Bloomberg Professional Services

This article was written by Mike Pruzinsky, Equity Indices Product Manager at Bloomberg.

For nearly two decades, the titans of big tech including the original FAANG stocks (Facebook now Meta Platforms, Apple, Amazon, Netflix, and Google now Alphabet), have commanded investor attention with their disruptive growth and remarkable returns. But the world has changed. Geopolitical tensions are rising, supply chains are being reimagined, and the need for resource security is taking center stage.

Enter the Bloomberg FAANG 2.0 Select Index — a strategically constructed benchmark that quietly is outperforming the broader market. While many investors remain anchored to past success, this next generation of FAANG captures the essential pillars of modern society: Fuel (F), Aerospace & Defense (A), Agriculture (A), Nuclear (N), and Gold & other Base and Precious Metals (G) across leading companies in the U.S. and Canada.

Examining performance

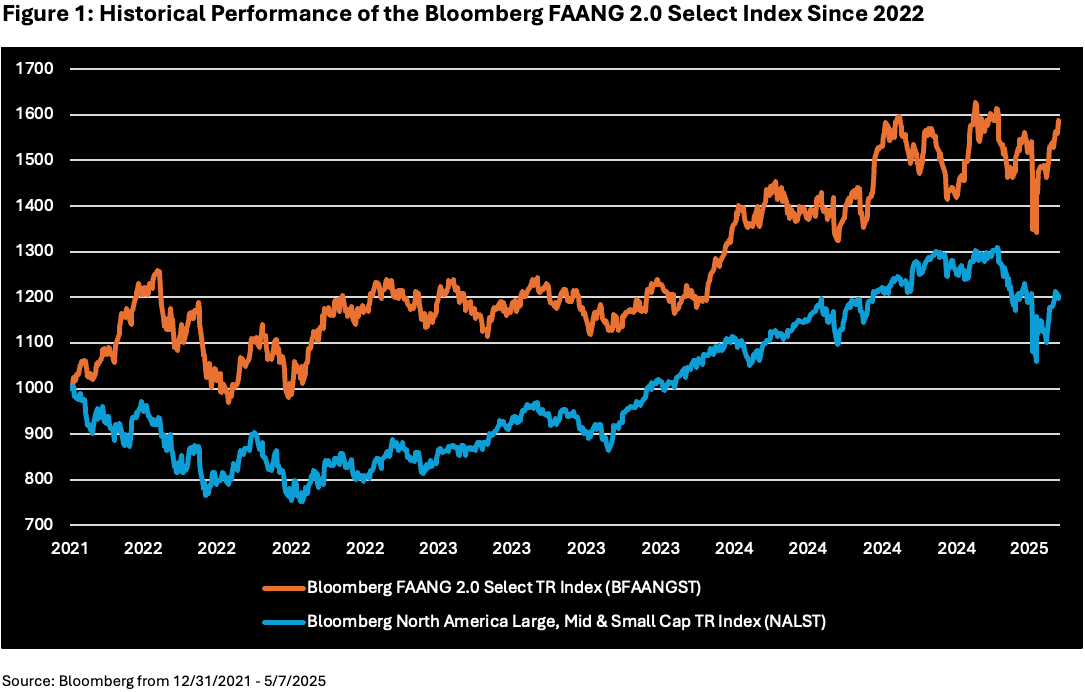

While past performance doesn’t guarantee future results, the early returns from FAANG 2.0 companies have been compelling. Since 2022, the Bloomberg FAANG Select 2.0 Index has demonstrated significant outperformance versus the broader stock market (represented in Figure 1 by the Bloomberg North America Large, Mid & Small Cap Index) and remarkable resilience during market turbulence.

The FAANG 2.0 stocks are not meant to be a fleeting, speculative play, but represent an investment in the fundamental building blocks that underpin national stability and economic resilience. The index has risen 11.52% year-to-date, reflecting the market’s increased attention toward companies that secure, produce, and protect critical resources.

Bedrock of national security and resource resilience

Ask yourself: What are the true non-negotiable elements for any functioning nation? What may come to mind is secure energy sources, robust defense capabilities, reliable food supplies, and access to critical materials. The companies represented by the Bloomberg FAANG 2.0 Select Index Methodology are essential to addressing these fundamental needs.

A closer look at the index groupings reveals this is not a gimmicky list of letters, but rather a systematic approach to capturing the companies who stand to benefit from a global pivot to prioritizing societal needs. Aligning your portfolio with these sectors means investing in companies that are at the intersection of national security and natural resources.

Diversifying stagflation risks

With concerns around stagflation mounting, prudent investors would be well served by reassessing equity portfolios and underlying exposures. While U.S. technology stocks have historically formed the cornerstone of many portfolios, the rationale for strategic diversification particularly into sectors demonstrating greater economic resilience is becoming increasingly compelling. As highlighted by historical performance during the inflationary period, these businesses often possess significant pricing power, enabling them to pass on rising input costs to consumers, thereby preserving margins. Furthermore, their tangible asset bases provide inherent value in an inflationary environment where the value of financial assets can be eroded.

The investment thesis for the FAANG 2.0 companies gains further strength when considering the potential for stagflation. Unlike traditional growth stocks, which are often highly sensitive to rising interest rates and the discounting of future cash flows, the constituents of the Bloomberg FAANG 2.0 Select Index can benefit from the very macroeconomic pressures that challenge growth sectors. During periods of slow economic growth coupled with elevated prices, resource-focused companies can maintain earnings stability and, importantly, generate consistent dividend income, offering a valuable source of return when overall market appreciation may be muted.

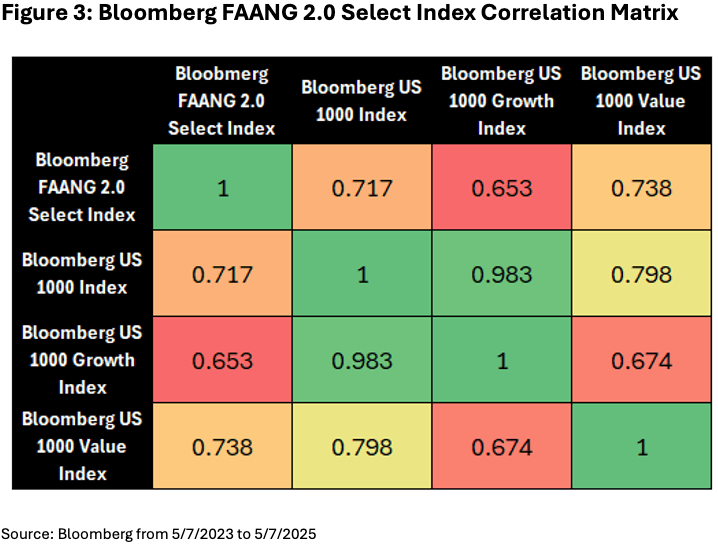

Moreover, the Bloomberg FAANG 2.0 Select Index offers a crucial element for robust portfolio construction: lower correlation with broader equity indices and growth-oriented sectors. This reduced interconnectedness allows investors to build more balanced and risk-aware portfolios, potentially mitigating overall volatility during market turbulence.

Bottom line

As we navigate an increasingly complex geopolitical landscape, the market’s appreciation for companies securing critical resources will likely only grow. The future belongs to companies that can deliver the essentials, safeguard national interests, and power economic resilience. The Bloomberg FAANG 2.0 Select Index offers a powerful new framework for preparing for the structural realities of the years ahead.

In uncertain times, companies that provide certainty — reliable energy, secure food supplies, strategic metals, defense capabilities, and clean power — may prove to be not just safe havens but long-term growth engines as nations prioritize resource security above all else. FAANG 2.0 is here — are you ready?

- Strive Asset Management has launched the Strive Natural Resources and Security ETF based on the Bloomberg FAANG 2.0 Select Total Return Index (BFAANGST) under the ticker FTWO.

The data and other information included in this publication is for illustrative purposes only, available “as is”, non-binding and constitutes the provision of factual information, rather than financial product advice. BLOOMBERG and BLOOMBERG INDICES (the “Indices”) are trademarks or service marks of Bloomberg Finance L.P. (“BFLP”). BFLP and its affiliates, including BISL, the administrator of the Indices, or their licensors own all proprietary rights in the Indices. Bloomberg L.P. (“BLP”) or one of its subsidiaries provides BFLP, BISL and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. Bloomberg (as defined below) does not approve or endorse these materials or guarantee the accuracy or completeness of any information herein, nor does Bloomberg make any warranty, express or implied, as to the results to be obtained therefrom, and, to the maximum extent allowed by law, Bloomberg shall not have any liability or responsibility for injury or damages arising in connection therewith. Nothing in the Services or Indices shall constitute or be construed as an offering of financial instruments by Bloomberg, or as investment advice or investment recommendations (i.e., recommendations as to whether or not to “buy”, “sell”, “hold”, or to enter or not to enter into any other transaction involving any specific interest or interests) by Bloomberg. Information available via the Index should not be considered as information sufficient upon which to base an investment decision. All information provided by the Index or in this publication is impersonal and not tailored to the needs of any person, entity or group of persons. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. For the purposes of this publication, Bloomberg includes BLP, BFLP, BISL and/or their affiliates.

BISL is registered in England and Wales under registered number 08934023 and has its registered office at 3 Queen Victoria Street, London, England, EC4N 4TQ. BISL is authorised and regulated by the Financial Conduct Authority as a benchmark administrator.

© 2025 Bloomberg. All rights reserved.