Bloomberg Intelligence

This analysis is by Bloomberg Intelligence Senior Industry Analyst Steve Man, with contributing analysis by Peter Lau, Michael Dean, Joanna Chen, and Giacomo Reghelin. It appeared first on the Bloomberg Terminal.

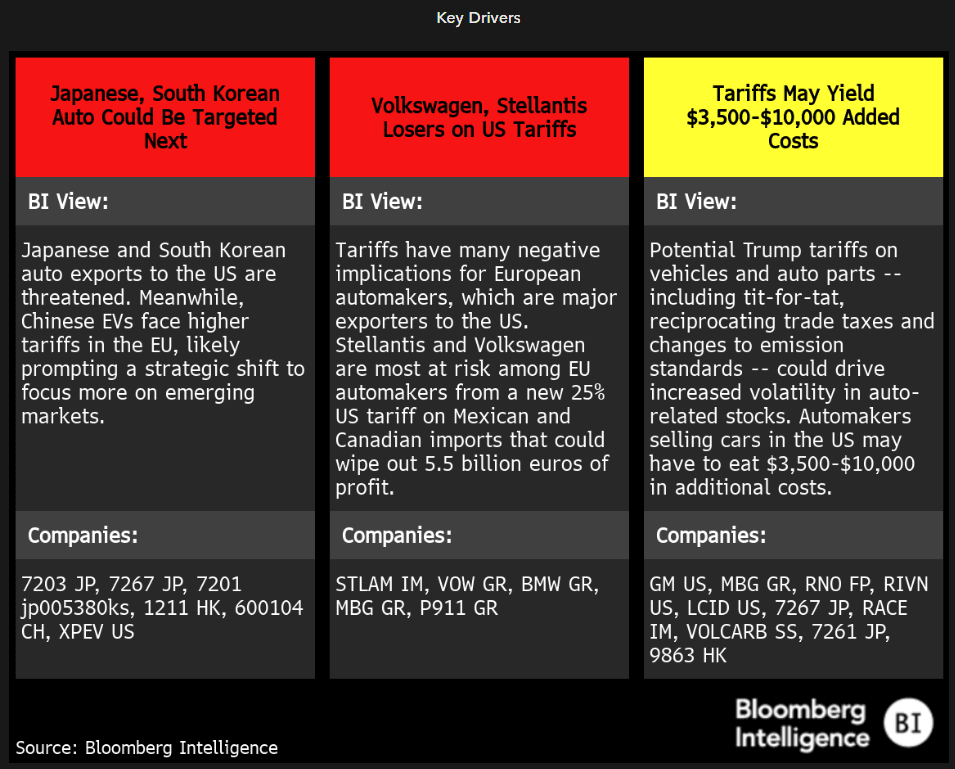

US tariffs on North American and EU imports could cut automaker profit by $3,500-$10,000 per vehicle, according to our analysis. The financial impact could be even greater as supply-chain disruptions slow production. Yet Tesla and other pure-play electric-vehicle makers, with tighter vertical integration, will likely be less affected than legacy automakers.

Three keys for tariffs’ impact on autos

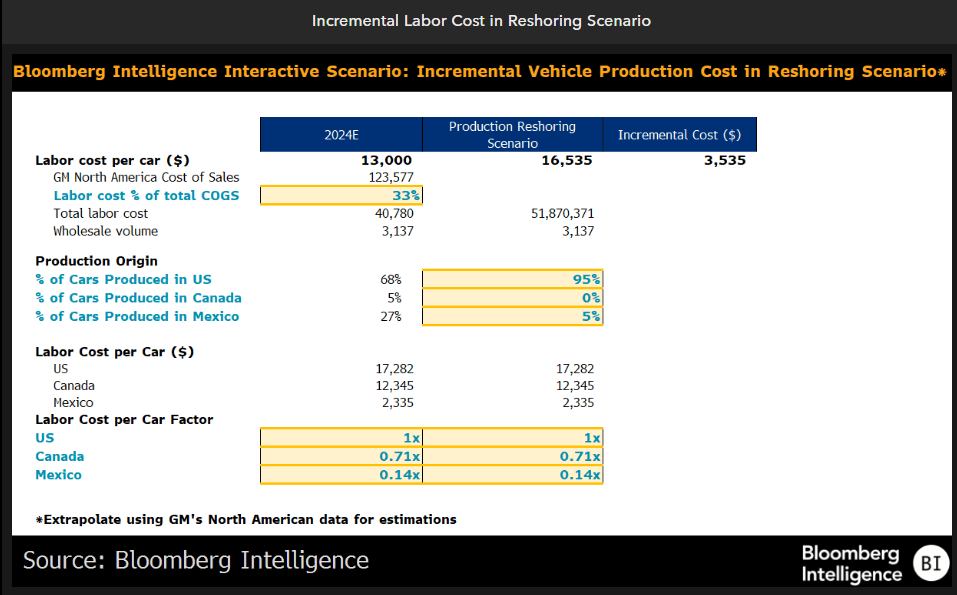

About $3,500 added cost per car in reshoring scenario

The cost of production per vehicle could top at least $3,500 if automakers opt to return most Mexican and Canadian car production to the US, based on General Motors estimates. The gain stems primarily from greater labor costs, which in Mexico are about one-seventh of the US. Our analysis assumes that labor makes up 33% of total cost of goods sold, based on GM’s previous filings. The actual increase might be higher, given US-produced cars rely heavily on parts made in Mexico or Canada. Increased tariffs on Chinese imports could also lift our cost assumption.

The average adjusted Ebit per car in 2023 among Ford, GM and Stellantis is roughly $4,421. Passing on 50% of increased labor costs to consumers may yield a 40% drop in Ebit per vehicle

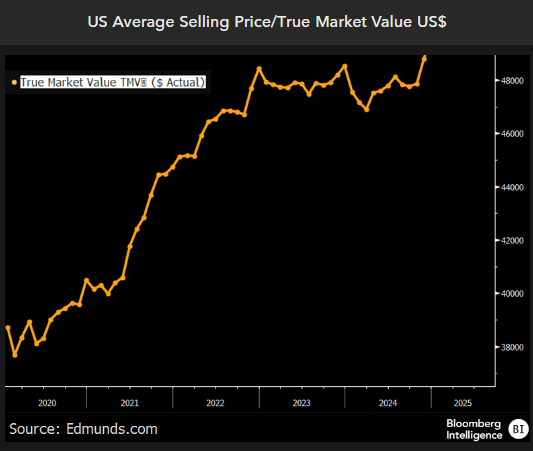

US-Mexico tariff may add $6,000-$10,000 to vehicle prices

Proposed 25% US tariffs on Mexico imports and segments involved, mean there’s limited scope to raise prices amid greater US price discounts averaging $2,000 and widespread overcapacity. The unlikely scenario of the whole levy being passed on to buyers would result in a $6,000-$10,000 price hike. Our analysis is based on an average US passenger vehicle costing $48,000, minus the dealer margin (10%) and the average automaker’s 20% gross margin to give a $35,000 transfer cost.

Mexico gross margins are larger, but even with creative accounting, it would be tough to justify an average transfer price of less than $24,000 (implying a 31% margin) incurring a $6,000 tariff. A high-margin RAM 2500 light truck average price is $74,000, and even assuming a lofty 40% margin, that suggests a $10,000 tariff.

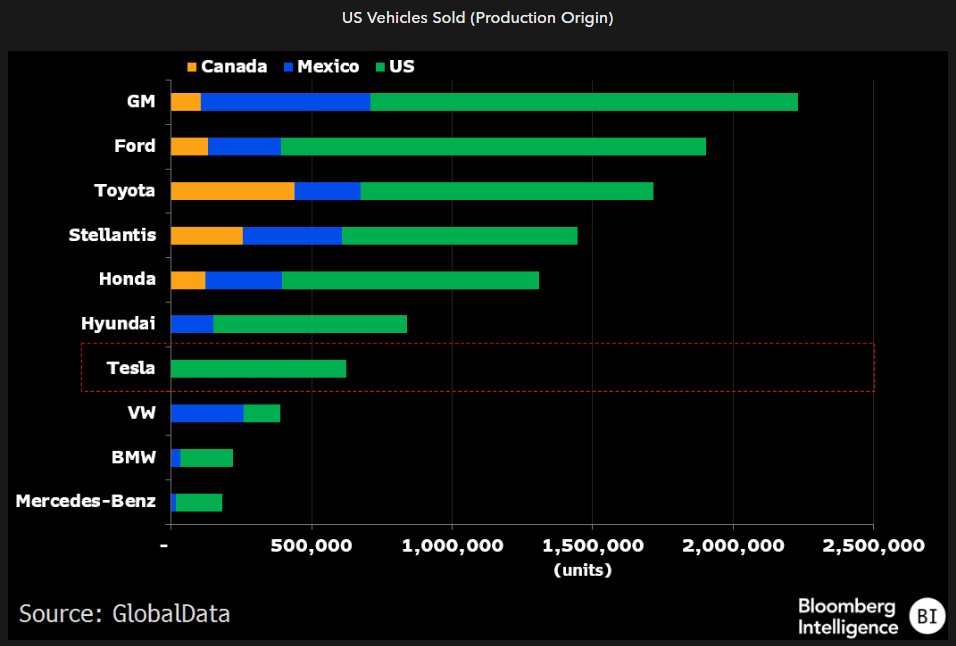

Tesla least affected; Ford, GM, Stellantis most

Tesla may be the least-affected among the major US original-equipment manufacturers by proposed tariffs. Almost all US-sold Tesla vehicles are produced domestically, while GM and Stellantis produce at least 25% of their US-sold vehicles in Mexico. Tesla is highly vertically integrated, manufacturing batteries and gigacasts — some of the most expensive components — locally for U.S.-sold vehicles. BMW and Mercedes could be less impacted, given their production in Mexico is limited. Yet Volkswagen, which produces almost 66% of its US-sold cars in Mexico, might have to reshore or import its cars outside of North America.

Tesla’s Model 3 stands out as the most American-made, with roughly 85% of its components sourced domestically.

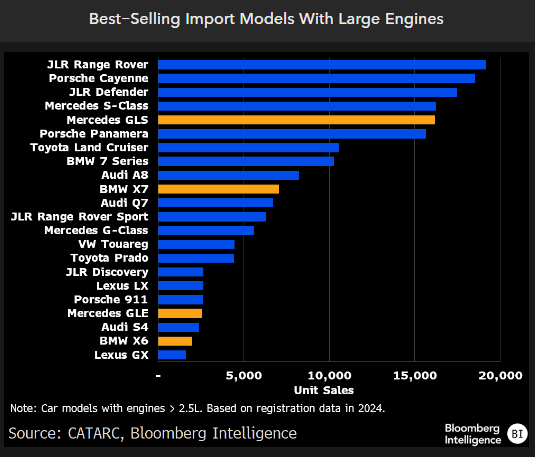

Tesla spared, Mercedes hurt in China’s retaliatory tariff

Mercedes and BMW appear more exposed than Tesla, Ford and GM to Beijing’s retaliatory tariffs of 10% on US-built cars with engines larger than 2.5 liters that take effect on Feb. 10. With the US being a global SUV manufacturing hub for both German auto brands, some GLS, GLE, X7 and X6 models will face higher Chinese tariffs, impacting 10-15% of their total unit imports, we calculate. Any price increase would risk hurting demand, as those cars are already selling at 10-20% below sticker price in China, according to pcauto data.

Tesla can dodge the bullet given its Model S and X are all electric, while the Cybertruck pickup is not on sale in China. Ford and GM’s import sales are modest.

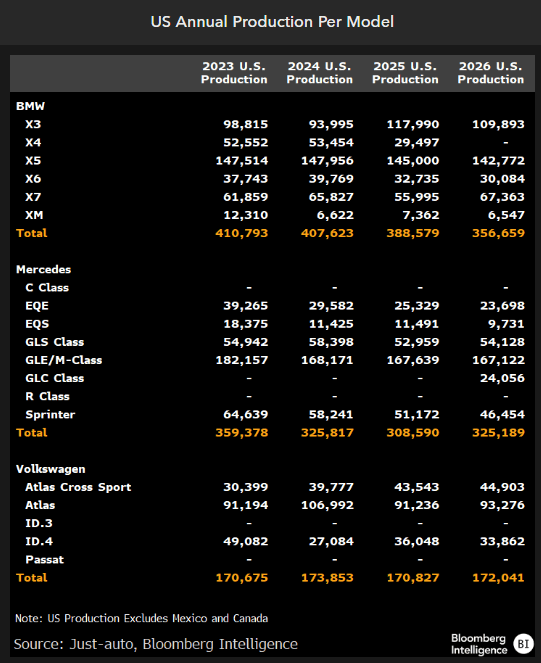

Tariffs put BMW, VW, Mercedes’ 1 million US production at risk

BMW and Mercedes have the highest levels of US production among European peers, so any tariff threat might see them retaliate by suggesting SUV production be shifted outside the US. Trump’s tariff talk appears to be aimed reducing the EU-US import-tariff imbalance, with the US at 2.5% vs. the EU’s 10%. The US does impose a 25% tariff on light-truck imports, which is bypassed European SUVs’ unibody construction.

BMW and Mercedes have major US assembly plants. Volkswagen produces its Atlas and ID models in Chattanooga, Tennessee, with the majority of North American production in Mexico, where about 465,000 VW and Audi’s will be assembled in 2025, according to just-auto. A new 200,000 unitcapacity factory is being built in South Carolina for a relaunch of VW’s Scout brand in 2027.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2025 Bloomberg.