ARTICLE

Insurance brokers’ 2025 consensus for growth may be conservative

Bloomberg Intelligence

This analysis is by Bloomberg Intelligence Senior Industry Analyst Matthew Palazola and Senior Associate Analyst Eric Bedell. It appeared first on the Bloomberg Terminal.

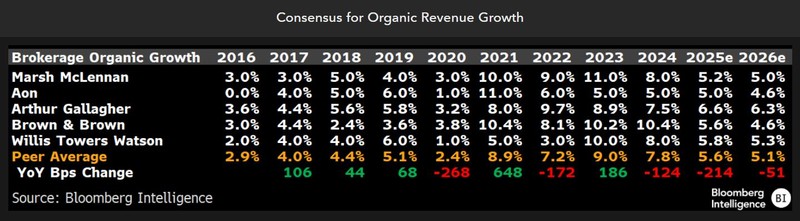

BI-covered insurance brokers may have room for upside to average consensus organic sales growth of 5-6% in 2025 even as price gains slow. Small and midsize brokers surveyed by Reagan Consulting expect a 10% gain, and analysts typically have been conservative. Since 2021, brokers beat growth estimates 70% of the time.

Analysts see revenue gains slowing this year

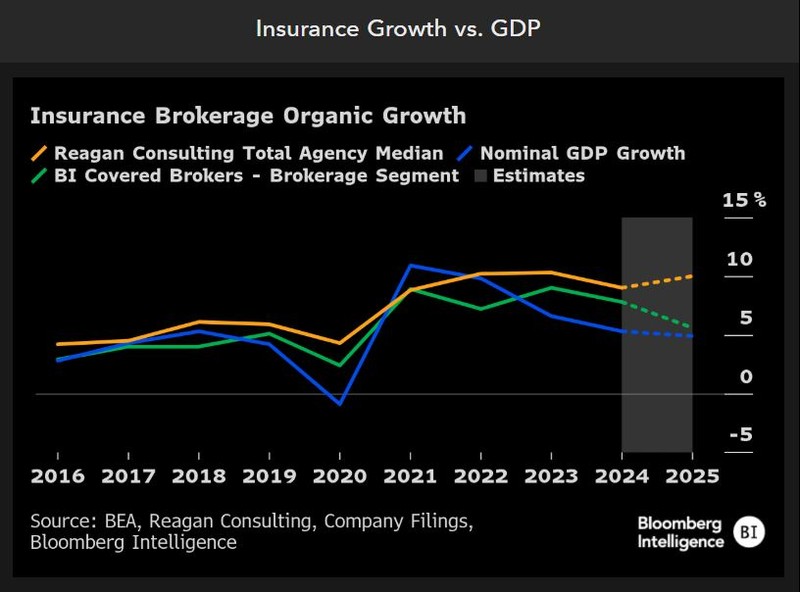

Insurance brokers including Aon and Marsh McLennan may have slight upside to consensus for 2025 organic growth despite slower price increases and lower fiduciary income. Brokers in our coverage have beat estimates 70% of the time since 2021. The consensus average for 2025 suggests a deceleration to around 5-6%, which would be above the mean of 3.4% for 2016-19 but down from 8% last year. Gains averaged 7.5% in 2020-23 as faster nominal GDP expansion and high insurance pricing boosted revenues.

Fiduciary income (interest on client funds held) added about 150 bps to 2023 revenue growth at Aon and Marsh and 30 bps last year. We expect the category to be a small headwind to revenue increases this year as money market rates are lower than in 2024.

Strong activity still may face headwinds

While we think consensus may be conservative, organic revenue growth still may slow after a few years above historical averages. Negatives outnumber positives as insurance prices and fiduciary income will likely drop and nominal economic activity might decline. Still, prices shouldn’t turn negative and tariff-driven inflation could boost commissions. Organic gains typically follow nominal GDP. However, results in 2020-24 were boosted by higher insurance and reinsurance prices, as well as inflation, leading median brokerage organic growth to double its historical pace. Upside may vary on new business wins.

Acquisitions are a significant part of revenue increases for some public brokers. About half of sales growth for A.J. Gallagher and Brown & Brown came from deals in 2019-24.

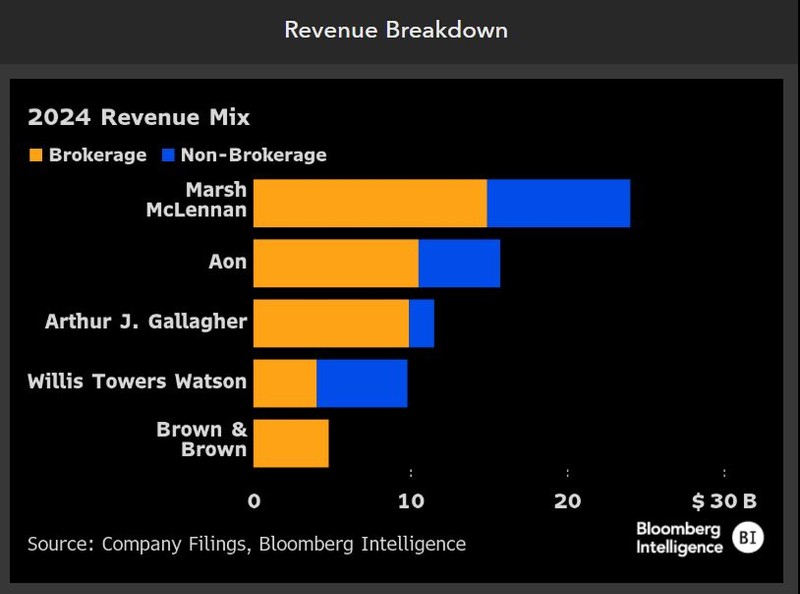

Business diversification varies widely

Brown & Brown’s EPS is most sensitive among peers to brokerage organic growth as other public intermediates have more exposure to human resources, consulting and claims management. Such businesses diversify earnings, and though some are steady through economic cycles, others are more sensitive than traditional insurance brokerage. Aon, Marsh, Gallagher and Willis have consulting or claims-focused businesses that make up an average of 35% of their top lines. Aon has said that 80% of its total revenue, including brokerage, is “highly recurring.”

Project operations like Marsh’s Oliver Wyman tend to be economically sensitive. The unit’s revenue fell 18% in 2009 yet rebounded shortly after. The business contributed 14% of Marsh’s 2024 revenue, compared with 63% for total (re)insurance brokerage.