ARTICLE

Insurer 2025 value creation pace may slow but stay above average

Bloomberg Intelligence

This analysis is by Bloomberg Intelligence Senior Industry Analyst Matthew Palazola and Senior Associate Analyst Eric Bedell. It appeared first on the Bloomberg Terminal.

P&C insurers’ value creation may be in the mid-teens this year based on consensus, higher than the almost 12% long-term average but down from 2024. The LA wildfires in 1Q add higher-than-average uncertainty to projected book value growth for the year, which is volatile by nature.

Investment income should be bigger value driver

Given still rising investment income and historically solid expected combined ratios, most insurers are on track for 2025 value creation ratios (VCRs) in the mid-teens — nicely above the roughly 12% 10-year mean. VCR equates to growth in book value per share (ex-AOCI) plus dividends. Though catastrophe losses may be elevated by the LA wildfires, investment income is poised to grow over last year. Underwriting income should decline from a high water mark in 2024 but underlying margins should be solid and pricing is a tailwind. Easing auto insurance loss costs have benefited personal lines businesses but comparisons are tougher.

Unless already announced, our VCR calculations don’t include assumptions for special dividends, realized gains or equity appreciation. These items typically benefit W.R. Berkley, AFG and Cincinnati.

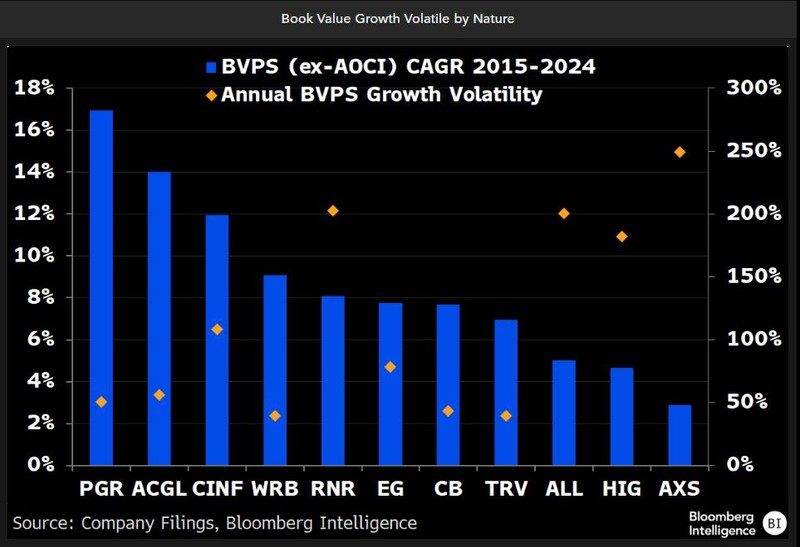

Progressive a book value growth leader

Among all P&C subsectors Progressive and Arch stand out as generating the highest book value growth with among the lowest levels of volatility. Though we think both should continue this trend, we’re more confident in Progressive. Arch’s property/catastrophe reinsurance premiums are nearly 8x bigger than 2019, adding to large loss risk. Personal lines carriers also don’t carry the legacy liability reserve risk of commercial/multi-line insurers. Several carriers’ unit sales have distorted their book value growth over the past decade. AFG’s proclivity for special dividends puts it among annual VCR leaders, and RenaissanceRe and Everest both raised equity capital, helping book value.

Book value growth in 2025 carries a higher-than-average potential for variability given the atypical nature of a major catastrophes in 1Q.

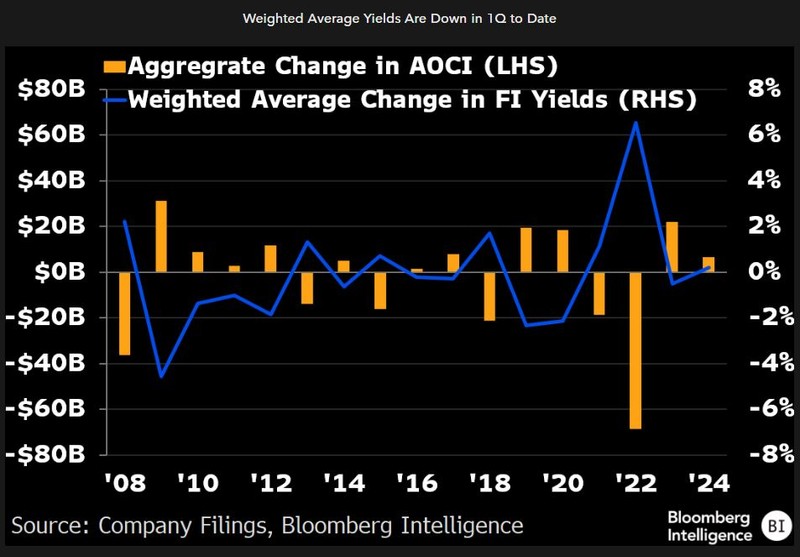

1Q book values likely to get a boost

Changes in AOCI may help insurers’ 1Q reported book values, given quarter-to-date movements in widely held fixed income categories. AOCI is largely made up of unrealized gains on available for sale fixed income securities but includes other items like foreign exchange. 2024 reported book values were modestly helped by the change in AOCI to 3% of equity vs. 10% in 2023 and a negative 24% in 2022. Insurers generally hold securities to maturity, which means these price movements will ultimately reverse but should these changes get large enough, they could impact underwriting capacity. Estimates for 2025 reported book values declined after 4Q results mostly due to wildfire losses.

Predicting quarterly fixed income yields is difficult, making book value excluding AOCI a useful metric.