This analysis is by Bloomberg Intelligence Senior Analyst Michael Shah and Analyst John Lee. It appeared first on the Bloomberg Terminal.

Weight-loss drugs such as Wegovy, Ozempic and Mounjaro are generating waves of hope and hype in the US. Investors are buying in, sending the market caps of Novo Nordisk and Eli Lilly soaring into the ranks of the world’s most valuable companies. In five charts, we look at the potential for weight-loss drugs in Asia, and the implications for Innovent.

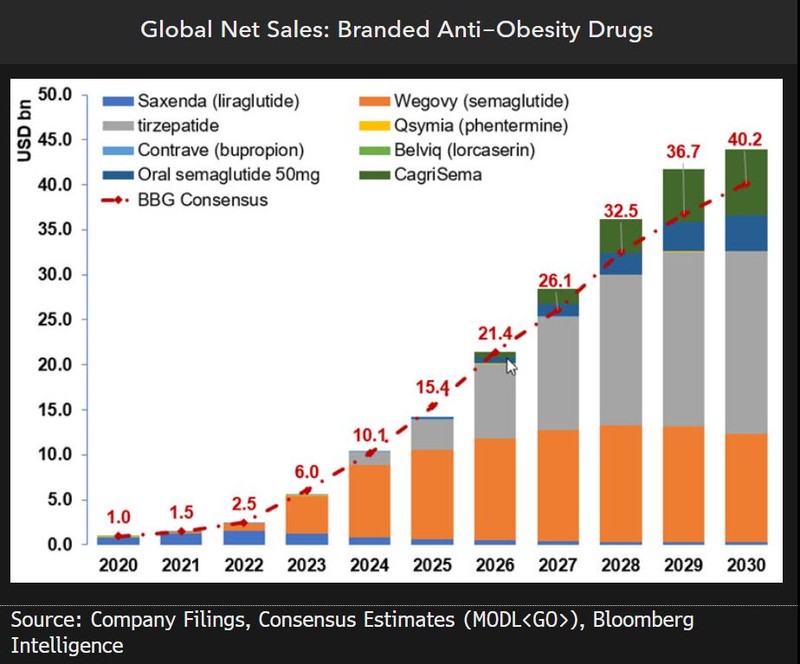

Obesity-fighting drugs’ sales could defy gravity

Anti-obesity drug sales worldwide could hit $44 billion in 2030 vs. $2.5 billion in 2022, with big pharma behemoths Novo Nordisk and Eli Lilly setting the pace. That Bloomberg Intelligence calculation was based on drugs already on the market and in phase 3 clinical trials, and assumes a conservative, 5% US market penetration rate by 2030. Early-stage drugs have since reported promising data, leaving the door open for that figure to soar as high as $60-70 billion, according to analyst Michael Shah, excluding the full potential for sales in China.

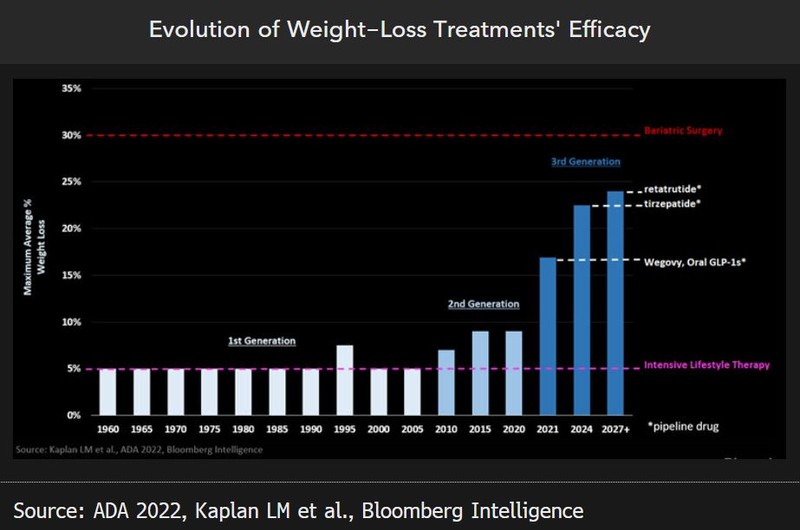

Why now? Better efficacy is raising the bar

First-generation obesity therapies — prior to 2005 — were associated with less than 5% weight loss, with the second generation — prior to 2020 — putting 10% within reach, including Novo Saxenda. The latest, third generation, including Wegovy, has been linked to as much as 18% weight loss across its phase 3 trials while Eli Lilly’s Mounjaro, or tirzepatide, has demonstrated results surpassing 20%.

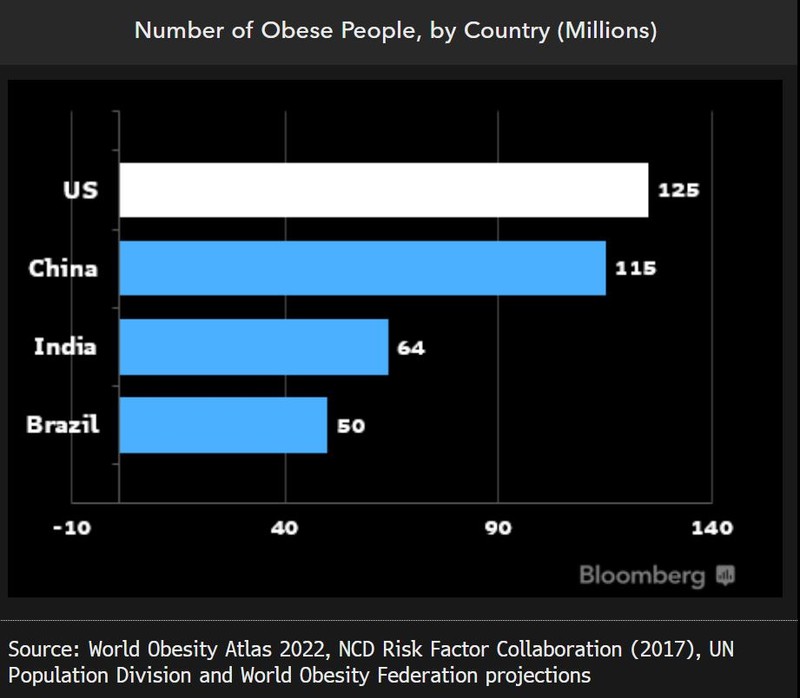

China obesity market a sizeable opportunity

Obesity, defined as having a body mass index (BMI) of 30 or higher, could affect 115 million adults in China by 2030, just slightly behind the US. Weight-loss or anti-obesity drugs’ selling prices in China are likely to be substantially lower than the US. While not a direct comparison, Huadong Medicine’s liraglutide — a generic version of Novo’s Saxenda — costs approximately $1,600 annually in China, less than a tenth the $17,500 annual gross cost of Novo’s Wegovy in the US.

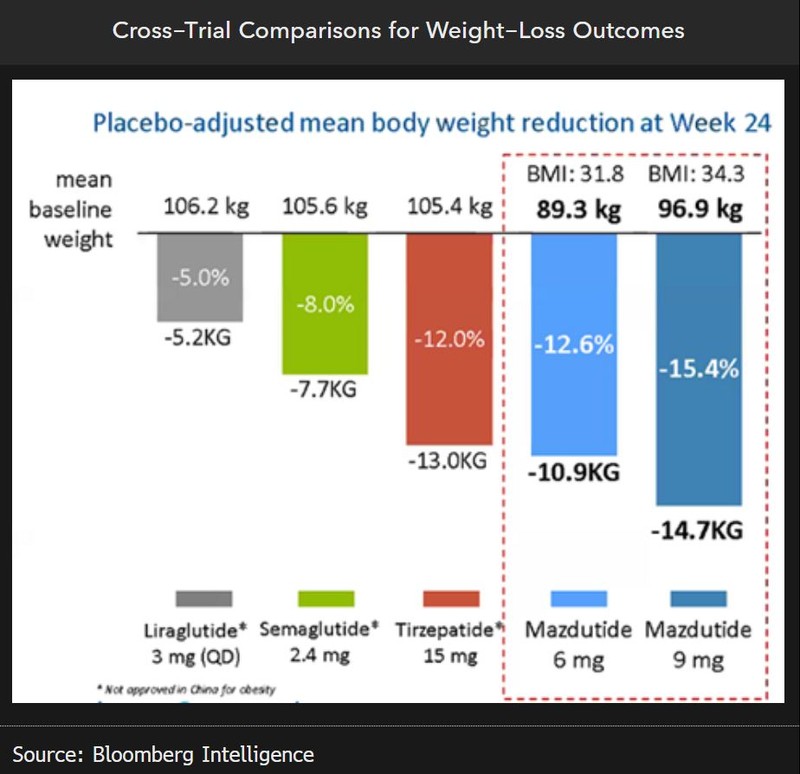

Innovent’s obesity drug shows promise

Innovent stands to capitalize on the growing sales of weight-loss drugs in China, according to BI analyst Leslie Yang. Innovent has a licensing agreement with Eli Lilly for the development and commercialization of mazdutide 9 mg in China, and it’s showing promise. After 24 weeks, mazdutide 9 mg showed competitive weight loss vs. Eli Lilly’s tirzepatide, although this needs to be replicated in larger Phase 3 trials. The drug showed a placebo-adjusted weight loss of 15.4% in Phase 2 trial testing of obese Chinese adults, which compares favorably to tirzepatide’s (15 mg) 12% placebo-adjusted weight reduction at a similar time point in Phase 3, and on par Phase 2 data for El Lilly’s retatrutide. Mazdutide 9 mg raised no major safety concerns during Phase 2 despite limited data.

China rivalry could heat up

Innovent could launch Phase 3 trials for mazdutide 9 mg in 2H and mazdutide 6 mg for obesity by 1H24, backed by positive data. So far, Huadong’s liraglutide and Benemae’s beinaglutide are the first GLP-1s approved for obesity in China, while a decision is pending for Wegovy. However, unlike Wegovy or mazdutide’s convenient weekly dosage, liraglutide is dosed once a day and beinaglutide thrice daily.