Bloomberg Intelligence

This analysis is by Bloomberg Intelligence Rate Strategist Ira F Jersey and Senior Associate Analyst Will Hoffman. It appeared first on the Bloomberg Terminal.

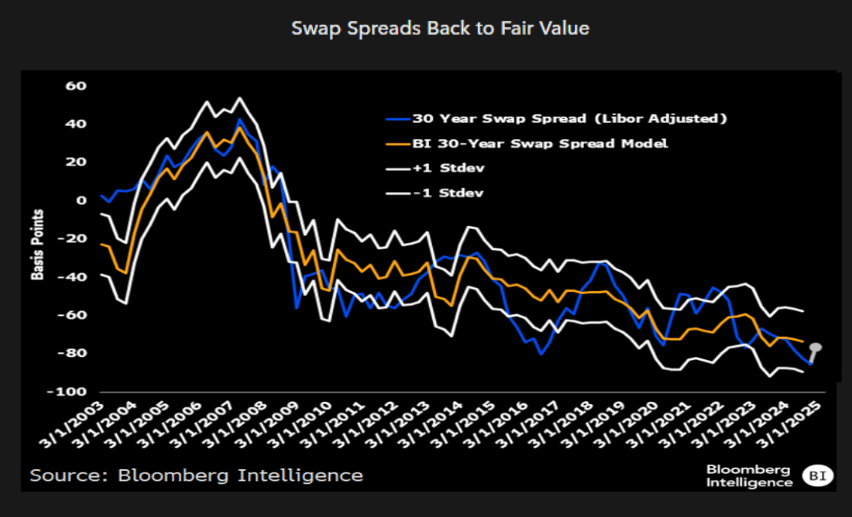

Depending on the details of shifts in bank regulations, swap spreads based on the secured overnight financing rate (SOFR) could widen further, with 30-year spreads potentially reaching negative 55 bps should bank balance-sheet constraints be eased. This note reviews how rule changes could affect the repurchase-agreement market and how Treasury liquidity improvements may only be marginal.

Swap spreads may widen more on bank deregulation

We believe constrained bank balance sheets are among many reasons why swap spreads are negative. Insatiable demand from liability-driven investors and insurance regulations incentivize receiving in swaps vs. buying bonds outright to make up for any duration gaps — causing tighter spreads. The recent discussion is that bank regulations, particularly changes to the supplemental leverage ratio, would allow banks to hold more securities and could increase prime brokerage and the size of Treasury repo-agreement books

In aggregate we don’t think long-end swap spreads will turn positive or that the spread of spread curve will be upward sloping. Yet a widening trend may materialize, with the first stop potentially being the top end of our fair value model’s error band, now at minus 55 bps, with minus 40 bps possible over time.

Repo market not the liquidity grease it once was

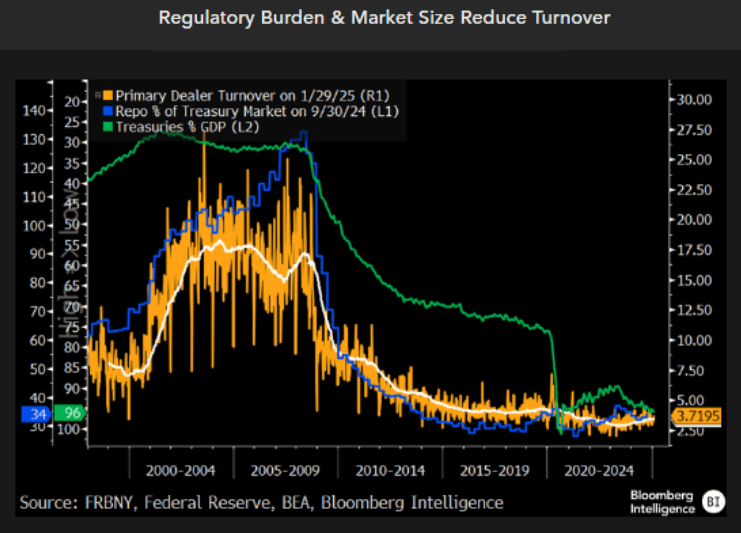

In efforts to make financial institutions, particularly banks, safer, regulators enacted rules that limited the attractiveness and ability for these institutions to fund the Treasury market via repurchase agreements. The repo market was one point of failure during the global financial crisis and a symptom of financial sector over-leverage. Repo volume grew to 120% of the Treasury market just before the GFC from an average of 50% from 1980-2000. Following the onset of stricter Basel capital and Dodd-Frank related rules, this has plummeted to 33%.

We don’t think there’s an absolute correct level of repo to the Treasury market. However, one major implication of any bank reforms that allow the Treasury repo market to grow, or banks to own more long-maturity Treasuries, would be for swap spreads to widen.

Treasury liquidity still threatened

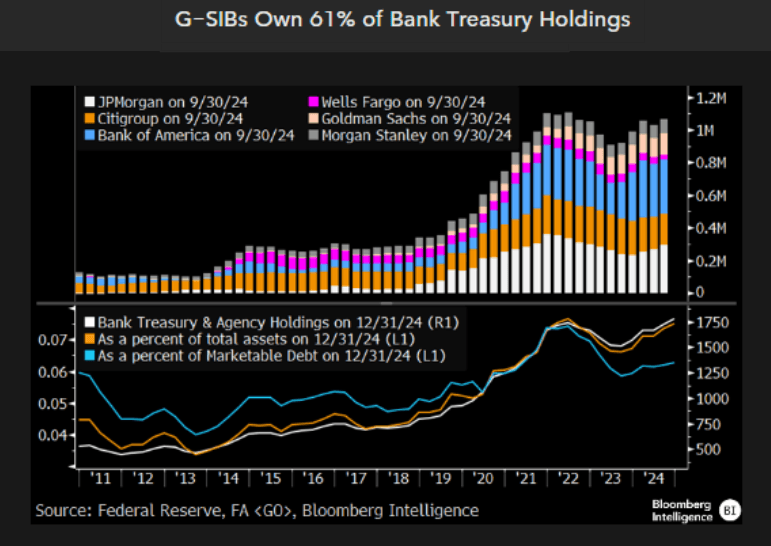

Though banks own about $1.8 trillion of Treasuries, many of these are held to comply with Basel rules, such as the liquidity coverage ratio (LCR), which is often a binding constraint for how large bank balance sheets can become. A moderation (rather than elimination) of some bank capital rules during the Trump administration may increase Treasury turnover and cause swap spreads to widen somewhat as levered Treasuries become a more viable option for some investors. That said, the total quantum of debt outstanding may be an impediment to large increases in some liquidity measures, such as turnover.

The exhibit highlights how Treasury trading by dealers tended to increase as repo leverage rose. Post-GFC regulations reduced the leverage available and therefore turnover, but also growth of the Treasury market has contributed.

Bank of America’s treasury holdings top JPMorgan’s

Global systemically important banks have a choice of which high-quality liquid assets to own to comply with Basel rules, the most common being bank reserves, which remain at over $3 trillion. Yet overall, banks still own about $1.8 trillion of Treasury securities, with more than half owned by just four — Bank of America (BAC), JPMorgan (JPM), Citigroup (C), and Goldman Sachs (GS). Given these securities are held to comply with capital rules, in a way these holdings do reduce the effective float of securities.

Treasuries held for HQLA purposes tend to be shorter in maturity than the overall market, similar to central-bank foreign currency securities holdings. It’s been a contributor to the relatively strong demand for short-term debt even when interest rates were exceptionally low.

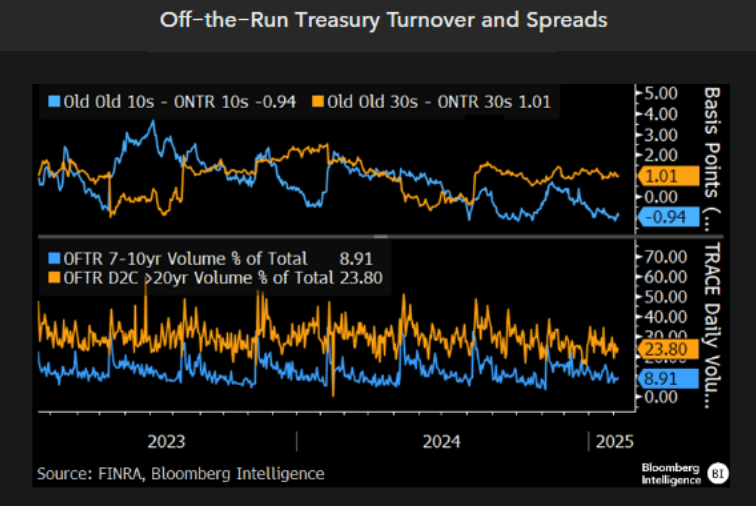

Off-the-run liquidity may Improve on rule change

The double-old 30-year bond has been trading about 1-bp cheap to the on-the-run bond since September 2024 as off-the-run turnover has declined, yet double-old 10-year notes are trading tight to on-the-run bonds, even though less than 9% of trading in the 7-10 year sector is off-the-runs.

Shifts in bank regulations may make off-the-run trading somewhat easier, though we doubt off-the-runs will ever contribute to a majority of Treasury trading.

Bloomberg Terminal subscribers can access research and key data via BI RATEN <GO>.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2025 Bloomberg.