Bloomberg Professional Services

This article was written by Vikas Jain, Quantitative Researcher at Bloomberg.

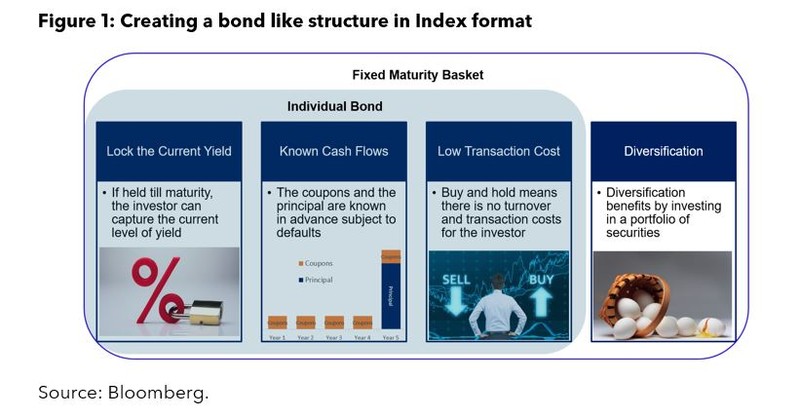

Traditional fixed income benchmarks may sometimes fall short of providing true bond-like characteristics. The continuous buying and selling of bonds result in consistent duration exposure and high mark-to-market risk relative to an individual bond.

As we explored in a recent paper, Fixed Maturity Portfolios (FMPs) target this concern by offering a bond-like structure with the added benefits of an index and the product wrappers around them. They generate more predictable cash flows through regular coupon payments and the return of principal (subject to defaults), reducing interest rate and credit spread risks.

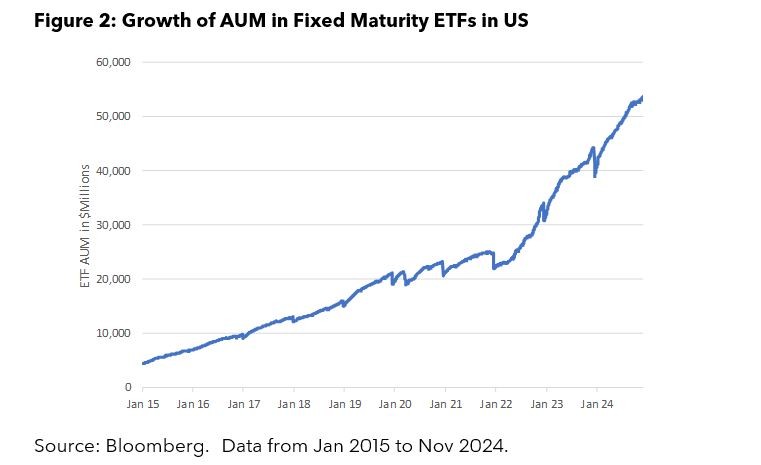

The higher yields available, along with increased market volatility and uncertainty, have been key drivers for the surge in demand for FMPs with ETF assets now exceeding $50 billion in the US.

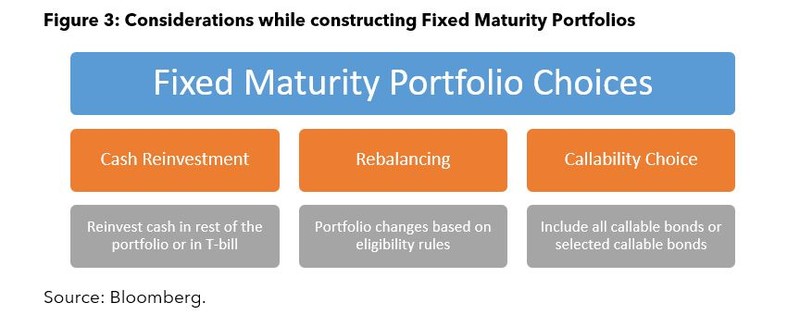

FMPs are typically constructed by selecting sets of bonds with similar maturity characteristics (for example bonds maturing in a specific calendar year). However, differences in construction of these portfolio can lead to varied outcomes.

Key choices in portfolio construction

Cash reinvestment

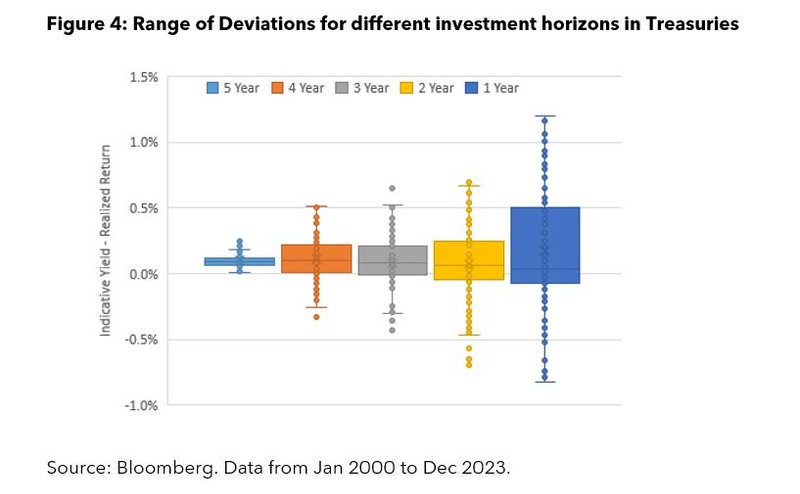

In FMPs, reinvestment of cash flows (generated from coupons, maturing bonds, calls, and defaults) is crucial to achieve the indicative yield. For Treasury portfolios, the realized return and ex-ante indicative yield are different only due to cash reinvestment risk. As shown in figure 4, the range of deviations is relatively small when investment horizon is longer but grows when the investment period is shorter.

Rebalancing

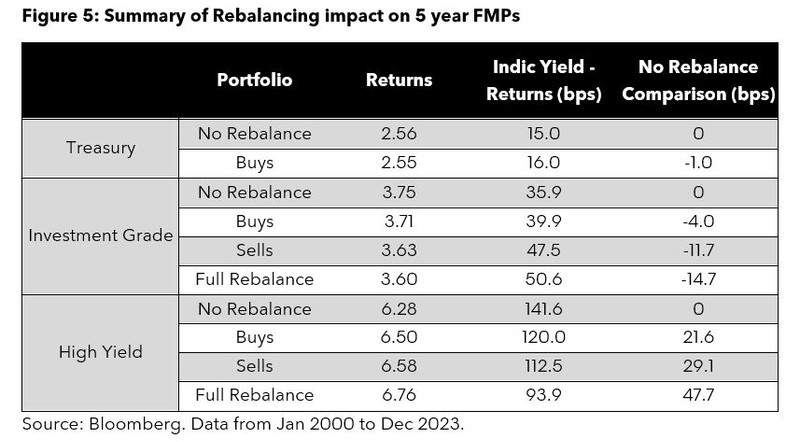

Maintaining a static set of bonds until maturity can minimize turnover and simplify management but may not be feasible for various reasons. Per Figure 5, historical data suggests rebalancing has a negligible impact on U.S. Treasury portfolios. However, investment-grade FMPs typically lose 15 basis points annually, while high-yield FMPs historically gain an additional 48 basis points annually by buying downgraded bonds and selling upgraded ones. Losses in investment-grade are driven by the selling of downgraded bonds (fallen angels), which simultaneously create gains for high-yield FMPs which purchase the bonds. Refer to Why Ratings Matter for more details on this.

Callability

Callable securities introduce reinvestment and prepayment risks that can affect realized returns. Our analysis suggest impact from callable securities is negligible in investment grade but are a crucial consideration in high yield FMPs. While avoiding callable bonds may not be feasible in high yield portfolios, there are choices available on defining the eligible universe based on the callability feature of bonds.

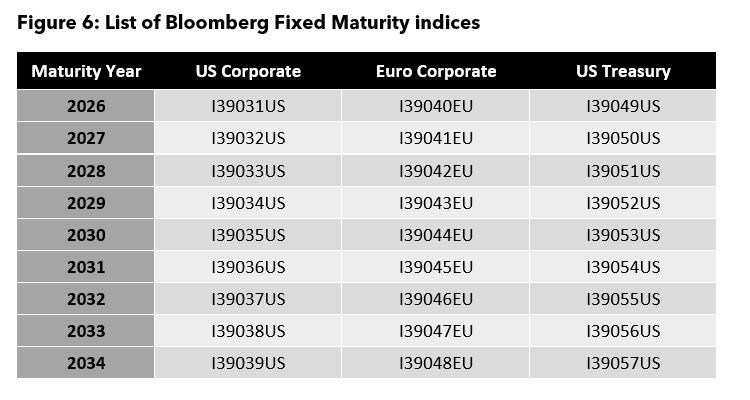

New family launch

To meet the surging demand of these products, Bloomberg recently launched a family of standard Fixed maturity benchmark indices across US treasury, US and European investment grade corporate bonds (see Figure 6). These new standard indices are constructed using a consistent methodology based on the results of our research, Navigating Uncertainty with Fixed Maturity Portfolio. The indices are accessible via the IN ALL<GO> function or using the tickers below on the Bloomberg Terminal.

Fixed Maturity Portfolios are typically constructed using Treasury, inflation-linked, municipal, investment grade, or high-yield bonds. They can also be constructed using more granular sub-groups such as rating buckets, target spreads or using quality filters (like default risk probabilities).