Bloomberg Intelligence

This analysis is by Bloomberg Intelligence Chief G10 FX Strategist Audrey Childe-Freeman and Latin America Rates and FX Strategist Davison Santana, with contributing analysis by Stephen Chiu and Thinh Nguyen. It appeared first on the Bloomberg Terminal.

The Bloomberg Dollar Index’s near-8.5% tumble in 1H has room to extend, given that the structural nature of the bears’ case still holds. De-dollarization is underway as global tariff upheavals still swirl and US debt dynamics are coming under increased scrutiny. Beyond structural forces, the cyclical case could add to the bearish outlook in 2H, carrying the risk that weakness in soft data in 1H will feed through to core economic prints in 2H. Still, dollar bears seem crowded already — and there will be bounces — and we also note that continued US economic resilience is the major threat to our 2H outlook, though a better-than-expected outcome to tariff turmoil would likely only bring temporary relief.

For now, expect dollar bears to keep the upper hand, with our views of euro-dollar at $1.15-$1.20, sterling-dollar at $1.35-$1.40 and dollar-yen at 145-140 dollar-yen holding.

Path to dollar recovery is very narrow

The mainly structural nature of the 1H selloff — driven by tariff policies and the associated worsening in global geopolitical and economic expectations and US fiscal considerations — means a sustainable and broad recovery may become feasible if we see a credible softening of, or U-turn in, tariff policies. That’s not our central working assumption, but any path toward a multitude of fast and balanced bilateral trade deals would help lift uncertainty, boosting global risk appetite and the dollar.

Crucially, at a time when US economic exceptionalism is questioned, confirmed strength in the core data or recovering soft data is the one scenario that would revive dollar bulls in 2H, in our view, though that’s not our central scenario for now.

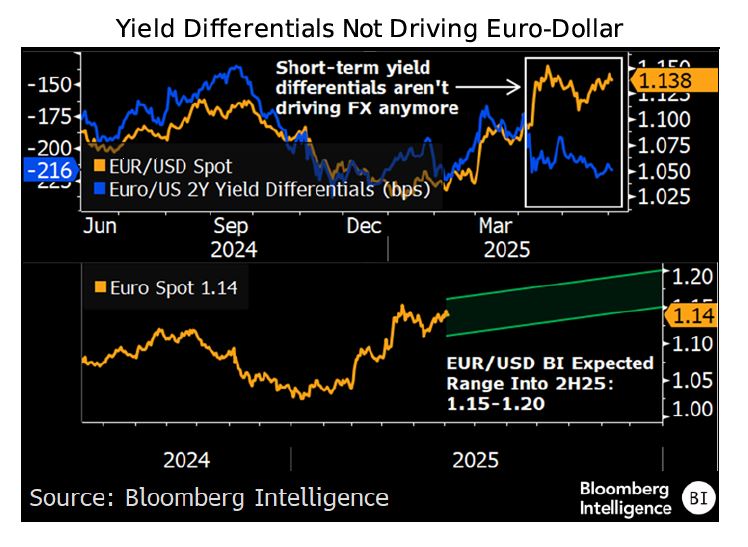

Euro appeals as yields don’t drive FX for now

The euro’s strong 1H performance was mainly driven by dollar weakness, but it was broad based and the fiscal stimuli announced by Germany and the EU are further bullish midterm cyclical and structural considerations, though the positive economic impact may not appear in the data before late 4Q or 2026. The expected near-term divergences between the ECB — still dovish — and the Fed — wait-and-see — have led to widening euro-US two-year yield differentials that would, in normal circumstances, give euro bears fresh ammunition. Still, economic and yield factors haven’t been driving FX and may be sidelined for now and for as long as structural considerations continue to be key.

We hold on to our expected $1.15-$1.20 euro-dollar range into 2H, while euro bears may have options via the euro-sterling channel.

Yen: Reasons to be bullish beyond BOJ

The yen may be a G-10 winner in allocation strategies at a time when tariff uncertainty has reignited the de-dollarization debate and sparked questioning about US economic strength. This has to be seen in a context in which diversification strategies outside the dollar gain momentum and the yen’s allure increases, thanks to a more favorable Japanese economic cycle vs. a decade ago, normalizing BOJ policy and stable institutions. The case for defensive positioning adds to our bullish yen view, and so do valuation and historically low levels.

After 1H’s dollar-yen decline of 11%, the pair is now sticky near 145, but the domestic (the BOJ trajectory) and international (de-dollarization) trends identified in 1H remain in place, so our 145-140 view for 2H holds for now.

Sterling has a domestic, international bullish case

Our sterling bull levels have already been reached and we maintain our $1.35-$1.40 sterling-dollar and 0.84-0.82 euro-sterling views into 2H. That’s as long as the bullish drivers identified in 1H hold, with pound bulls primed by a better-than-expected economic performance and, just as important, a Bank of England that’s resisting dovish temptations and offering yield support. The UK’s management of the tariff threat, compared with the EU, gives pound bulls a further reason to shine. The G-10 FX de-dollarization narrative remains a prime bullish driver for sterling, as is the currency’s regained appeal in diversification strategies.

A sudden and unexpected turn in risk sentiment is the main risk for sterling bulls, given the pound’s high-beta status.

Franc bull? Yes, but beware the SNB

A highly uncertain economic and geopolitical backdrop, and the associated de-dollarization theme, has boosted our defensive FX case this year, with the franc rising almost 10% vs. the dollar and outperforming most others in G-10 diversification strategies. Still, as we flagged on April 7, a strong franc was always going to pose a problem for the SNB, given the stage in the Swiss economic cycle and SNB President Martin Schlegel’s remarks on May 6 (see below) validate this assessment, so franc bulls will have to consider the risk of a more interventionist SNB in 2H.

Notwithstanding a 10% slide from its January high near 0.92, our 0.80 expected dollar-franc view holds as we consider 2H, while a 0.9250-0.9550 euro-franc range makes sense for as long as risk sentiment remains in relatively good shape.

Krone appeals most in commodity FX in 2H

In a broadly weaker dollar context and as tariff uncertainty persists, the Canadian dollar remains highly exposed across the G-10. Meanwhile, the Aussie remains attractive on valuation and is under-owned, but it’s at the mercy of a late RBA easing cycle and China’s economic fortunes. All this implies that the Norwegian krone is the most alluring among G-10 commodity currencies, even after an outstanding 1H gain of more than 11.5% vs. the dollar, given its yield appeal and likely interest in diversification strategies.

Bloomberg Terminal subscribers can access the full version of this analysis via BI<GO> and additional G-10 FX Strategy analysis via BI CURR <GO>

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2025 Bloomberg.