ARTICLE

AI infrastructure spending resilient despite market pullback

Bloomberg Intelligence

This analysis is by Bloomberg Intelligence Senior Industry Analysts Kunjan Sobhani and Woo Jin Ho with contributing analysis by Jake Silverman and Oscar Hernandez Tejada. It appeared first on the Bloomberg Terminal.

AI semiconductor stocks have pulled back sharply, but fundamentals suggest this is more of a valuation reset than a structural decline. Hyperscaler AI capital spending continues to rise, supporting demand for GPUs, custom ASICs and networking products, even as margin forecasts face compression.

Meanwhile, AI-hardware vendors and networking chipmakers are navigating near-term uncertainty from tariffs and product cycles but remain positioned for long-term growth. Small- and midcap AI semis have faced multiple compression on capex and economic fears, though earnings outlooks remain stable. If AI infrastructure spending sustains its momentum, these segments could post a strong recovery.

AI semi stocks’ retreat seems more recalibration than breakdown

AI semiconductor stocks’ sharp pullback may be driven more by a recalibration than a structural decline, with rising hyperscaler spending fueling demand for GPUs, custom ASICs and networking solutions raising revenue consensus for AI-chip makers, despite margin pressure and competitive shifts. Though valuations have compressed, AI infrastructure spending remains strong, positioning the sector for long-term growth.

Fundamentals check – has anything changed?

AI compute chipmakers’ revenue consensus in the past six months indicates rising projections as GPU, custom compute and AI network-demand continues to climb. Some outliers like Intel, AMD and Nvidia’s Data Center networking show declines due to market-share loss (Intel, Infiniband) and company-specific growth issues (Intel, AMD) rather than end-market weakness. Custom compute and networking participants like Broadcom, Marvell and Astera Labs have seen significant upward revisions, reflecting hyperscaler AI investment beyond GPUs.

Though some AI-spending headwinds exist (including DeepSeek, trade restrictions and tariffs), data suggests these haven’t affected estimates on a quantitative level, but have impacted those valuations driven by qualitative perspectives.

Valuation reset – cheap or justified?

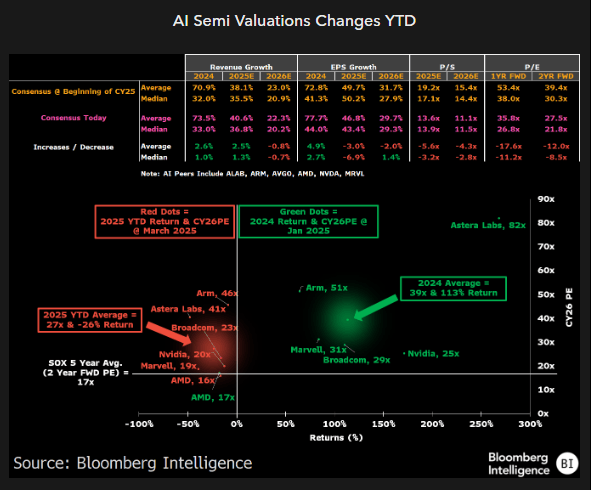

P/E multiples for AI peers were trading at a 100% premium to SOX (39x vs. 17x), before narrowing to 57% (27x vs. 17x). Previously, names like Astera Labs (82x), ARM (51x) and Marvell (29x) commanded hefty valuation premiums, but these have significantly retreated. Nvidia’s has fallen to 20x from 25x, Marvell’s has dropped to 19x vs. 31x, and AMD now trades at just 16-17x.

Though AI fundamentals remain strong with revenue estimates boosted for Nvidia, Broadcom and others, margin projections have been cut, largely due to company-specific headwinds rather than economic weakness. The compression appears more tied to geopolitical risk and near-term uncertainty than a deterioration in AI demand. If fundamentals remain strong and AI capex continues rising, this could just be a near-term correction.

Drop in semis echoes recession playbook

A recent downturn in fundamentals and corresponding semiconductor-valuation contractions provide a framework for possible recessionary scenarios and implications for current multiples, our analysis suggests. Though the computing semis outlook doesn’t suggest a fundamental recessionary downturn, the recent valuation contraction (minus 26% 2024 peak to YTD 2025) suggests concerns about being priced in. A current SOX multiple of 17x — at five-year average levels — suggests a limited downside scenario, unless 2025-26 fundamentals get readjusted significantly (about 15% below 2024’s sales levels).

Despite volatility, computing semiconductor revenue (driven by AI) is projected to grow at a 9.5% CAGR, reinforcing long-term demand.

AI compute companies face margin compression

A recent downturn in fundamentals and corresponding semiconductor-valuation contractions provide a framework for possible recessionary scenarios and implications for current multiples, our analysis suggests. Though the computing semis outlook doesn’t suggest a fundamental recessionary downturn, the recent valuation contraction (minus 26% 2024 peak to YTD 2025) suggests concerns about being priced in. A current SOX multiple of 17x — at five-year average levels — suggests a limited downside scenario, unless 2025-26 fundamentals get readjusted significantly (about 15% below 2024’s sales levels).

Despite volatility, computing semiconductor revenue (driven by AI) is projected to grow at a 9.5% CAGR, reinforcing long-term demand.

Bloomberg Terminal subscribers can access full version of this analysis via BI <GO>.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2025 Bloomberg.