Bloomberg Professional Services

APAC ex-JP

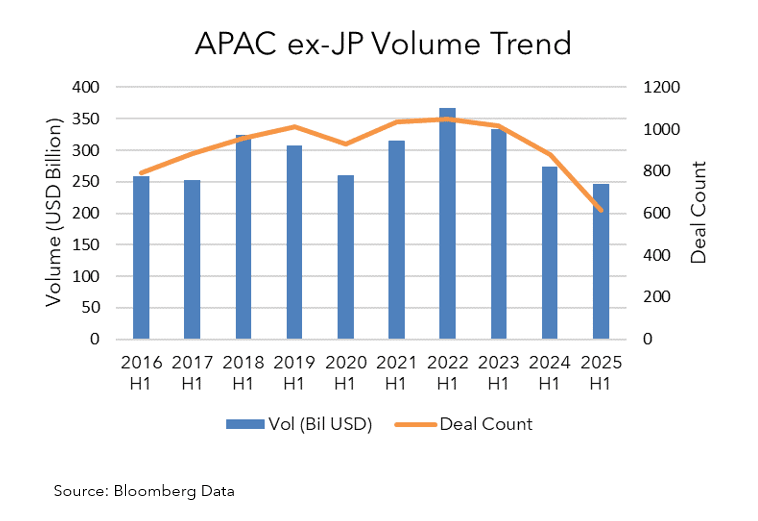

Syndicated loan activity slowed globally in the first half of 2025, with volume falling 5.1% year-on-year. However, H1 2025 still ranked as the second-highest level of activity for any H1 period in the past decade, underscoring a resilient baseline of demand. In contrast, the APAC ex-Japan market posted its third consecutive year of first-half declines. Volume in the region fell 10.1% from the same period last year and has contracted by roughly one-third compared to H1 2022.

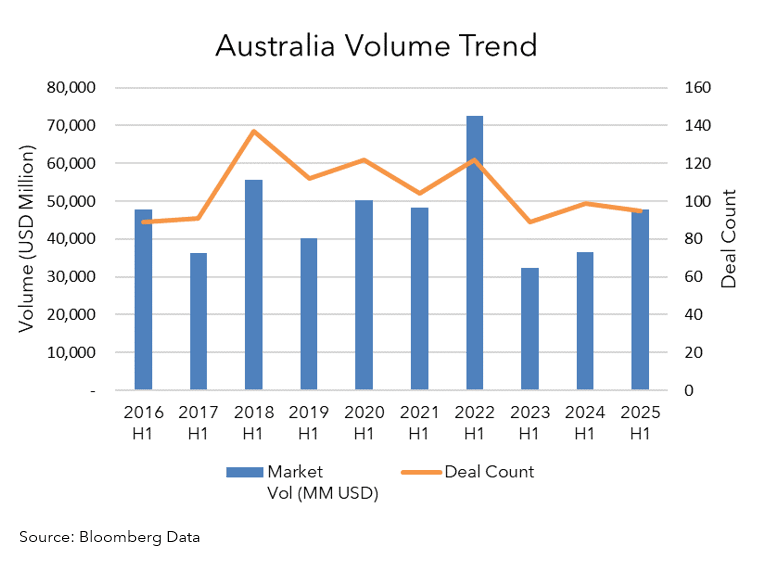

Australia led the APAC ex-Japan syndicated loan market in H1 2025 with a 30.7% year-on-year increase in total volume, the highest regional growth. The growth was largely led by larger-sized transactions—24 deals over AUD 1 billion were signed, up from 12 in the same period last year. Project finance saw an 81.4% surge, led by Connecting Orana Finco Pty Ltd’s AU$7.4 billion green loan, the largest Project Finance deal so far this year. Acquisition finance jumped 138.2%, buoyed by TPG Telecom’s refinancing of its Vodafone Hutchison Australia takeover financing.

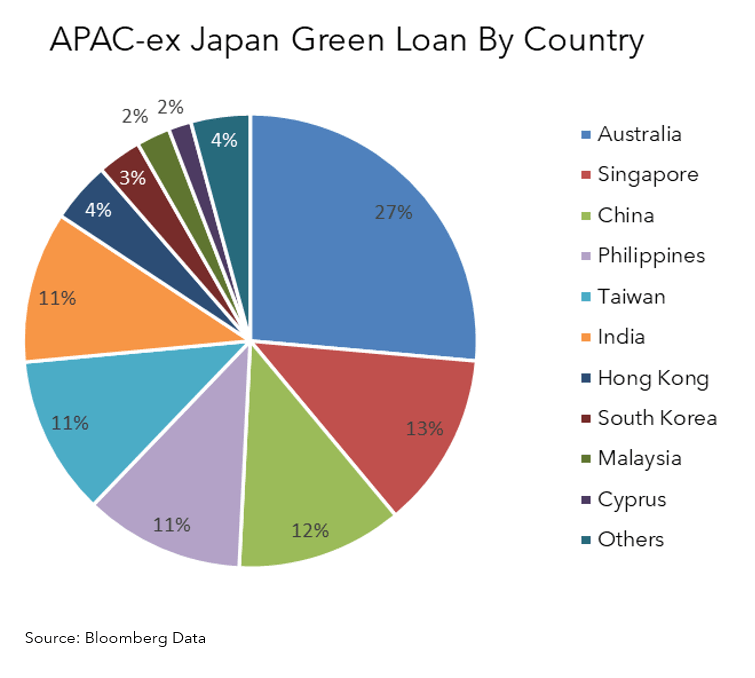

The APAC-ex Japan green loan market grew 68.3% year-on-year in H1 2025, with volumes now nearly 16 times larger than in H1 2016. This could indicate continued activity in sustainable finance compared to prior years. APAC-ex Japan now accounts for 34% of global green loan issuance, up sharply from 5.9% a decade ago, reflecting how the region’s global share has evolved over the past decade. Australia remained the top contributor, driving over a quarter of regional volume, followed by Singapore and mainland China, which also posted strong activity amid growing demand for ESG-aligned financing.

Greater China

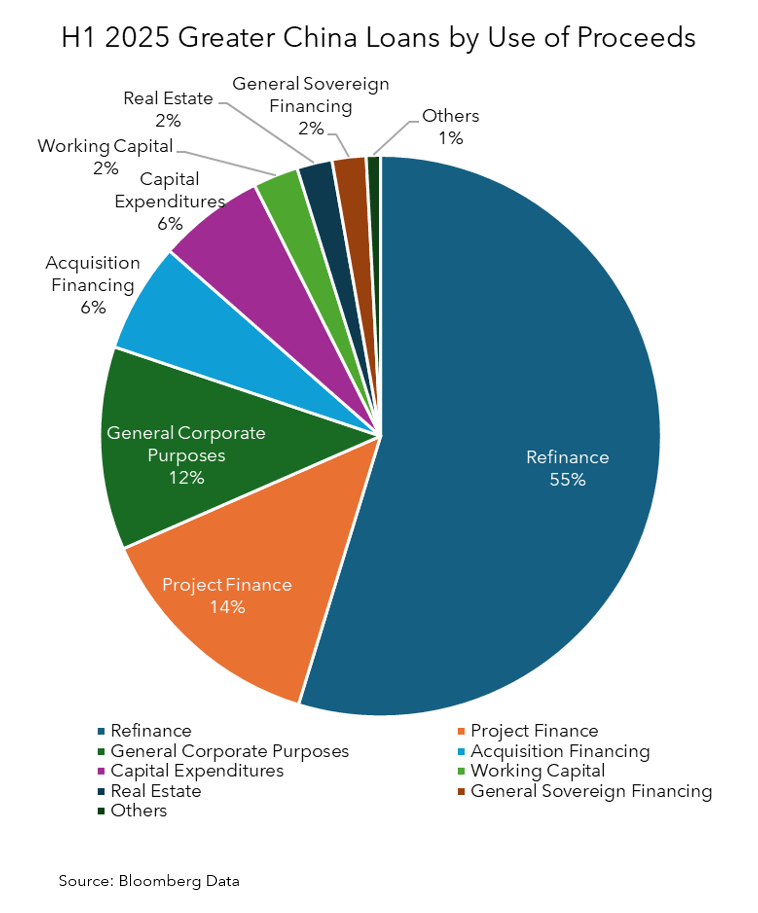

Greater China syndicated loans issuances concluded at USD 82.9 billion in H1 2025, marking a 34.5% decrease in volume year-on-year. Borrowers are cautious in raising funds, with over half of the loans issued went into supporting refinancing efforts, sitting at 55% of the total volume. Meanwhile, project finance and general corporate purposes came in at 14% and 12%, respectively. As for capital-related expenditures, the spending momentum did not sustain from last year, issuances fell sixfold.

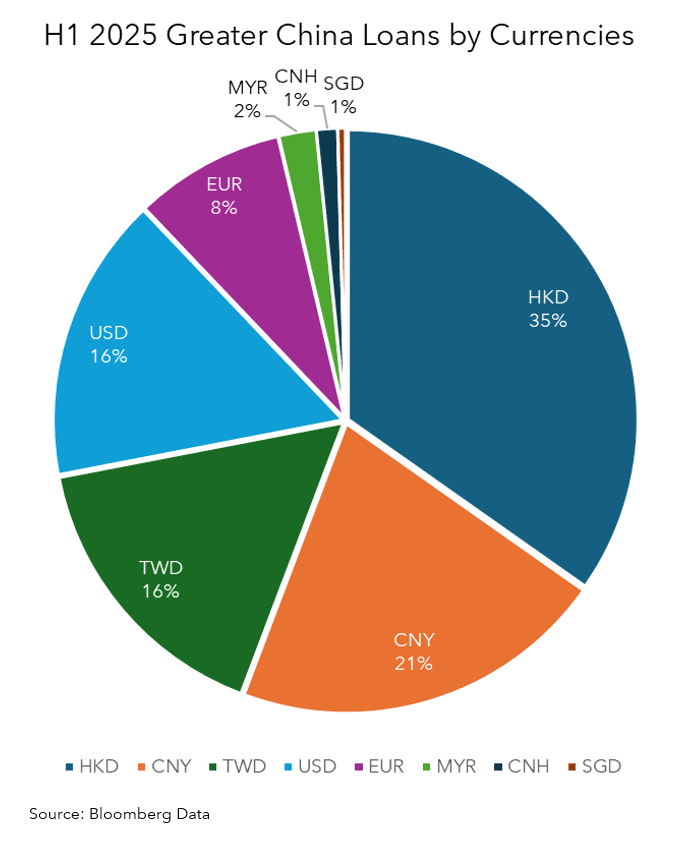

In terms of currencies, HKD gained the spotlight, with 34.8% of Greater China loans volume denominated in HKD. Worth noting, there was also an increase in the popularity of issuing in Euros in H1 2025. Especially in the Offshore China Loans market, the popularity of Euro-denominated loans accounted for around 40% of the volume.

The largest deal signed in H1 2024 was issued by Fengmiao Wind Power with SMBC as the green loan coordinator. It was signed with a dual-currency TWD-EUR in a 9-tranche structure, totaling TWD 102.9 billion (USD 3.9 billion equivalent). The deal was also considered the second largest APAC ex-Japan Green UoP deal in H1 2025.

ASEAN

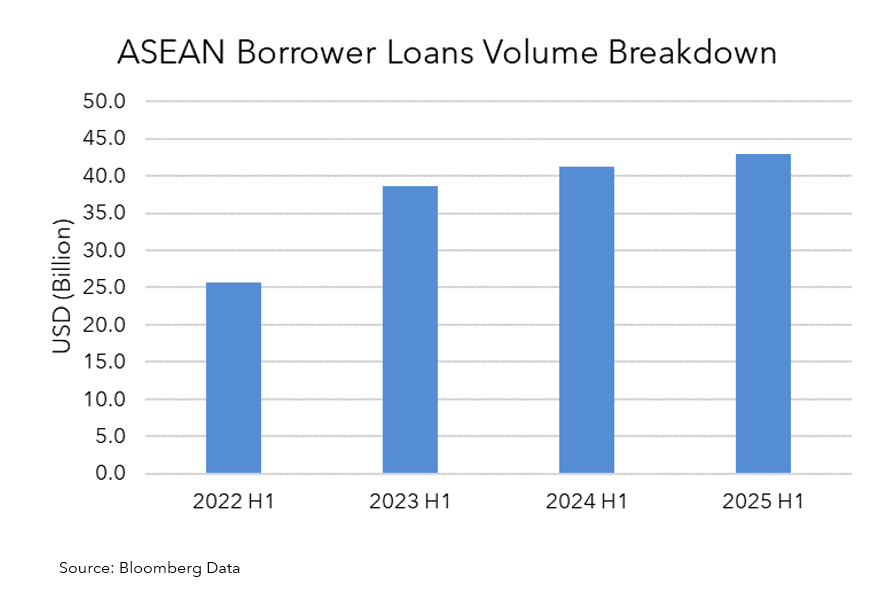

Syndicated borrowing amongst ASEAN borrowers in H1 2025 were not in line with the trend of dropping volume across the broader APAC ex-Japan region, marking an increase of 25.3% year-on-year, totaling USD 42.9 billion.

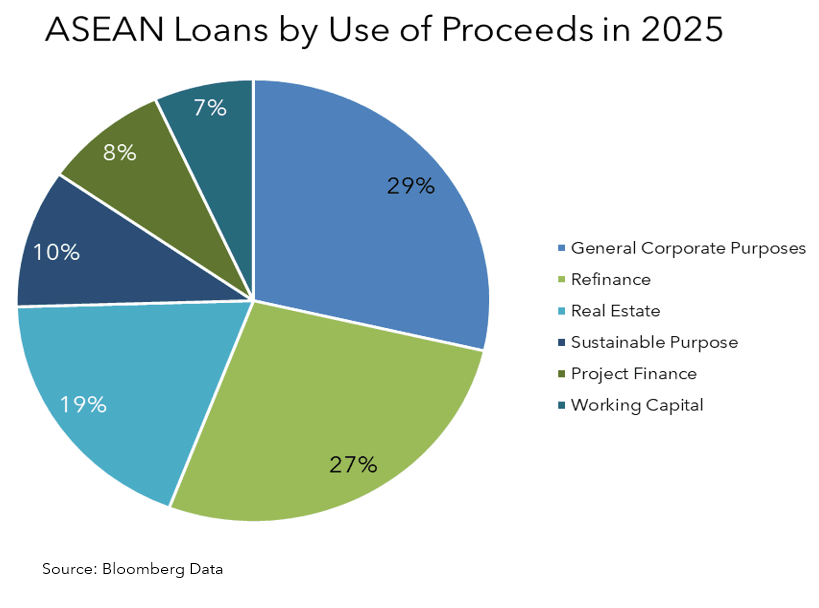

ASEAN Borrower loans were primarily issued for general corporate purposes (24%) and refinancing (23%), while issuance for real estate and sustainable purposes rose to 16% and 9%, respectively. The share of refinancing has declined, reflecting a growing focus on ESG, long-term infrastructure, and development financing.

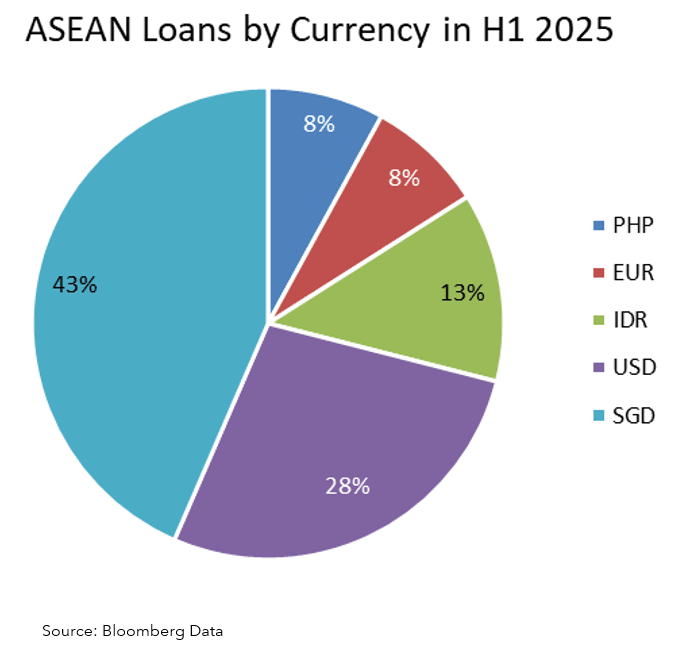

The share of USD-denominated loans to ASEAN borrowers has dropped from 48% to 27.5% year-on-year, as borrowers increasingly diversify into other currencies like SGD, which now leads at 43.5%. This shift is largely driven by the weakening of the U.S. dollar—spurred by recent U.S. tariff policies and evolving global monetary dynamics—making USD borrowing less attractive.

The largest ASEAN loan signed in H1 was to Marina Bay Sands integrated resort for SGD 12.0 billion (USD 9.4 billion equivalent). It is to finance the expansion of the Marina Bay Sands Resort, including the construction of a new fourth tower. It is signed with a 3-tranche structure with over 26 banks participating in the deal.

Among the mandated lead arranging banks, United Overseas Bank claimed the top spot, followed by DBS and Oversea-Chinese Banking Corp, with market shares of 8.73%, 8.0%, and 7.94%, respectively. Among the bookrunners, United Overseas Bank ranked top, followed closely by BDO Union Bank, and DBS, making up market shares of 10.59%, 9.84% and 8.32%.

Bloomberg Terminal users can access official league tables and wallet share analytics for verified debt, loan, municipal bond, mortgage, and equity deals via LEAG <GO>.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except that Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products in Argentina, Bermuda, China, India, Japan and Korea. BLP provides BFLP with global marketing and operational support. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. Bloomberg makes no claims or representations, or provides any assurances, about the sustainability characteristics, profile or data points of any underlying issuers, products or services, and users should make their own determination on such issues. BLOOMBERG, BLOOMBERG TERMINAL, BLOOMBERG PROFESSIONAL, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG ANYWHERE, BLOOMBERG TRADEBOOK, BLOOMBERG TELEVISION, BLOOMBERG RADIO and BLOOMBERG.COM are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries. © 2025 Bloomberg