ARTICLE

Japan’s power trading set to surge with end of key deal

Bloomberg News

This article was written by Srinidhi Ragavendran and Shoko Oda. It appeared first on the Bloomberg Terminal.

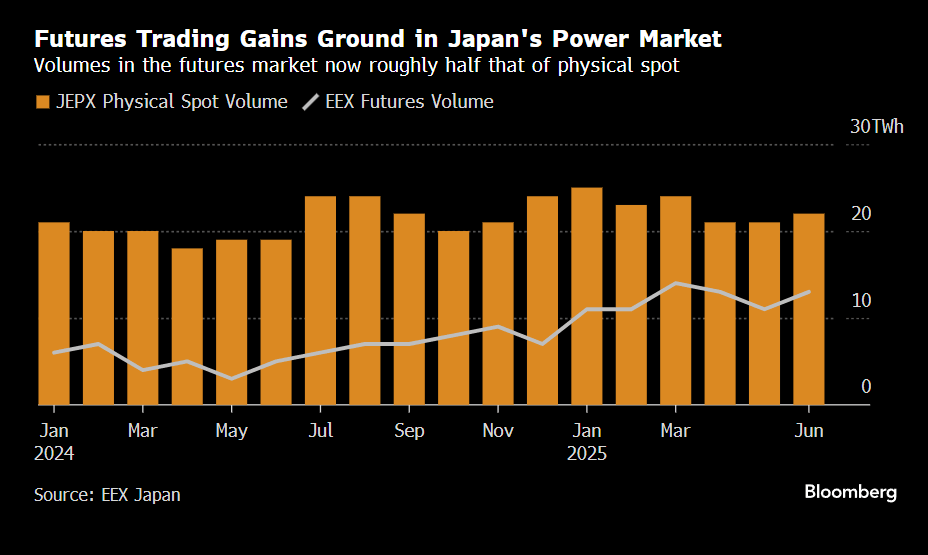

Trading volume in Japan’s power futures is set to climb as companies prepare for the upcoming expiration of a key agreement between the nation’s largest utilities, a shift expected to jolt the market.

The power purchase pact, which gives the retail arms of Tokyo Electric Power Co. and Chubu Electric Power Co. access to energy from top generator Jera Co., will lapse at the end of the fiscal year in March. That means the two largest distributors could procure more spot electricity — or, conversely, Jera could flood the market.

This is also an opportunity for other suppliers and retailers to secure deals with Tepco, Chubu and Jera.

The shakeup is already driving hedging activity in the futures market, as traders position for potential changes in supply and demand. Trading volumes on the European Energy Exchange AG — the largest bourse for Japanese power derivatives — more than doubled in June from the same month last year.

“We have seen very active hedging trades in the EEX Japan Power futures market to cover the risk exposure from those physical positions for the same period,” said Bob Takai, chief executive officer of EEX Japan. While traders usually hedge summer and winter 2026 contracts at the end of the year, volumes for those seasonal products are already picking up, he added.

Still, some traders remain cautious as it’s still unclear how much electricity the major retailers will actually procure.

Jera, a 50-50 venture between Tepco and Chubu, was founded in 2015 to combine power generation assets and overseas fuel procurement.

A spokesperson for TEPCO Energy Partner, the utility’s retail arm, declined to comment on specific plans for power procurement. The company will make use of the market and various products for an optimal procurement method and balance, the spokesperson said.

Chubu Electric’s retail arm will continue to build an appropriate procurement portfolio taking into account factors like economics and stable supply of electricity, a spokesperson said, declining to comment on the details of its contract with Jera.

Jera will offer wholesale electricity on equal terms to all retailers, including those at Tepco and Chubu, which must participate in public and brokered sales like any other firm, a spokesperson said. The company plans to expand wholesale offerings to a wider range of retailers from fiscal year 2026, the spokesperson added.

Demand has become increasingly difficult to forecast amid extreme weather and natural disasters, highlighting the growing importance of hedging strategies. The recent heat wave pushed day-ahead spot prices to a four-month high on Sunday, making weather a major driver of short-term volatility.

In response, EEX is preparing to launch a daily futures product for the Kansai area, giving traders more tools to hedge against regional price swings.

“It is quite possible that Japan’s futures will be two or three times bigger than the spot market in a few years’ time,” EEX’s Takai said.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2025 Bloomberg.