Bloomberg Professional Services

This analysis is by Bloomberg Intelligence Senior Insurance Analyst Charles Graham and Senior Insurance Analyst Kevin Ryan. It appeared first on the Bloomberg Terminal.

European insurers are better able to weather financial market volatility after the smooth adoption of IFRS 17/9 accounting rules. Prospects for European life companies in 2025 remain positive despite an uncertain economic outlook. Performance of life businesses exceeded expectations in 2024, boosted by higher investment yields and a recovery in sales. Ten-year sovereign yields are forecast to remain above 2% in Germany, 3% in France, Italy and UK and 4% in the US, which should continue to support returns. Bulk annuity deals look set to boost new business in the UK and the Netherlands.

Predictable returns are key to pushing more capital back to shareholders. Insurers have reduced sensitivity to interest rates and equity markets by raising exposure to alternative assets like real estate, mortgages, private debt and equity.

Three keys for 2025: European life insurance

Higher interest rates lift Europe life-insurer earnings outlook

Interest rates’ rise from zero levels has lifted European life insurers’ earnings and solvency ratios, boosting capacity for share buybacks and dividends. Robust capital ratios remain a strength even as President Donald Trump’s tariff policy and Germany’s decision to boost defense spending leaves the outlook for interest rates, inflation and recession risk finely balanced.

Europe life shares provide some shelter from the storm

Shares of European life insurers have outperformed the benchmark Stoxx Europe 600 price index, which was battered by concern about US tariff s and a global trade war. While not directly affected by tariffs, financial-market volatility is a potential concern. Insurers have significantly reduced the sensitivity of their general account assets to interest-rate movements and equity market volatility, in part through investment in alternative assets. Adoption of IFRS17 accounting standards also helps. Yet the effect of market volatility and a much more uncertain economic outlook is a threat to investor confidence, which could harm net fund flows and new business.

The Stoxx Europe insurance index was up about 17% between April 30 and the beginning of the year, outperforming a flat performance in the wider Stoxx Europe 600 Index.

Europe insurance valuations rise as accounting fog clears

Insurance company valuations have recovered from the immediate shock of President Trump’s “Liberation Day” tariff announcement. The adoption of IFRS 17 has helped since it limits balance sheet strains from falling bond values. The piecemeal progression of IFRS 17 disclosure hasn’t helped comparative analysis and it will take time for the new accounting standard to settle. The sector’s blended 12-month forward P/E ratio for companies in the Stoxx 600 insurance index has settled at 12.3x, near new despite weaker European growth prospects. The peer group trades on a price-to-book value of about 2.1x, which reflects IFRS17/9 adjustment of net asset values.

Increased dividends have supported insurers rising share prices

The average dividend payment of the constituents of the Stoxx 600 Europe insurance index (SXIP) has increased by 50% over the last five years and by 20% since the beginning of 2024. Yet the average forward dividend yield has remained in a 5.5-6% range since the beginning of 2023, reflecting the upward momentum in stock valuation. Increased dividends have been supplemented by share buybacks, reflecting insurers solvency capital strength and the generally positive effects of higher interest rates and the rise in investment yields.

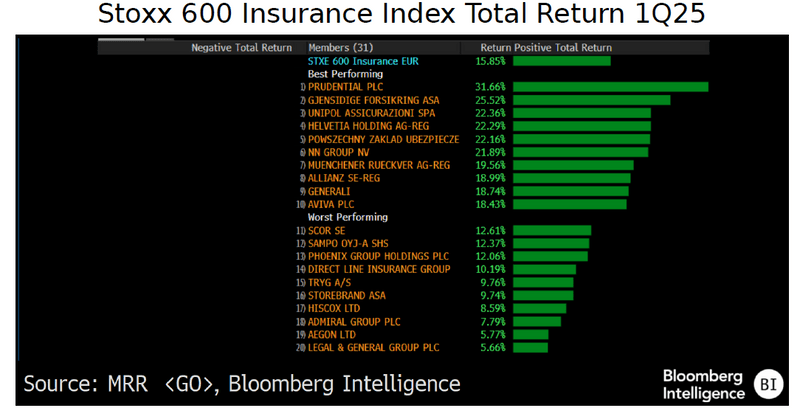

European insurance shares return nearly 16% in 1Q

Strong dividend growth, boosted by share buybacks, helped insurance stocks deliver strong returns in 1Q outperforming the wider market. The Stoxx 600 European insurance index delivered a total return of 15.85% compared to the 5.9% return of the wider Stoxx 600 Europe index. The star stocks included Prudential, which bounced back from a weak performance in 2024 to deliver a return of 31.7%, and Gjensidige, which made 25.5%. Unipol Assicurazioni, Helvetia, PZU and NN Group all delivered more than 20%.

The weakest performers were Legal and General, which made 5.7%, and Aegon, 7.8%. Tryg, Storebrand, Hiscox and Admiral all delivered returns of less than 10%.

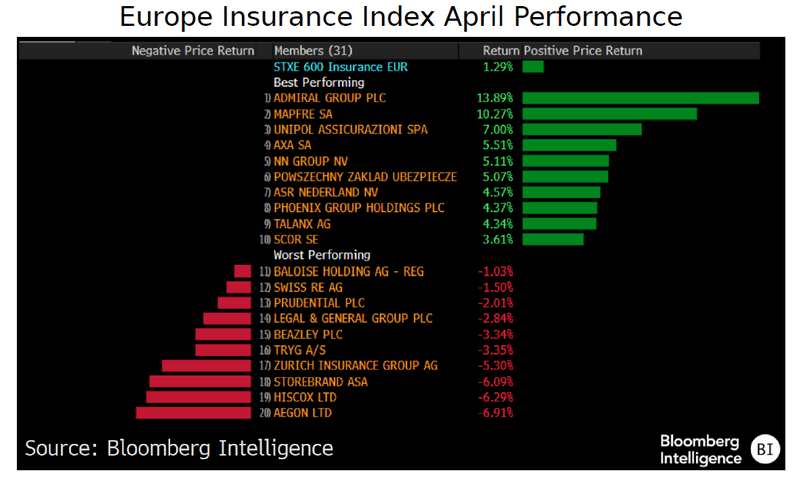

European insurance stocks weather financial market storm

Share prices of insurance stocks in the Stoxx 600 Europe index have risen on average been since the beginning of April, by more than 1%. Still, that reflects a wide range in performance, with shares in Admiral up 13.9% after Ageas’ acquisition of Esure drove further consolidation in the UK auto-insurance market in the wake of Aviva’s bid for Direct Line.

US-exposed companies have been the weakest performers following President Donald Trump’s announcements on tariffs. Shares in Aegon were down 6.9% and Zurich Insurance shares fell 5.3%, reflecting uncertainty about the outlook for the US economy and a weakening US dollar.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2025 Bloomberg.