX derivatives, whether that be mark-to-market and valuations or hedge effectiveness testing or both.

Bloomberg innovation in front-to-back workflow will now allow for FX hedgers to:

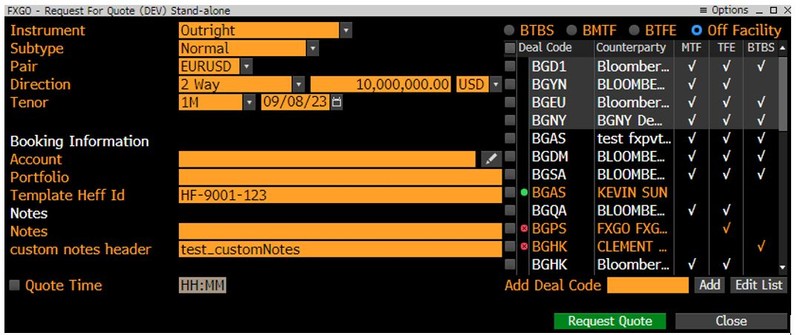

1. Input a ‘hedge designation ID’ (as a template) into their request for quote (RFQ) FX electronic trading ticket at the point of going out to the market for a price.

2. Accept the quote and trade with their preferred bank.

3. Automatically receive all completed valuations and hedge effectiveness reports at the end of their selected reporting period.

Where the terms match, it will no longer be necessary for FX hedgers to set up hedge accounting designations on an ongoing basis, or manually run their end of month reports. The several-day reporting process will soon be as distant a memory as telephone dealing.

For more information on Bloomberg’s FX electronic trading platform FXGO <GO> and hedge accounting module HEFF <GO>, please reach out to your Bloomberg Sales Representative.