Bloomberg Professional Services

This article was written by Jim Wiederhold, Commodity Indices Product Manager at Bloomberg.

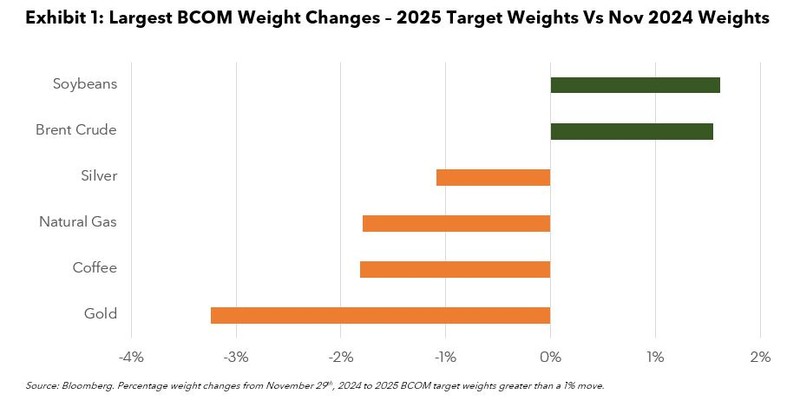

Gold prices rose 35% in 2024 to the all-time high set in October, the biggest yearly increase in four decades. Gold held the biggest single commodity future weight in the Bloomberg Commodity Index (BCOM) to start 2024 (14.35%) and as of November 29th, the weight has increased by over 3% over the course of the year to 17.53%. With the release of the 2025 BCOM Target Weights, we see the weight of gold will fall to 14.29% during the annual reconstitution coming in the first half of January. This will be the largest absolute percentage change across the 24 commodities futures that make up BCOM. The next two biggest reductions in weight are seen from coffee and natural gas. In this short blog, we will discuss these changes as well as the biggest increases in weights from brent crude oil and soybeans as we turn the calendar to the new year.

In Exhibit 1, the magnitude of the percentage change in gold is apparent when viewed against the other biggest changes in weights for BCOM constituents from the end of November to the 2025 target weights. Each year, BCOM weights are initially constructed 2/3rd based on underlying futures trading volumes and 1/3rd based on world production of each commodity. These are achieved by taking 5-year averages of USD value traded and production. Gold will decline in weight for the third consecutive year since it peaked in 2022 hitting the 15% target limit set by the BCOM methodology for any single commodity. Gold prices have had a banner year so far in 2024 and trading volumes rose by over 20% compared to 2023 but this isn’t reflected in the 5-year trading volume average used to calculate the initial target weights for 2025. The last 5 full calendar years are used with 2023 being the last full year. Over the prior three and a half years, we witnessed declining trading volumes in gold futures. During this time, gold prices moved sideways in a $1800 to $2000 range and this lack of price direction may have contributed towards gold trading volumes decreasing from 2020 to the end of 2023. This constitutes a driver for the drop in gold target weights in BCOM this year.

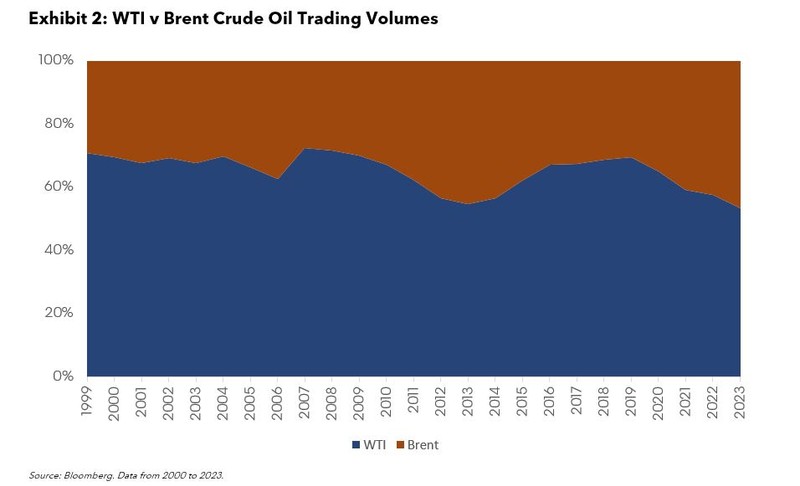

For 2025, the most traded and produced commodity (crude oil) has once again hit the individual commodity cap of 15% within BCOM, just as it did in 2024. Crude oil is represented by two futures contracts, WTI crude oil and Brent crude oil. In 2024, target weights were roughly the same at about 7.5% each but Brent will pull ahead with a weight of 8.03% while WTI will be 6.97% at the January 2025 reconstitution. Brent will surpass natural gas as the highest weighted component in the energy group for the first time since Brent’s inclusion into the index in 2012. This trend of increasing trading volumes and significance of Brent crude oil was first highlighted in a blog earlier this year. Exhibit 2 highlights the trend of Brent crude oil encroaching on WTI dominance over time.

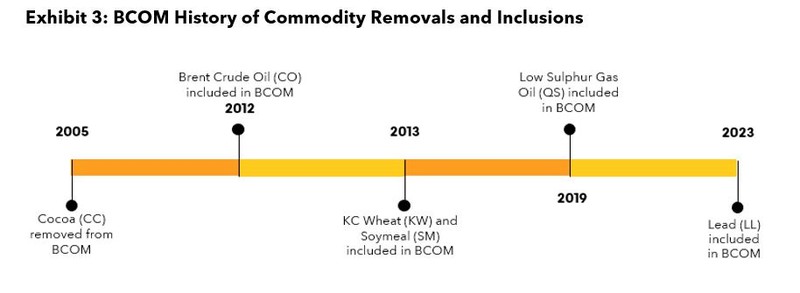

One final thing to mention involves commodities potentially moving in or out of the index. Two such commodities are cocoa and lead. During the 2025 target weight analysis, cocoa successfully met the minimum threshold requirement for the first time and will need to pass next year as well to be eligible for inclusion in 2026. Lead, which is currently in the index, will remain in BCOM for 2025 as it has met the minimum threshold requirement defined by the methodology. Exhibit 3 showcases the commodities included and removed since BCOM was launched almost 30 years ago.

Per Exhibit 3, the makeup of BCOM does not significantly change from year to year. The overall changes between the target weight announcements from 2024 to 2025 are minimal across all commodities and highlights the continuous nature of BCOM. This broad commodities index seeks to keep the basic construction stable while adjusting for the changing dynamic commodities markets in a slow, balanced manner over time.