Bloomberg Professional Services

This article was written by Mike Pruzinsky and Sean Murphy, Equity Index Product Managers at Bloomberg.

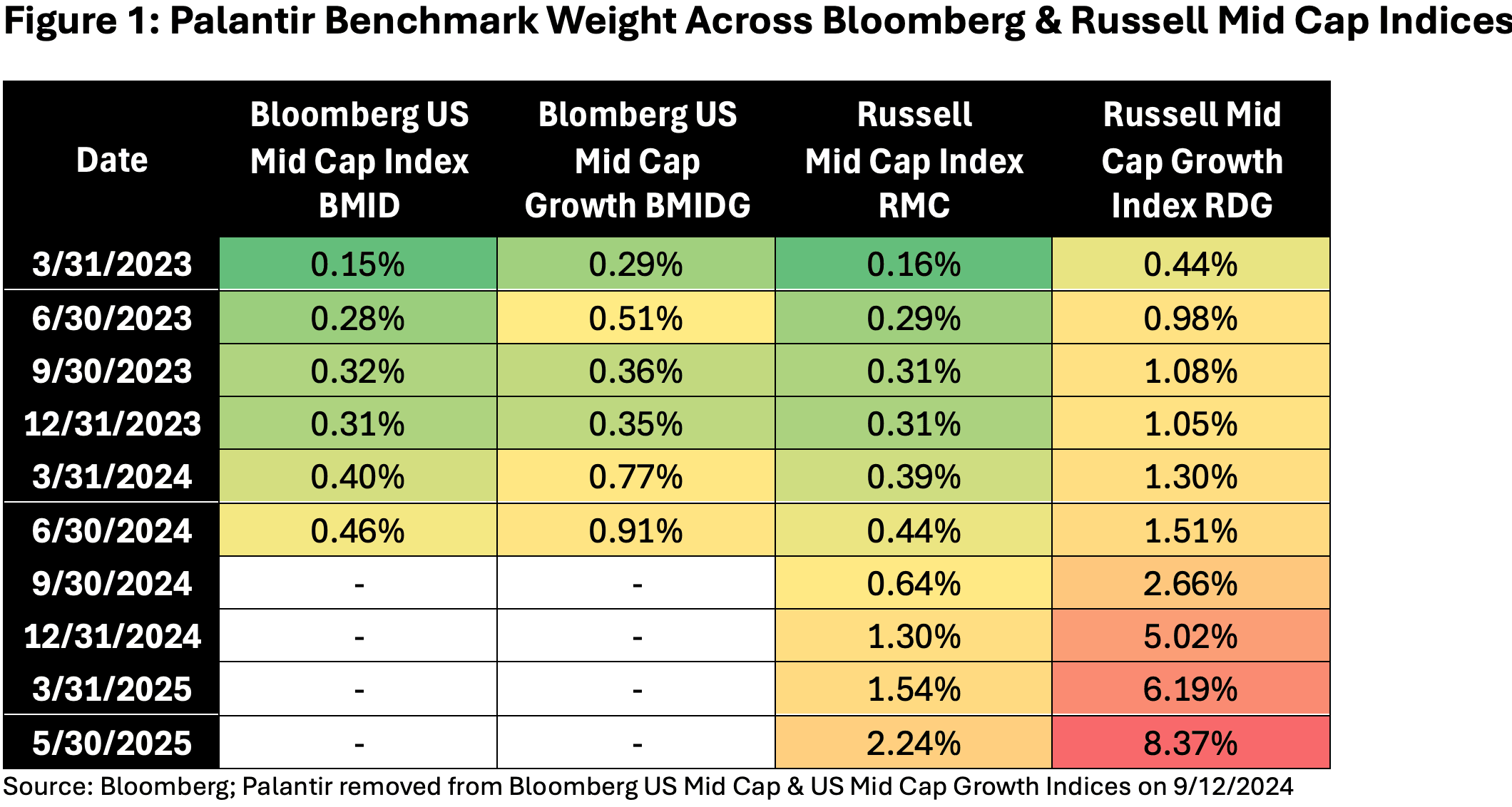

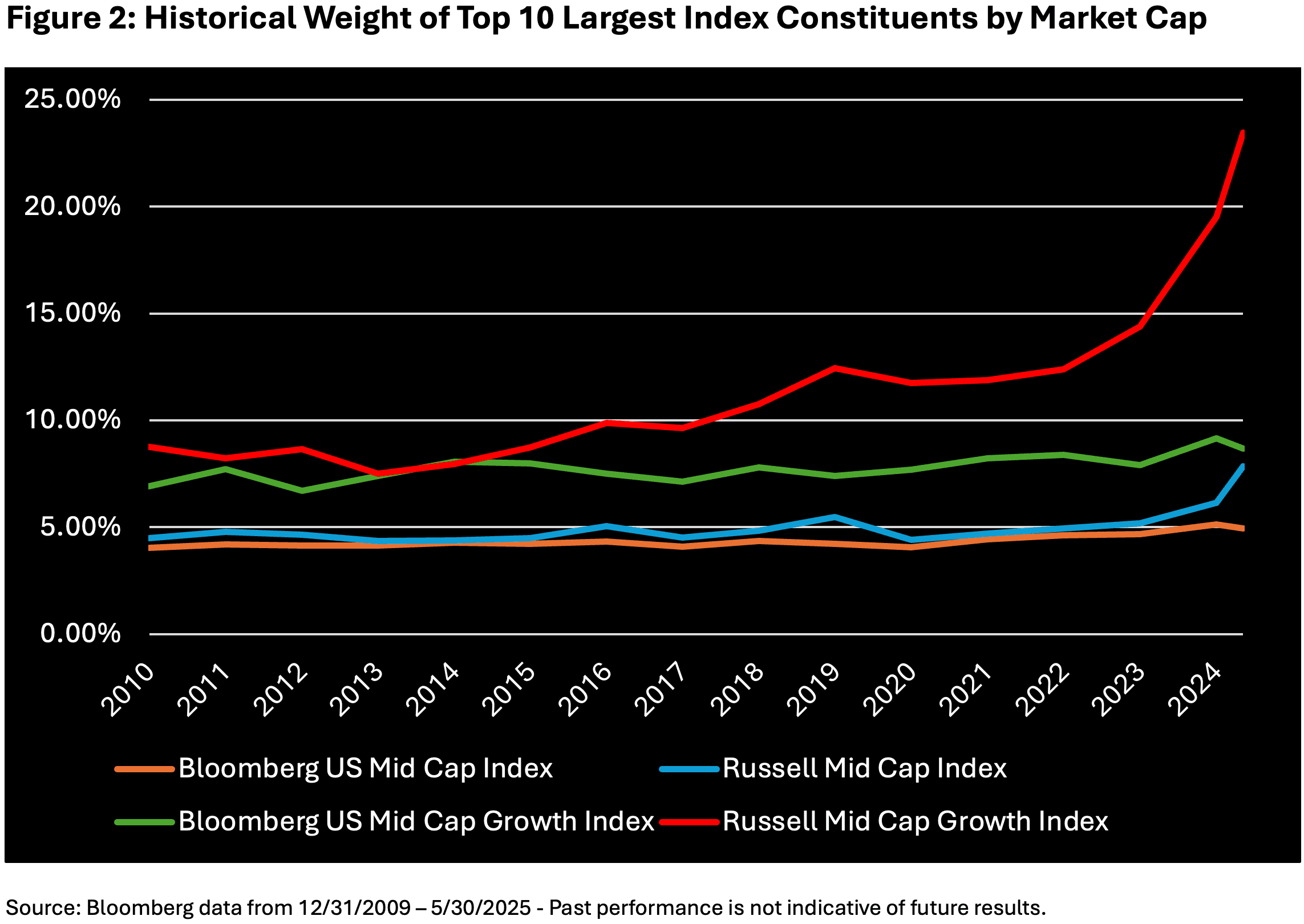

In the evolving landscape of benchmark indices, Palantir Technologies’ continued inclusion in the Russell mid cap indices has become a flashpoint for active managers and investors alike. The data-mining giant, with its $281 billion market capitalization, now stands as an anomaly within a benchmark designed for mid-sized companies, creating unintended consequences for investment portfolios across the industry.

Size mismatch creates performance distortion

Palantir’s meteoric rise since its direct listing in 2020 has transformed the once-secretive government contractor into a tech heavyweight, yet its classification remains unchanged in the Russell index hierarchy. The company now represents a disproportionate 8.3% of the Russell Mid Cap Growth Index, despite sporting a market cap that clearly places it among large cap if not mega cap territory.

Index rebalancing frequency under scrutiny

Unlike the Bloomberg US Domestic Equity Index family, which conducts a semi-annual reconstitution, Russell applies an annual reconstitution schedule, with adjustments occurring just once per year. This approach has seen Russell acknowledging the need to enhance their indices’ responsiveness to market changes. In fact, a similar situation occurred just last year when Super Micro Computer Inc, a stock with over $50 billion in market capitalization, was classified by Russell as a small cap stock as a member of the Russell 2000 Index.

For active managers operating under strict investment mandate guidelines, the problem is particularly acute. Many mid-cap funds are prohibited from holding stocks above certain market cap thresholds, regardless of their benchmark inclusion.

“The lag in reconstitution creates artificial constraints that hurt active managers who are benchmarked against the Russell Mid Cap Growth Index but can’t hold Palantir due to mid-cap investment mandates,” says David Cohne, a mutual fund analyst with Bloomberg Intelligence. “We’re seeing situations where active managers are handcuffed, and the recent underperformance can be attributed to this single stock anomaly.”

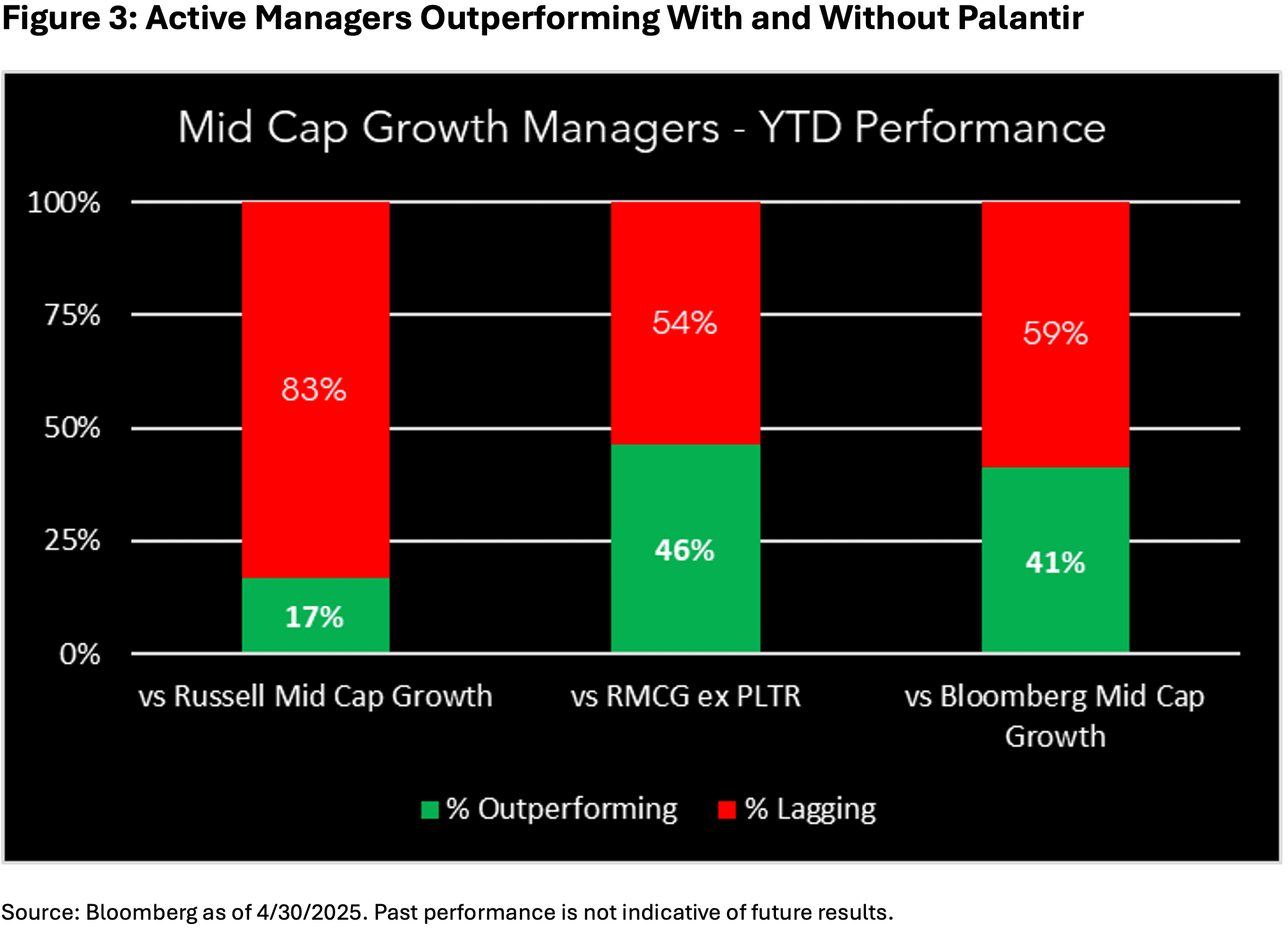

The implications extend beyond portfolio construction to asset owners and consultants who must decide how to assess a mid-cap fund manager that cannot own Palantir – creating what many consider an unfair comparison. When examining performance of mid-cap growth managers to that of the Russell Mid Cap Growth Index (-4.4% through April), only 17% have outperformed thus far in 2025. But when examining contributions to return for the Russell Mid Cap Growth Index, Palantir contributed nearly 3%. If we were to exclude that contribution from the Russell index, the number of managers who have outperformed jumps from 17% to 46%.

This number is much closer to Bloomberg Mid Cap Growth outperformers and more typical of what an investor should expect to see when compared to a truly representative category benchmark. Investors focused on a particular style box might prefer to measure a manager’s relative performance verse a benchmark that is highly responsive, as that relative performance may otherwise be skewed by a stock that doesn’t belong in the category– or one that should be and hasn’t yet been added.

A more responsive alternative

As the Palantir situation highlights the limitations of annual reconstitution, the Bloomberg US Mid Cap Index (BMID) and Bloomberg US Mid Cap Growth Index (BMIDG) emerge as potentially more representative gauges of the mid-cap market segment. Unlike the Russell methodology, Bloomberg’s indices implement a semi-annual reconstitution schedule, reviewing and adjusting constituent companies every six months.

Despite differences in methodology and index construction, the Bloomberg mid cap indices demonstrate high correlation. As displayed in Figure 4, the Bloomberg US Mid Cap Index shows a rolling correlation approaching 1 for almost two decades and despite Russell’s inclusion of Palantir the Bloomberg US Mid Cap Growth demonstrates a correlation above 0.99 more than three quarters of the time.

Conclusion

For investors and allocators, the Palantir situation offers a case study in the importance of understanding index construction and its implications for performance assessment. As passive investing continues its ascent, the mechanisms underlying index construction warrant increased scrutiny.

The Palantir anomaly serves as a reminder that in modern markets, methodology matters, and the ripple effects of market measurement decisions extend to real-world investment outcomes affecting millions of investors. For many market participants, Bloomberg’s semi-annual approach increasingly represents a more timely and representative reflection of today’s dynamic market environment.

Explore how Bloomberg Indices offers a clearer view of the mid-cap market and learn more about our comprehensive index solutions.

The data and other information included in this publication is for illustrative purposes only, available “as is”, non-binding and constitutes the provision of factual information, rather than financial product advice. BLOOMBERG and BLOOMBERG INDICES (the “Indices”) are trademarks or service marks of Bloomberg Finance L.P. (“BFLP”). BFLP and its affiliates, including BISL, the administrator of the Indices, or their licensors own all proprietary rights in the Indices. Bloomberg L.P. (“BLP”) or one of its subsidiaries provides BFLP, BISL and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. Bloomberg (as defined below) does not approve or endorse these materials or guarantee the accuracy or completeness of any information herein, nor does Bloomberg make any warranty, express or implied, as to the results to be obtained therefrom, and, to the maximum extent allowed by law, Bloomberg shall not have any liability or responsibility for injury or damages arising in connection therewith. Nothing in the Services or Indices shall constitute or be construed as an offering of financial instruments by Bloomberg, or as investment advice or investment recommendations (i.e., recommendations as to whether or not to “buy”, “sell”, “hold”, or to enter or not to enter into any other transaction involving any specific interest or interests) by Bloomberg. Information available via the Index should not be considered as information sufficient upon which to base an investment decision. All information provided by the Index or in this publication is impersonal and not tailored to the needs of any person, entity or group of persons. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. For the purposes of this publication, Bloomberg includes BLP, BFLP, BISL and/or their affiliates.

BISL is registered in England and Wales under registered number 08934023 and has its registered office at 3 Queen Victoria Street, London, England, EC4N 4TQ. BISL is authorised and regulated by the Financial Conduct Authority as a benchmark administrator.

© 2025 Bloomberg. All rights reserved.