This analysis is by Bloomberg Intelligence Chief G10 FX Strategist Audrey Childe-Freeman. It appeared first on the Bloomberg Terminal.

A scenario of selective 2021 dollar weakness across G10FX is intact, but we can’t see a one-way trade and some currencies may temporarily retreat when the dollar bounces next, given positioning and moves year-to-date. It was easier to be Canadian-dollar bull at 1.25 or a sterling fan below 1.40, and both are exposed on a dollar rebound, but it’s no reason to give up altogether.

Loonie, sterling near 10-year average

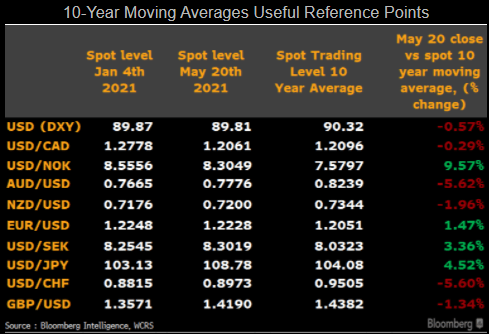

Long-term historical currency levels and 10-year moving averages are useful indicators when it comes to large FX moves, assessing whether there’s room for additional upside/downside or whether a move may have been overdone. In that respect, we note the pound still trades about 1.5% below its 10-year moving average vs. the dollar, while the Canadian dollar is quite close to its current average at nearly 1.21.

One of our favored G10 currencies in 2021, the Norwegian krone, trades almost 10% lower vs. the greenback compared with its 10-year moving average, suggesting the currency is historically cheap and dovetailing nicely with our bullish case.

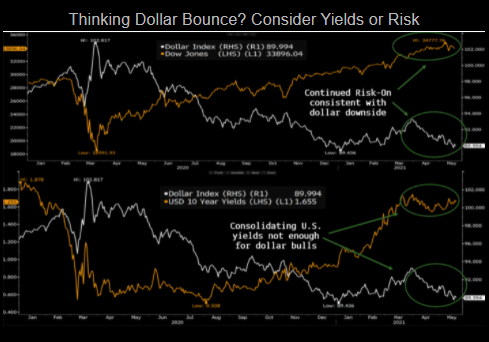

Risk-off, yields could trigger dollar bounce

Selective dollar downside in the G10 world in 2021 is our central working assumption, but it won’t be a straight line of greenback weakness and we believe another bounce is feasible in 2H. That leaves currencies such as the loonie more exposed to a potential short-term pullback, given positioning and moves year-to-date. When it comes to identifying catalysts for the dollar’s next bounce, higher U.S. yields or a risk-off move could be relevant. Higher yields aren’t seen for now, with the Federal Reserve resisting a hawkish adjustment and recent data mixed. Our expectation of range-trading yields isn’t enough for dollar bulls.

Meanwhile, a sustained risk-off market move triggered by returning inflation concerns or an unexpected negative turn on the virus front could also revive the dollar.