Bloomberg Intelligence

This article was written by Bloomberg Intelligence Senior Equity Strategist Laurent Douillet and Equity Strategist Kaidi Meng. It appeared first on the Bloomberg Terminal.

Fiscal stimulus is supporting the relative performance and valuation of the European industrial sector as it should be the primary beneficiary of Germany’s infrastructure spending plan (€500 billion over 10 years) and a European defense push (also €500 billion over 10 years). Electrical-equipment companies (Schneider, ABB, Legrand) and Siemens can benefit from their strong presence in the US and the rollout of AI data-center capacity, while Vestas and Siemens Energy are at the center of the energy transition in Europe and Asia.

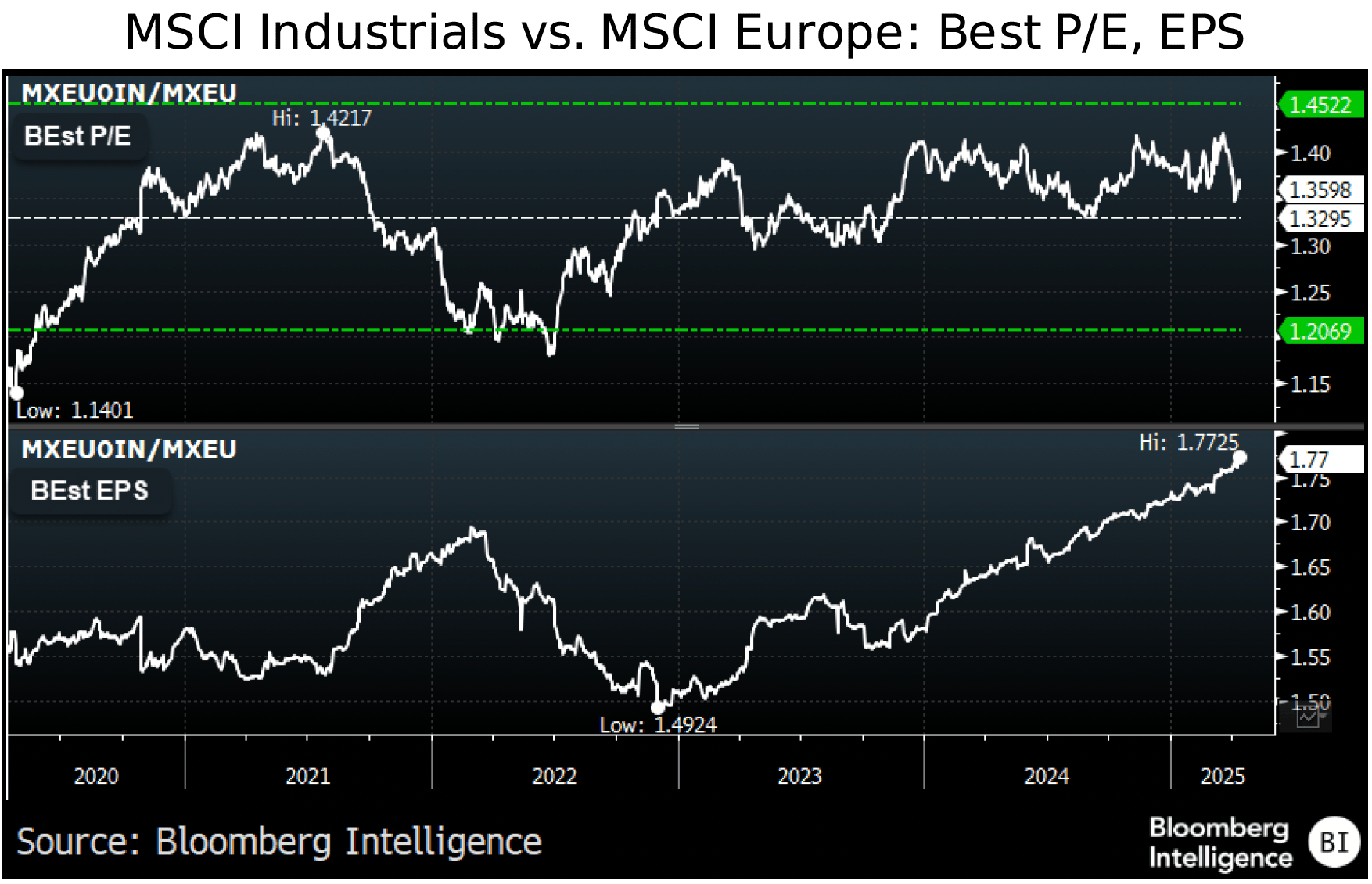

Following the recent correction — brought on by US tariffs and profit-taking in defense-related names — the sector’s forward P/E fell to 18x, in line with 10-year average while its premium to the European market slid to 1.36x vs. a long-term norm of 1.25x.

Aerospace & defense, electric equipment at reasonable valuation

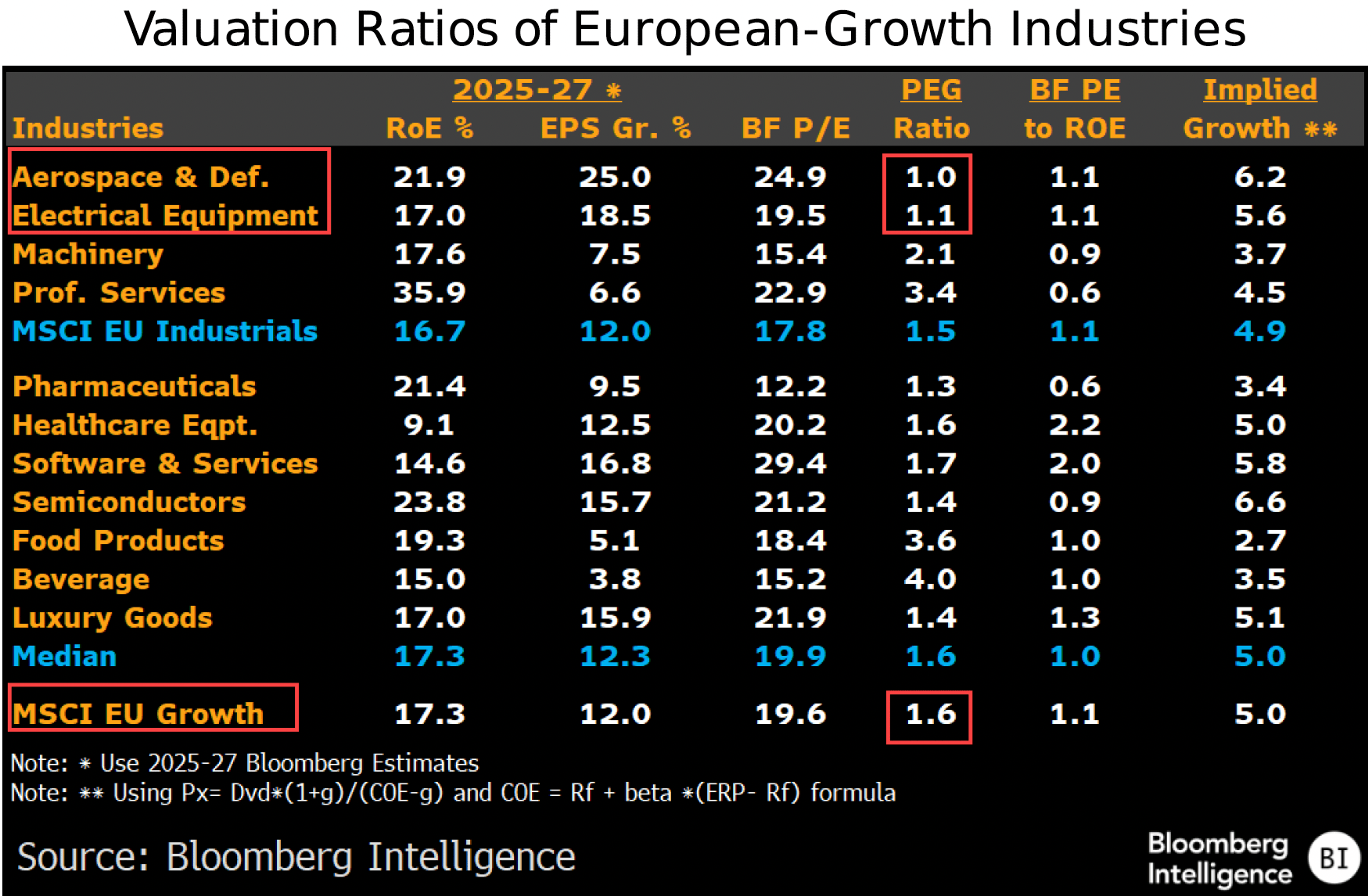

Despite their rerating in the past three years — bar the recent market correction — the aerospace & defense and electrical-equipment segments still have the lowest PEG ratios of European growth industries due to their superior earnings growth. At 25% and 19% respectively, they’re well above the median of our selection of growth industries or the MSCI Europe Growth Index (12%), with PEG ratios of 1x and 1.1x vs. a median of 1.6x for European growth companies. Their implied long-term rise of 6.2% and 5.6% are now on par with the technology sector’s 6%.

Conversely, the defensive nature of professional-services peers (Wolters Kluwer and RELX) means they have a high PEG ratio (3.4x) but the lowest P/E-to-ROE multiple (0.6x) in our selection, given their high profitability (ROE of 36% vs. a median figure of 16.7%).

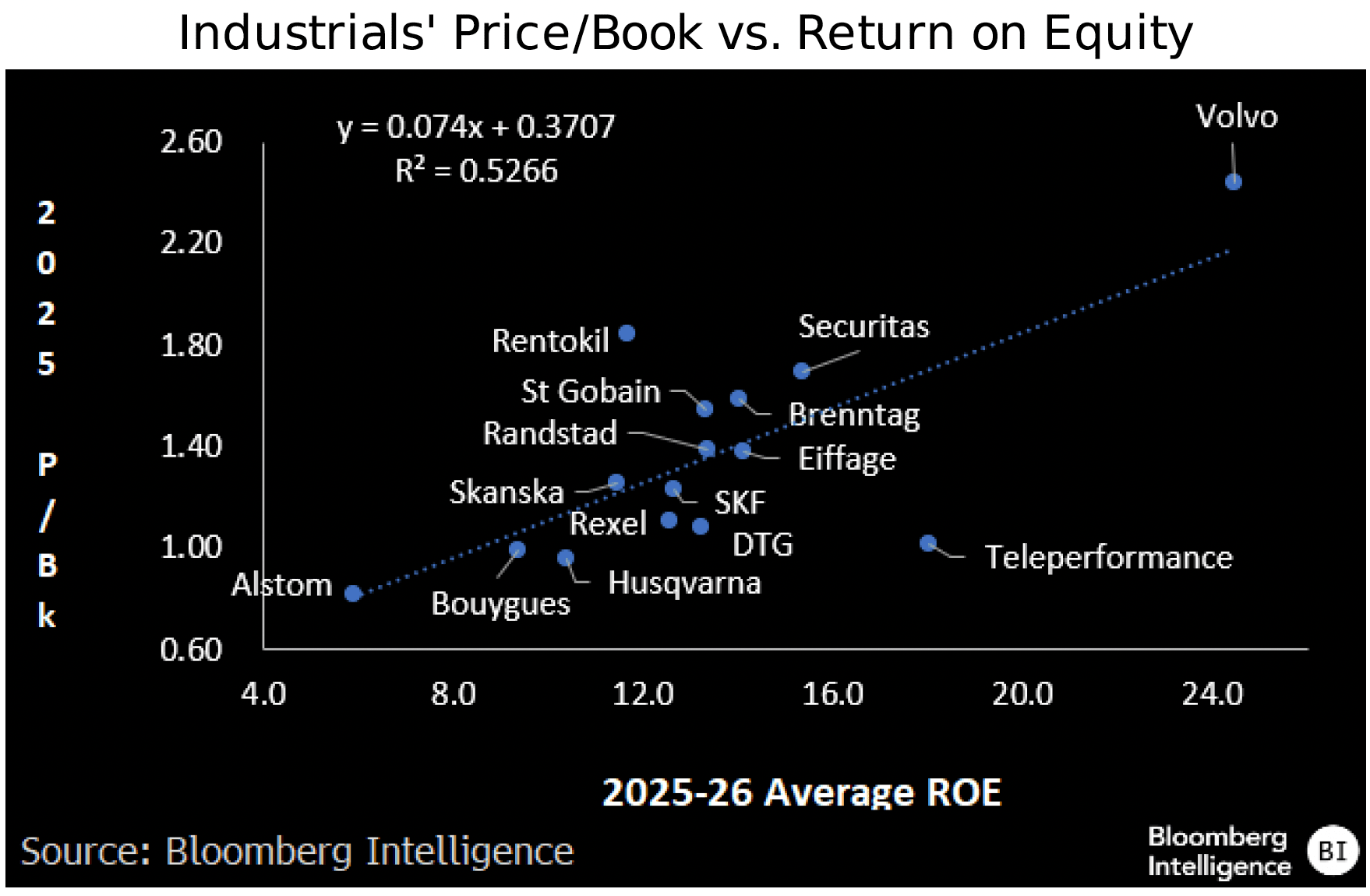

Value in industrials continues to underperform

Industrial companies with lower valuation ratios are either cyclical (Saint-Gobain, Bouygues, Randstad and SKF) or challenged by the green-energy transition (Daimler Truck and Volvo) or AI (Teleperformance and Securitas). Their valuation discount on a forward P/E (median of 10x vs. 17.8x) or price to book (1.3x vs. 3.1x) looks excessive as their ROE and EPS growth (median of 13% and 7%, respectively) are 20-30% lower than the sector (16.7% and 9.3%). That suggests investors aren’t confident that their performance can endure over the medium to long term.

Our selection includes 15 industrial companies with the lowest P/E z-scores in the past 10 years (from minus 1.8 for Teleperformance to minus 1 for Eiffage). Since the start of the year, their share prices are down 9% vs. a 3% drop for the sector.

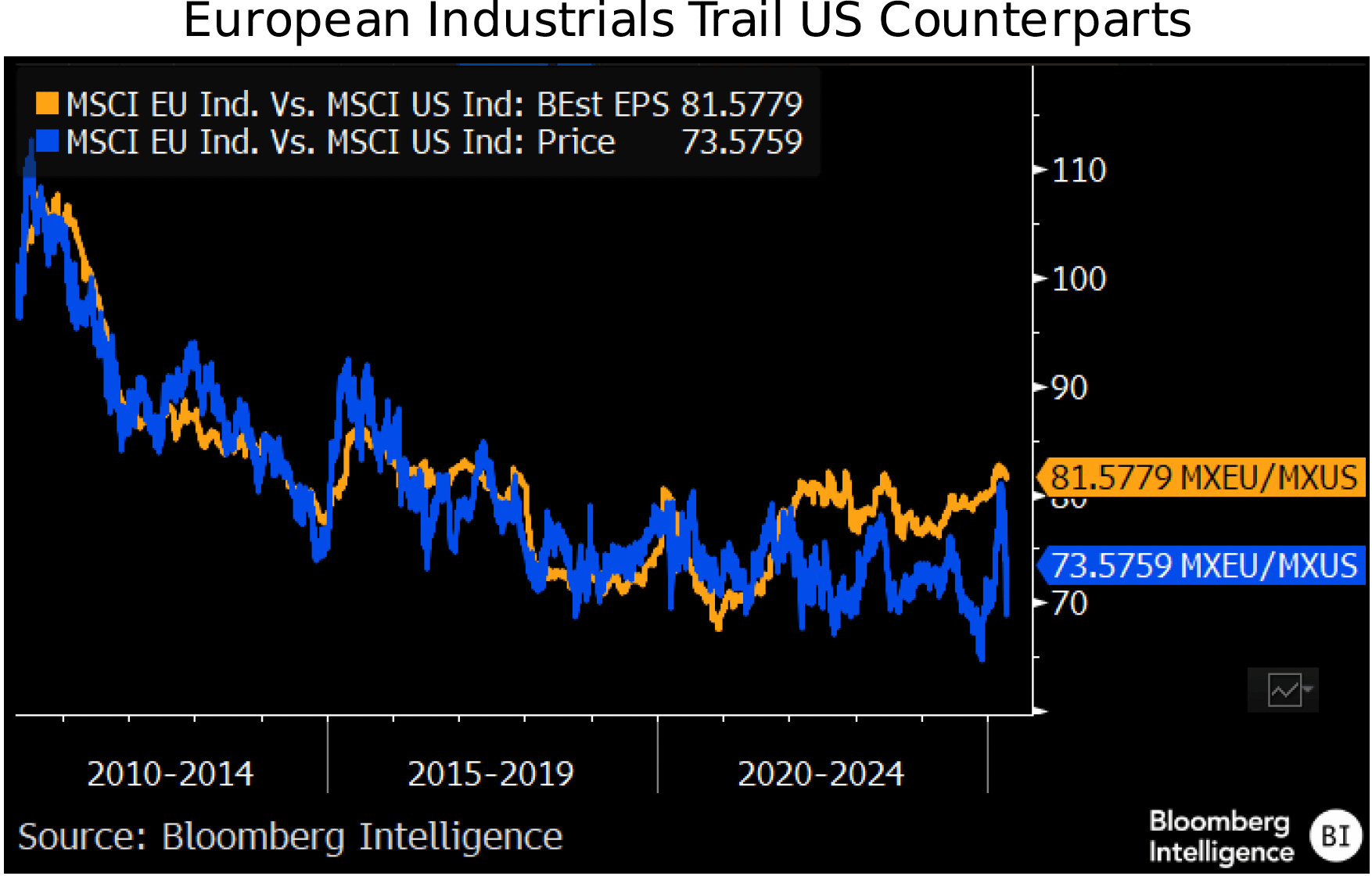

Higher ROE, EPS growth push US industrials higher vs. EU

After recovering most their relative underperformance vs. US peers, European industrials have been hit hard by the US tariffs. That’s led to a renewed drag on the sector, which fell 7% since President Donald Trump’s “Liberation Day” vs. a decline of 4% for the US. As a result, the European sector still trades at a 17% forward P/E discount vs. the US one (17.9x vs. 21.4x). The US sector is expected to deliver a compound annual 2024-27 EPS growth of 13% vs. 12% for Europe, giving it a slightly higher PEG ratio at 1.6x vs. 1.5x.

The difference in valuation multiple can also be explained by a more efficient use of capital, with the MSCI US industrials index having a ROE at 24.6% in 2025-27 vs. 16.7% for Europe and lower earnings-growth volatility over the past decade (13% vs. 17%).

Scorecard looking for growth

Fiscal stimulus, tariffs, AI rollout are upending EU industrials

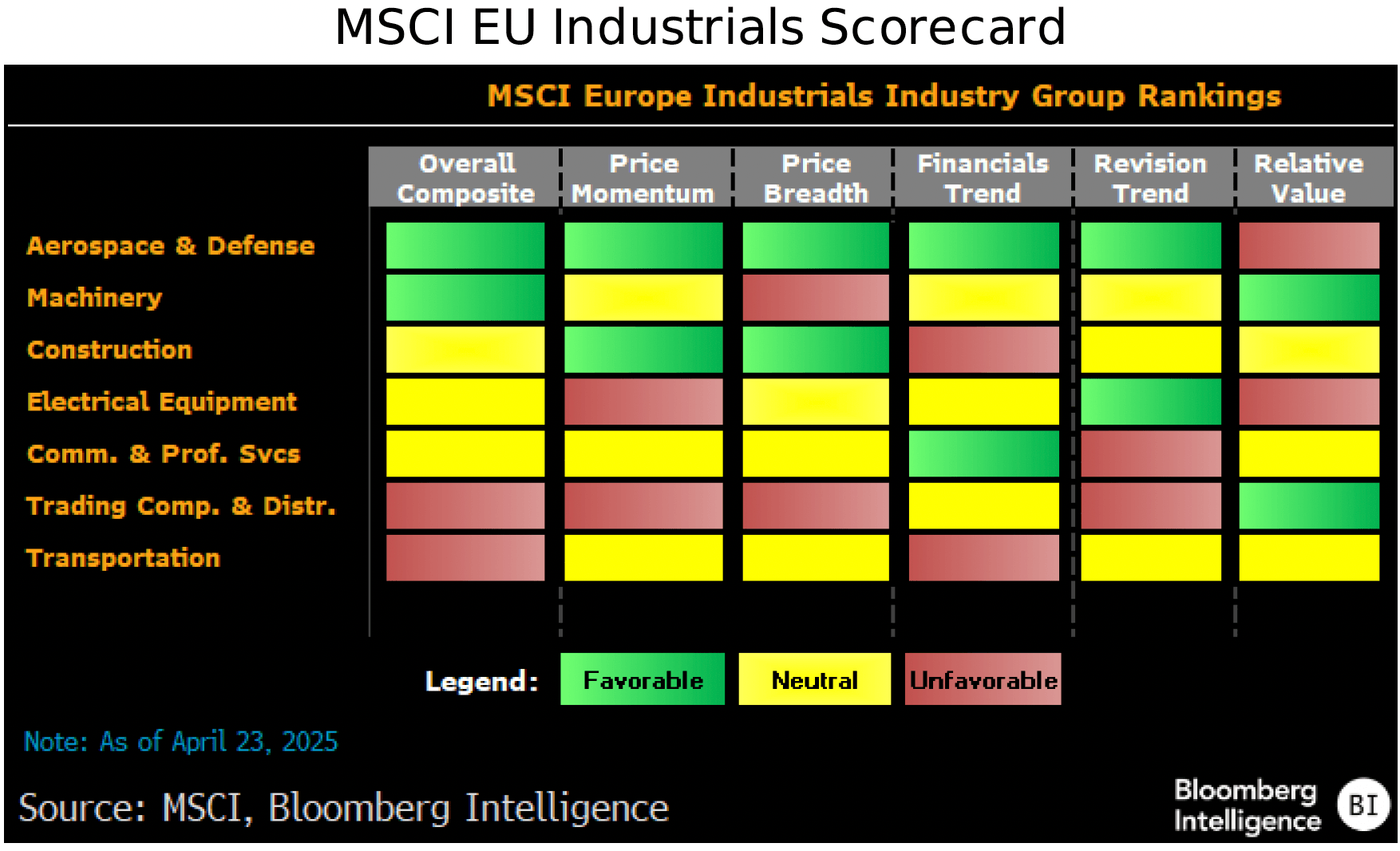

Hopes of fiscal stimulus in Europe and US tariffs split apart our European industrial scorecard, with aerospace and defense on top — lifted by strong price momentum and solid fundamentals — while transportation companies and distributors slip to the bottom. The electrical equipment segment has been hit by fears of slower AI data-center rollouts and drops into mid-table.

Aerospace and defense, machinery top industrials ranking

Hopes for a strong EU stimulus in infrastructure and defense spending are pushing aerospace and defense along with machinery companies to the top of our industrials scorecard, while tariffs are hurting segments with exposure to the short-term trading cycle. Aerospace and defense score well in all segments expect valuation, following a strong rally over the past six months. Electrical equipment has slipped from top to the fourth spot on weaker technicals as the segment fell heavily following the DeepSeek announcement and an upcoming sharp earnings growth deceleration after a strong rise over the past 12 months (38%).

Transportation and trading companies sink to the bottom as tariffs should hit trade volumes and push operating costs higher, weighing on both earnings growth prospects and revisions.

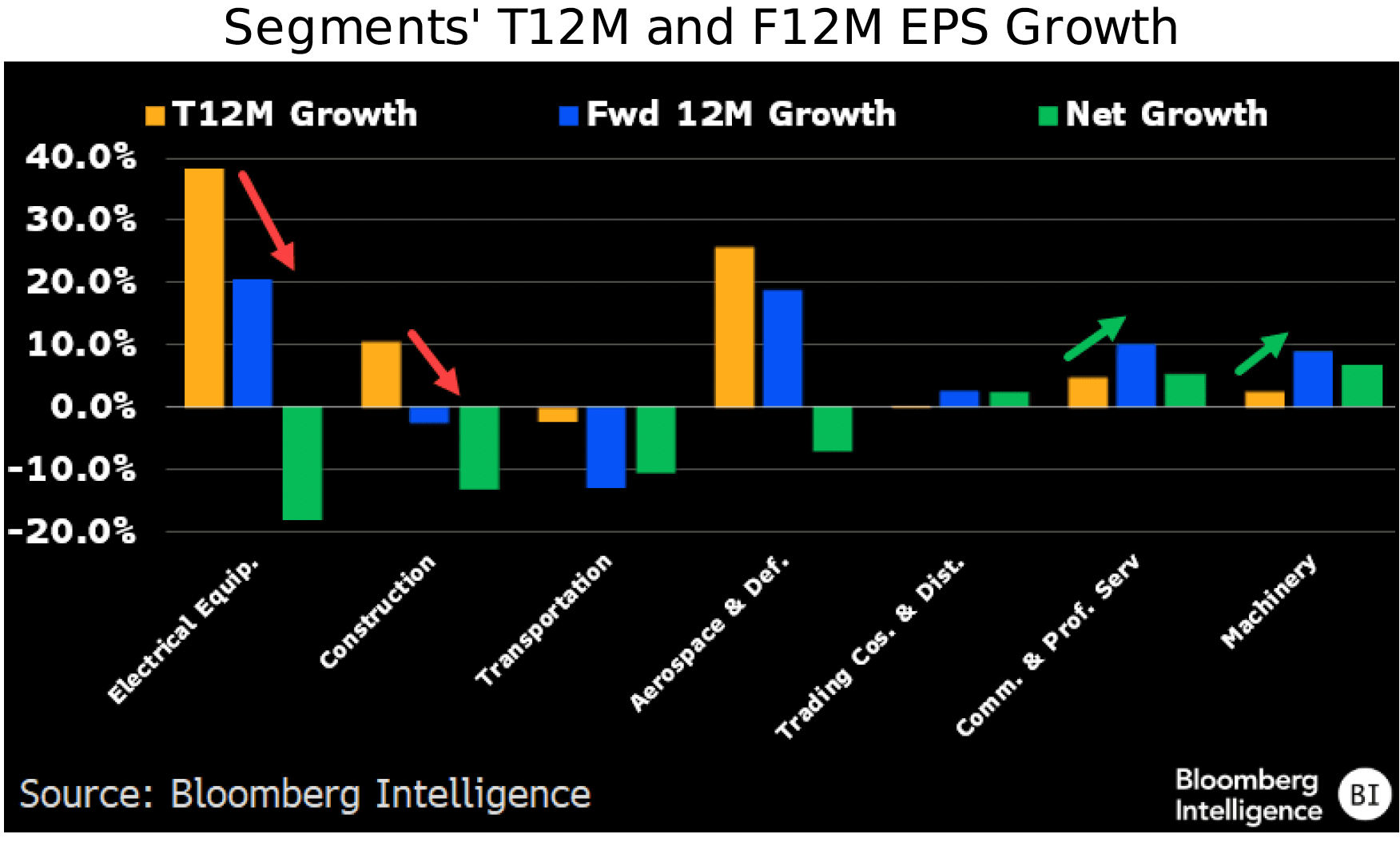

Commercial and professional services leads on net forward growth

Though the electrical equipment segment is expected to deliver the highest earnings growth over the coming 12 months at 20%, it will see a sharp deceleration from 38% in the previous 12 months, giving a net minus 18%, placing the segment mid-table of our growth pillar. Commercial and professional services rank first with a 5% net growth thanks to an acceleration to double-digit growth ahead. Aerospace and defense ranks second as it is also hit by its growth deceleration while machinery ranks third on a 6% net growth given an easier comparison base.

Transportation is still poised for an earnings decline but at a higher rate than in the past 12 months, dragged mainly by Maersk and therefore remains last. Construction slips to the bottom as its earnings are forecast to decline 3% going forward after rising 10% previously.

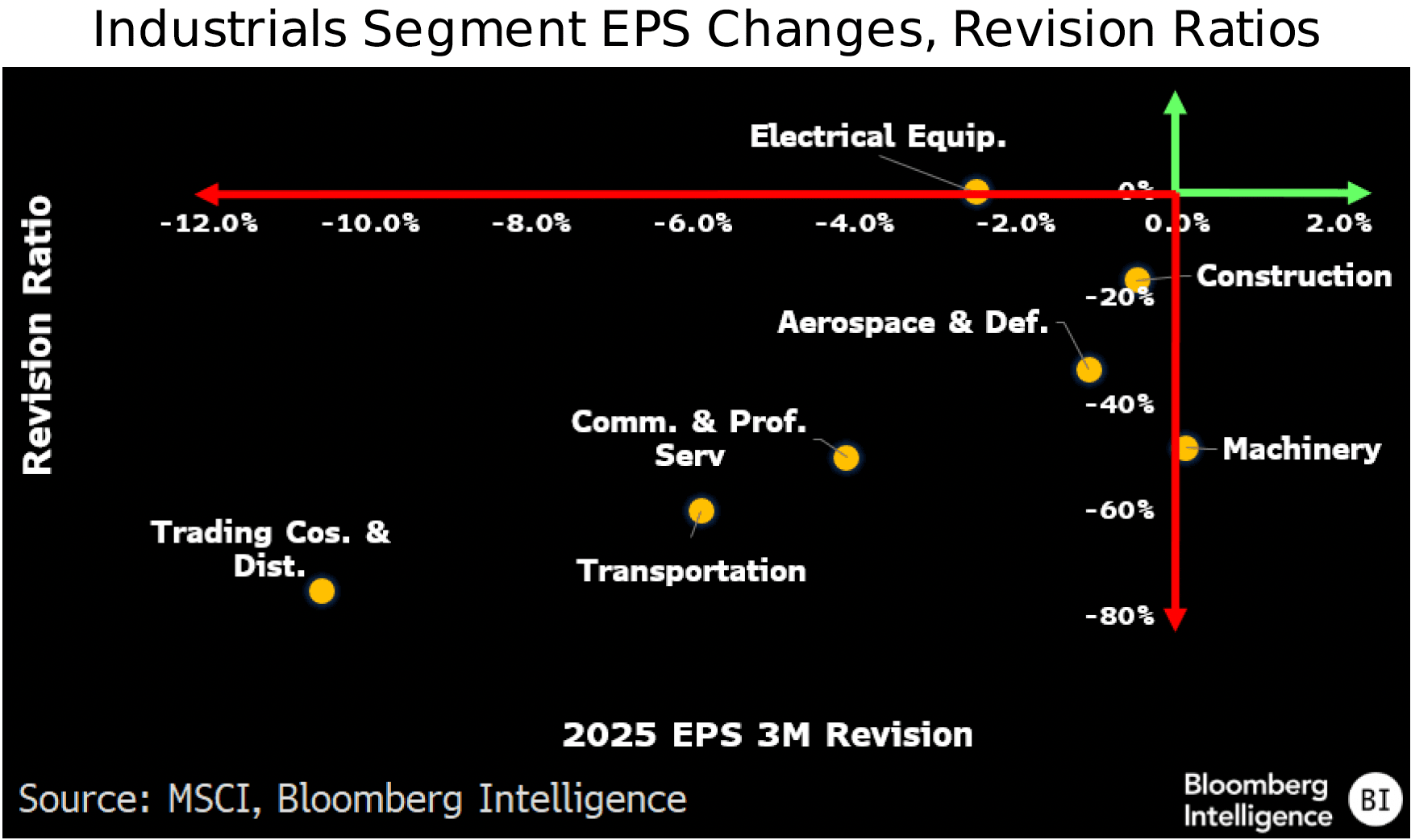

Electrical equipment tops EPS revisions

Electrical equipment regains the top spot of earnings revisions from transportation despite an EPS downgrade of 2.5% as half of the segment members have seen upgrades (Schneider, Legrand, Siemens Energy), giving a zero revision ratio. Aerospace and defense ranks second with a 1 % estimate cut and a ratio of minus 33% as upgrades to defense companies are not enough to offset cuts to Airbus and Safran. Machinery is the only segment to see a slight upgrade thanks to Siemens, but downgrades outpace upgrades three to one. Trading and distribution as well as transportation are showing the weakest revision trends on double-digit cuts to Ashtead, AerCap, DSV, Maersk as well as ADP.

The 2.3% downgrade to industrials’ 2025 EPS estimate leads the 5% cut of the MSCI Europe, but with a worse revision ratio at minus 46% vs. minus 36%.

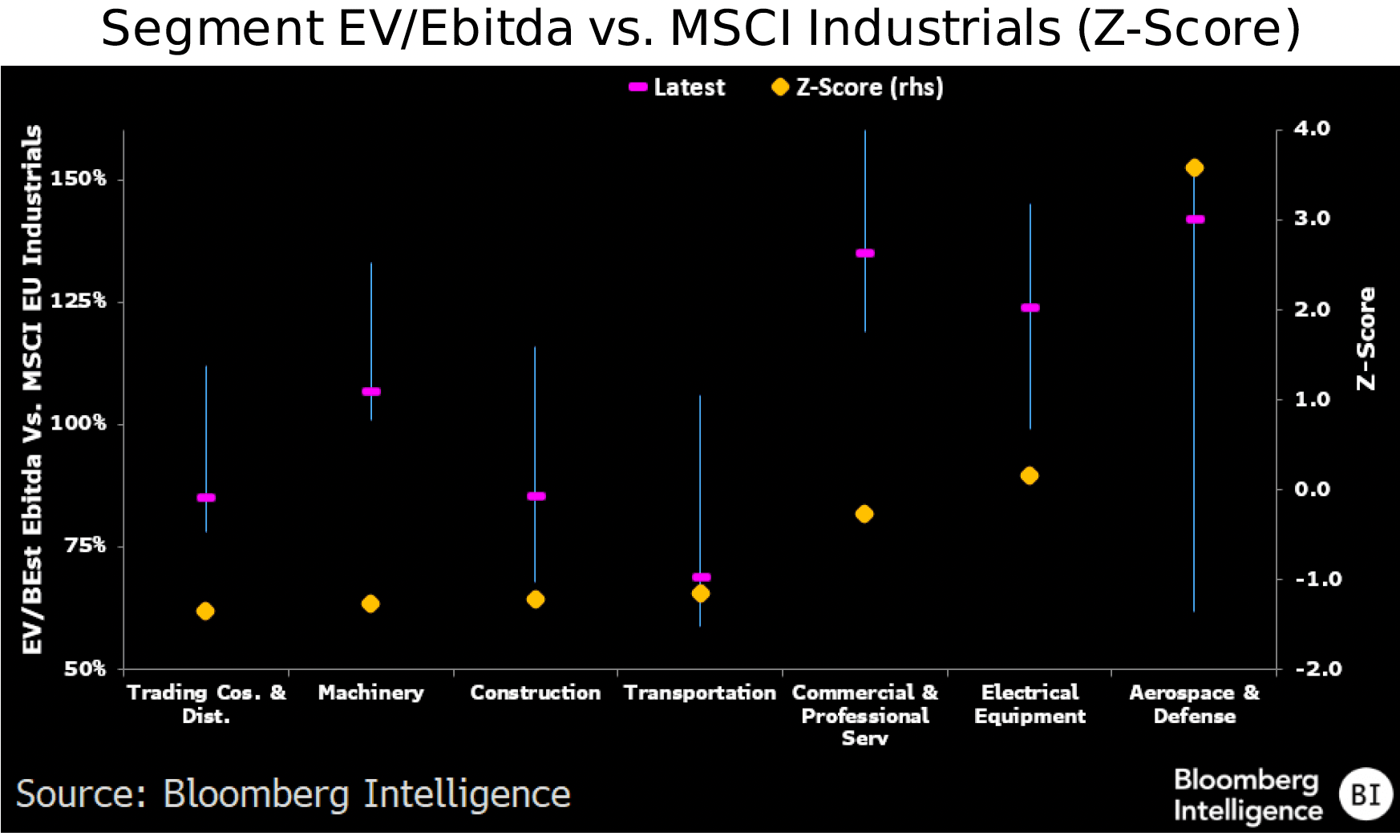

Decent sector valuation but for aerospace and defense

The divergent performance of industrials subsectors is sending their valuation ratios toward extremes vs. historical norms. The aerospace and defense companies have rerated sharply over the past six months, pushing the subsector EV/Ebitda multiple to 13.7x vs. a 10-year average of 9.2x. Its premium vs. the MSCI EU Industrials Index jumps to 41%, or 3.6 standard deviations above its long term norm. Following its correction, the EV/Ebitda of the electrical-equipment segment has fallen 24% from its January peak and is now in line with its historical level of 11.7x,a 23% premium to the sector.

The construction, machinery, transportation and trading and distribution segments valuations are the most depressed with a z-score between minus 1.2x and minus 1.3x due to the uncertainty on US tariffs and their impact on global trade.

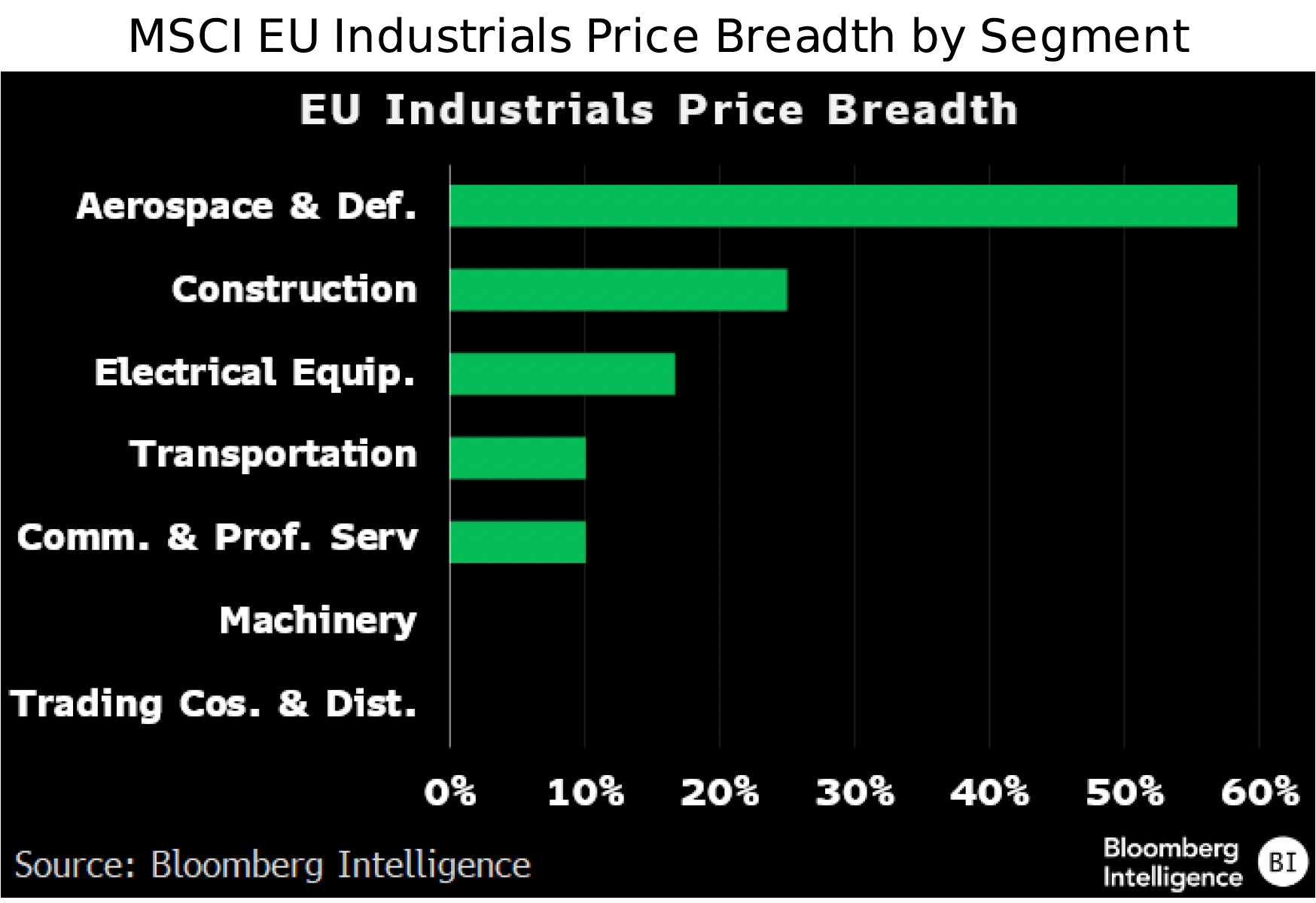

Aerospace and defense technicals above sector’s

Industrials’ performance has been upended by higher-than-expected tariffs and the debt-brake reform in Germany, with aerospace and defense along with construction companies coming on top of our momentum and breadth pillars. The former is the only segment with a positive momentum — six months minus two weeks — and more than 50% of its members above their 50- and 200-day moving average (MA). Despite a negative momentum and only 25% of its members above both moving averages, the construction segment ranks second, given the defensive nature of the concession businesses of Vinci, Eiffage and Ferrovial and the telecom operation of Bouygues.

Electrical equipment has the worst momentum following the DeepSeek announcement, but its breadth is helped by Siemens Energy, which is above its 50- and 200-day MA after a 40% rally.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2025 Bloomberg.